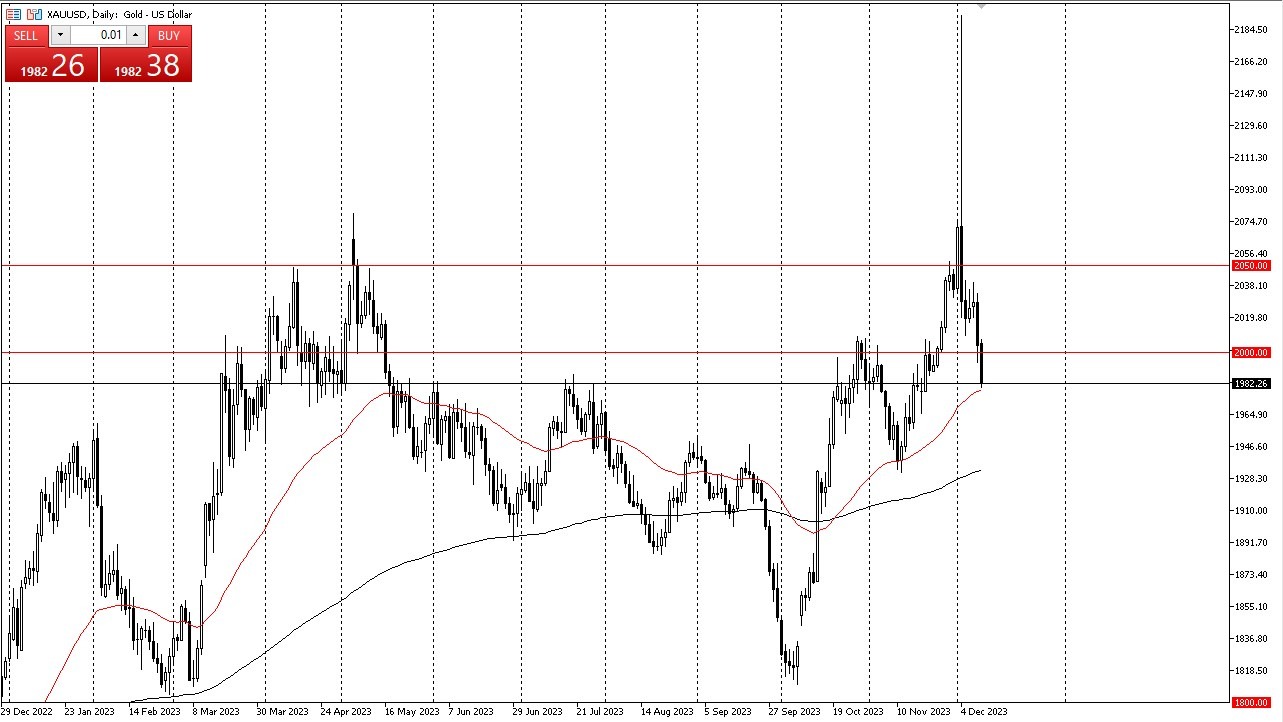

The gold market experienced another decline during Monday's trading session, under the weight of persistent downward pressure. The 50-Day EMA, situated below, implies the potential for limited support. It is evident that the market has undergone a significant and rapid descent since the occurrence of the notable "blow off top" a couple of weeks ago. Given the current conditions, breaking below the 50-Day EMA could pave the way for a descent towards the $1950 price level.

Top Forex Brokers

The recent appears to be influenced by traders capitalizing on substantial profits ahead of the holiday season. Additionally, the upcoming week brings meetings of major central banks, including the Federal Reserve, Swiss National Bank, Bank of England, and European Central Bank. Consequently, the interest-rate sectors worldwide are expected to witness heightened turbulence, discouraging many traders from retaining positions exposed to such market sensitivity.

However, it is crucial to acknowledge that despite the recent challenges, the overall trend remains upward, albeit under significant strain due to the testing of crucial support levels. The potential for a reversal and an upward surge hinges on the ability to overtake the $2000 threshold again, which could send gold prices towards the $2050 mark. Whether such a resurgence unfolds before the New Year remains uncertain, but it is conceivable that value investors will reemerge eventually.

Goldbugs to Return in January?

- It would not be surprising if gold enthusiasts opted to defer their buying activity until after the holiday season. An event of particular interest is the outcome of the Federal Reserve meeting scheduled for this Wednesday, which could have the potential to instigate significant shifts in market dynamics.

- The recent turmoil has witnessed a considerable degree of market volatility, making it increasingly plausible that a correction may be imminent.

- It is worth noting that markets often exaggerate movements, and the present circumstances suggest we are possibly near where such a correction may materialize.

At the end of the day, the gold market sustained another decline amidst ongoing downward pressure, with the 50-Day EMA offering modest support. Profit-taking ahead of the holidays and impending central bank meetings have compounded market volatility, dampening enthusiasm among traders sensitive to interest-rate fluctuations. Nevertheless, the overarching upward trend remains intact, contingent on a potential breakout above the $2000 level. While the exact timing of such a resurgence remains uncertain, value-seeking investors will probably reenter the market. The outcome of the Federal Reserve meeting stands as a pivotal event capable of reshaping market dynamics.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.