- Gold markets experienced fluctuating movements during Wednesday's trading session, reflecting a period of uncertainty as investors await the Federal Reserve's impending announcement.

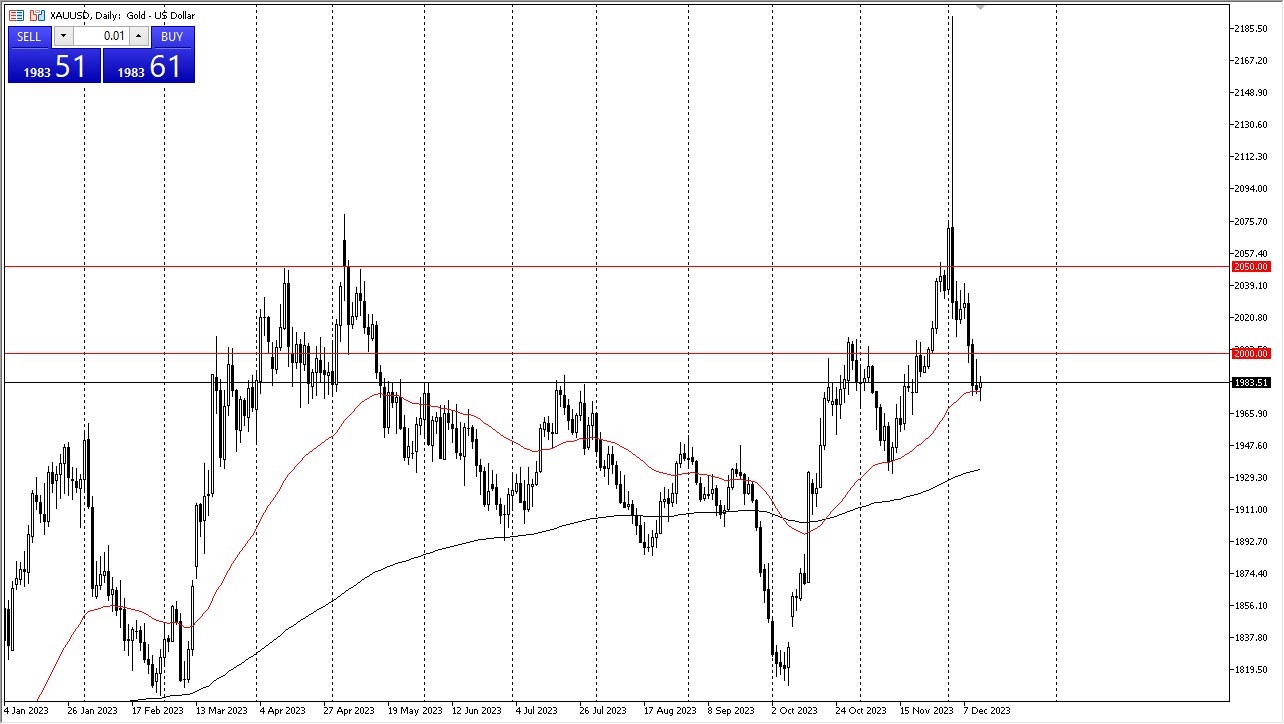

- The key focus is on the $2000 level, which is seen as a major threshold. A breakthrough above this level could propel the market towards the $2050 mark.

- However, there is also significant support near the 50-Day Exponential Moving Average, amidst a backdrop of volatile market behavior.

Top Forex Brokers

The upcoming announcement from the Federal Reserve is expected to significantly influence the direction of gold prices. A rally above the $2000 mark, particularly if it culminates in a daily close above this level, would signal a strong bullish trend. Such a move would not only breach a psychologically important round figure but also surpass the inverted candlestick pattern observed in the previous session. The potential support provided by the 50-Day EMA suggests that buyers may continue to enter the market, perceiving value at these levels.

What About Continued Selling?

Conversely, a downturn breaking below the $1950 level could mark a negative shift, potentially leading to a descent towards the 200-Day EMA. This longer-term moving average is another critical indicator, making it an attractive target in the event of a downward break. The gold market has been characterized by extreme volatility, indicating that choppy trading conditions are likely to persist. As the holiday season approaches, concerns about market liquidity add another layer of complexity to the market's dynamics.

Adding to the volatility is the fact that the upcoming Thursday session includes interest rate decisions and statements from major central banks, including the Swiss National Bank, the Bank of England, and the European Central Bank (ECB). These events are likely to introduce additional volatility into the gold market. The aftermath of these sessions may compel the market to make a more decisive, longer-term decision regarding its direction.

Finally, gold markets are currently in a state of anticipation, with significant support and resistance levels at $1950 and $2000 respectively. The Federal Reserve's announcement, coupled with other central banks' decisions, is poised to be a major determinant of the market's next moves. Investors and traders should brace for continued volatility and be prepared to respond to the outcomes of these critical economic events. The gold market's direction in the near term will largely hinge on how these various factors play out, making it a crucial period for market participants to closely monitor and analyze.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.