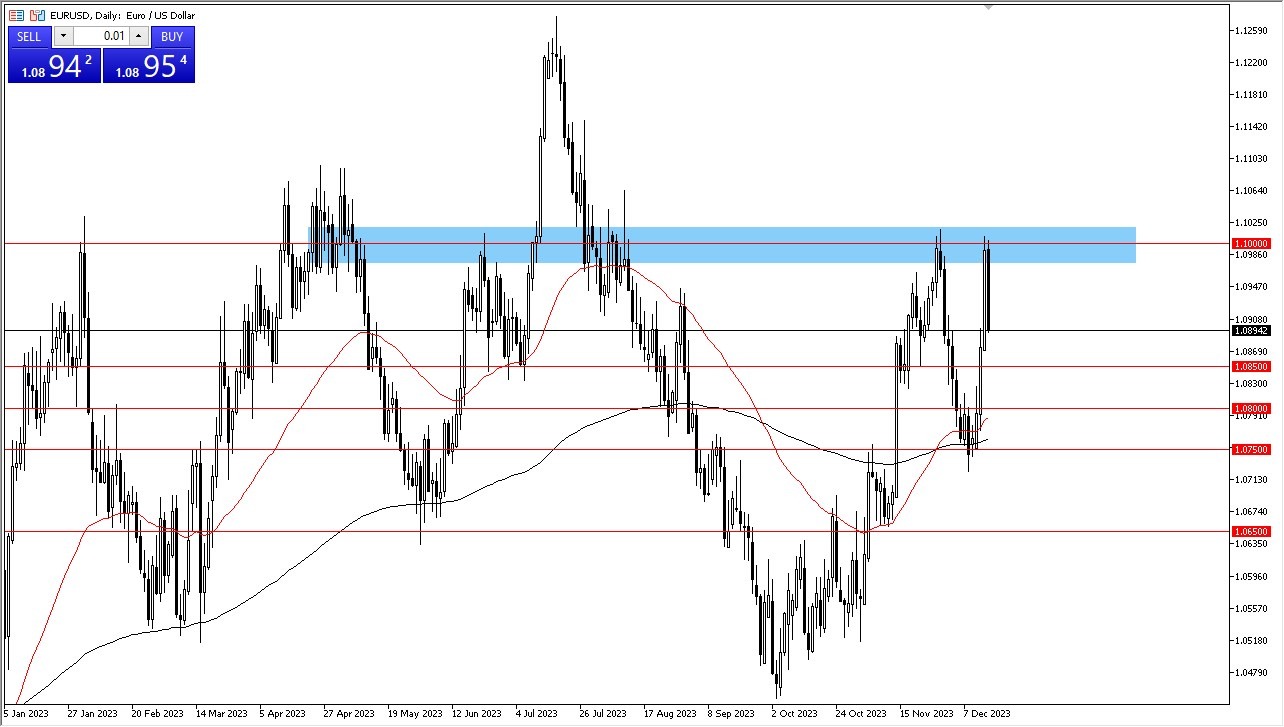

- The EUR/USD faced a slight pullback during Friday's trading session, testing the crucial 1.10 level.

- This level carries significance as it has previously acted as resistance and stands as a psychologically significant round figure.

- While the market shows signs of pulling back, it's important to consider the broader context, despite the fact that we fell hard.

Top Forex Brokers

Recent days have seen the Euro's market become somewhat overextended, contributing to the observed pullback. The potential for a deeper retracement down to the 1.09 level should not be dismissed. However, if the market reverses course and breaks to the upside, the 1.10 level is expected to offer resistance once again.

A breakout above the 1.10 level could set the stage for a move towards 1.1250, an area that has historically posed significant resistance. Over the longer term, such a move would signal further Euro strength. Nevertheless, in the short term, the market is characterized by noisy behavior, reflecting a major shift in sentiment.

The Fed and Its Pivot

The recent pivot by the Federal Reserve towards the possibility of rate cuts next year contrasts with the European Central Bank's stance, which has not yet considered such actions. This divergence has contributed to market uncertainty and fluctuation.

In this evolving landscape, buying the Euro on dips seems to be the prevailing sentiment, as interest rate differentials between the U.S. and Eurozone undergo changes. Monitoring the 10-year U.S. Treasury note, particularly its yield, remains crucial for market participants.

As we look ahead, market liquidity is expected to become a potential concern next week, which could lead to more erratic movements. Nevertheless, the past few days have demonstrated the dominance of buyers, suggesting that a "buy the dip" strategy remains in favor.

Ultimately, the Euro faces challenges and opportunities amidst changing sentiments and shifting central bank positions. While the 1.10 level currently tests the market, it's essential to be mindful of potential support at 1.09. A breakout above 1.10 may target 1.1250, indicating a stronger Euro over the long term. Short-term volatility is expected, given the recent market shifts. Buyers seem to hold the upper hand, but vigilance and prudent trading strategies are essential, particularly with potential liquidity concerns on the horizon.

Potential signal: The EUR/USD pair is watching the 1.10 region as a major barrier. If we can recapture that – it would be immense in its positivity. I’m a buyer above there on a daily close, with a 100 pip stop loss. However, the market has shown reluctant on Friday.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex trading brokers in the industry for you.