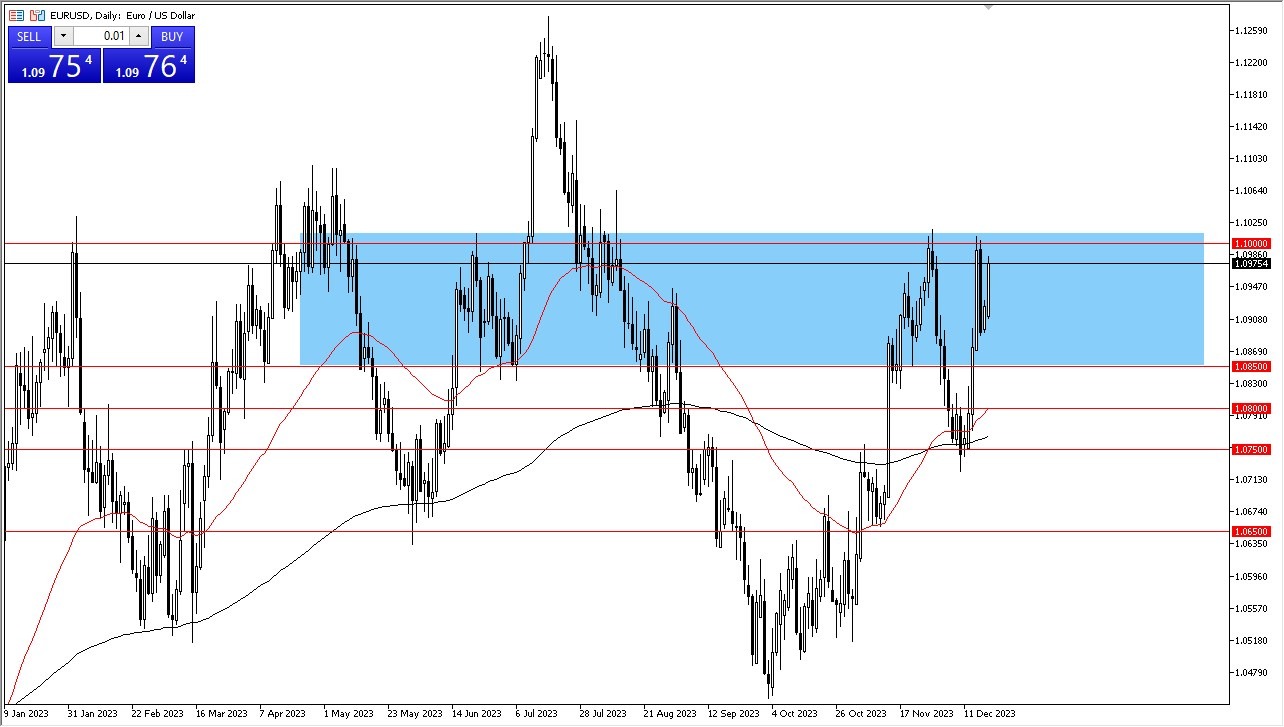

The EUR/USD exhibited a degree of upward momentum during the trading session on Tuesday, indicating a potential intention to challenge the psychologically significant 1.10 level situated above. This level, with its rounded and prominent nature, naturally draws the attention of market participants. A notable aspect of this scenario is the emergence of a double top formation, prompting a substantial cohort of traders to closely monitor this region, assessing whether it will persist as a robust resistance point. If the market successfully overcomes this pivotal threshold, there is a plausible scenario where it could extend its gains further, potentially targeting the 1.1250 level. It is imperative to acknowledge that the 1.1250 level has previously held a position of significance and encountered considerable selling pressure.

Top Forex Brokers

Beneath the current trading levels, the 1.0850 region emerges as a prospective short-term support zone. Moreover, the presence of the 50-Day EMA indicator should not be underestimated, as it possesses the capacity to exert influence on market dynamics. Taking a holistic view, it is reasonable to expect that this market will continue to exhibit a degree of volatility as we approach the holiday season. This heightened volatility is attributable to the anticipation of lower liquidity levels, especially with Christmas Day falling on a Monday.

Playing the Range with an Eye on Breakouts

- In light of these considerations, it is prudent to anticipate that the market may primarily oscillate within a trading range delineated by the 1.10 level above and the 1.0850 level below.

- While the possibility of a breakout exists, such a move is likely to be driven more by the reduced liquidity that characterizes holiday trading, rather than a meaningful shift in market sentiment.

- Consequently, despite the apparent bullish inclination, it is essential to remain mindful of the formidable resistance posed by the 1.10 level, which must be surmounted before adopting a strongly bullish stance.

In the interim, it is advisable to prepare for the likelihood of the market remaining range-bound, characterized by its propensity to trade within this established corridor. The market's movement within this range can be seen as a reflection of the prevailing uncertainty and hesitancy stemming from the holiday season's peculiar trading conditions. As such, the focus remains on navigating this environment with a discerning eye and prudent risk management strategies.

Potential signal: I am a buyer of the EUR/USD on dips. Every 50 pips we pullback, I am buying a small position. However, if we were to break above the 1.10 level, then I am a buyer and aiming for the 1.1250 level above.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.