- Gold markets showed resilience during Tuesday's trading session, with a slight rally that caught the attention of investors.

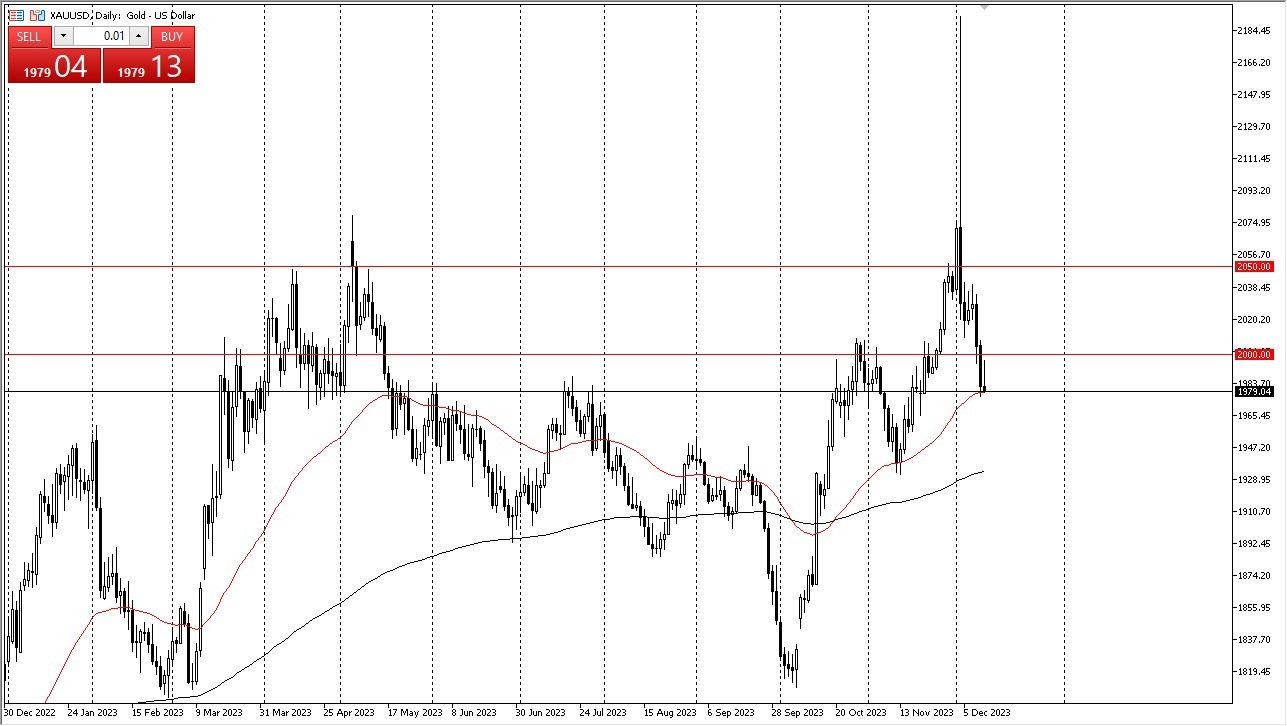

- The presence of the 50-Day Exponential Moving Average provided some support, and the immediate target for gold is the $2,000 level.

- However, we have since seen the market show signs of weakness yet again as metals cannot catch a sustained bid. However, breaking above this threshold would be a strong bullish signal, as round, psychologically significant figures tend to attract market attention, potentially leading to an influx of capital.

Top Forex Brokers

However, the upcoming week is marked by key central bank meetings, including the Federal Reserve, Swiss National Bank, Bank of England, and the European Central Bank. These events are expected to inject significant volatility into the gold market, adding complexity to its near-term outlook. Investors should be prepared for heightened market noise.

Oversold? Yes. Will it Change?

Despite recent selloffs in gold, there is a sense that the market may be approaching oversold conditions. Bond yields, particularly the US 10-year bond yield, have a notable inverse correlation with gold prices. The severity of the gold selloff has prompted expectations of a potential rebound. However, a break below the low point of the Monday session's candlestick could signal a concerning turn of events, potentially leading to a decline towards the $1,950 level. It's worth noting that the $1,950 level is also supported by the 200-Day EMA, making it a significant level of interest for traders.

As we approach the end of the year, some traders may engage in position squaring, which can contribute to market dynamics. Additionally, there is an underlying sense of caution in the market due to the drastic turnaround witnessed last Monday, which saw significant price swings and heightened uncertainty.

To gauge the future direction of the gold market, it is essential to monitor factors such as the US dollar's performance, interest rates, and risk appetite. These elements play a crucial role in influencing gold prices. While the next day or two may bring heightened volatility and noise, it is likely that the market will eventually settle into a more stable rhythm as we enter the holiday season. Liquidity will continue to be a major issue as we drift into the New Year. The gold markets look pathetic at the moment, but you can’t start selling at these low levels.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.