- The gold markets experienced a modest decline in the early hours of Thursday's trading session, but there is no immediate sign of a significant breakdown on the horizon.

- However, it's essential to acknowledge that the market appears to be in an overextended state, and this is a factor that warrants careful consideration.

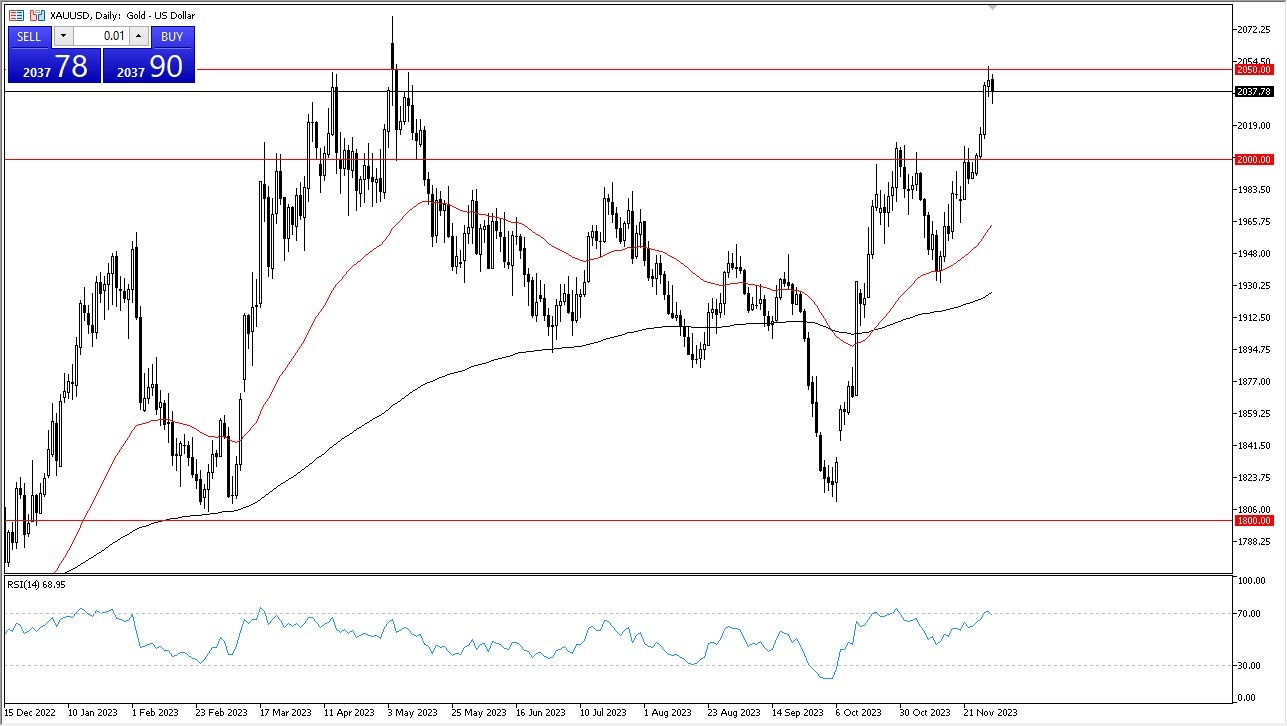

- The critical resistance level at approximately $2050 has proven to be a formidable barrier, as it has been on multiple occasions in the past. The Relative Strength Index (RSI) indicator currently indicates an overbought condition, suggesting that a potential pullback may be looming.

Top Forex Brokers

Nonetheless, it's crucial to clarify that this doesn't necessarily translate to an imminent bearish trend in gold. Instead, if you already hold long positions in this market, it may be judicious to contemplate tightening your stop-loss orders. It's a well-established principle that markets cannot sustain uninterrupted upward trajectories, and a temporary consolidation or retracement is a reasonable expectation. Given sufficient time, a breakout to the upside remains plausible, particularly if the Federal Reserve adopts a more dovish stance, a scenario that many market participants have been anticipating.

Volatility Will Continue

In the broader context, this market exhibits considerable volatility, necessitating vigilant monitoring of developments in the US bond market and careful attention to statements from central bank officials. Attempting to short this market at the present juncture may prove challenging. However, a potential pullback could present an attractive buying opportunity, particularly if prices approach the $2000 level. Although this would represent a $40 decline from the current trading levels, it remains a minor retracement in light of the upward momentum that originated just above the $1800 level. While exercising prudence regarding position size is advisable, it's crucial to recognize that short-term pullbacks are likely to evolve into buying opportunities within a persistently bullish market that merely requires a respite from relentless buying pressure.

In conclusion, the gold market is displaying a temporary dip, but it has not yet shown signs of a substantial breakdown. Overextension and significant resistance at $2050 are factors to consider, with the RSI indicating an overbought condition. While caution is warranted for existing long positions, this does not imply an immediate shorting opportunity. Instead, a pullback may offer potential buying opportunities, particularly around the $2000 level, as the market continues to exhibit overall bullishness. Monitoring the bond market and central bank communications is crucial in this volatile environment.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.