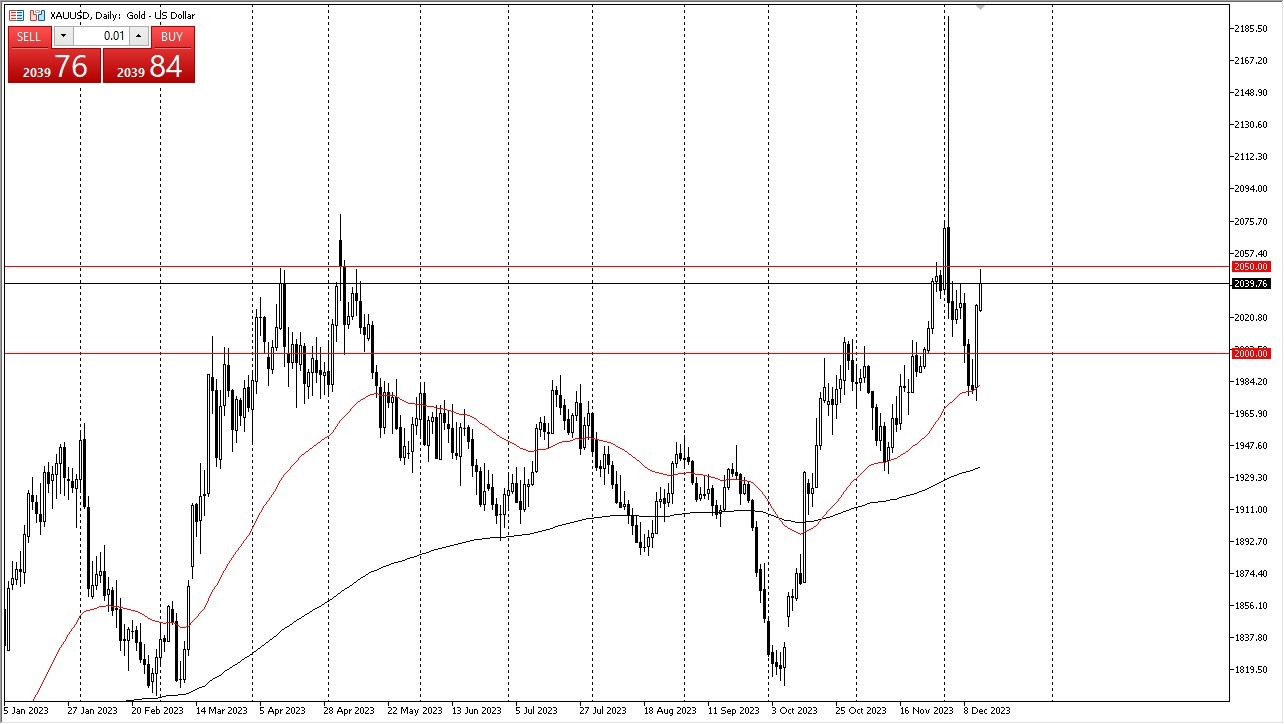

- The gold market has been experiencing a surge in recent times, and it appears to be on the verge of reaching the $2050 mark.

- This level is a significant point of resistance and holds great psychological importance.

- However, the current momentum suggests that gold prices might continue to climb higher in the near future.

Top Forex Brokers

It's important to note that while short-term pullbacks are possible, they are more likely to be met with buying interest, especially if yields in the United States continue to trend lower. The Federal Reserve seems poised for a change in direction, which could favor gold's performance in the coming weeks.

In the recent past, we witnessed a substantial upward move in gold prices, marked by a massive candlestick formation. This indicates strong market momentum. Additionally, the 50-Day Exponential Moving Average has proven to be a crucial support level that the market has bounced from, making it an essential indicator for many traders.

Gold and Yields

Gold typically exhibits an inverse relationship with yields, so monitoring the 10-year yield in the United States, as well as those in other countries like Germany, is vital. While it's true that the gold market can be quite noisy at times, it's important to understand that shorting it may not be the wisest choice, even when occasional pullbacks occur.

It's only when we see a close below the 50-Day EMA that concerns about a possible shift in the overall trend should arise. It's worth acknowledging that there are challenges on the path to higher gold prices, but the recent market dynamics suggest that the trend is likely to continue for the remainder of the year.

Looking ahead, there's a possibility that the gold market could remain bullish throughout 2024. However, it's essential to be prepared for occasional bouts of volatility, especially as central banks worldwide navigate their respective policies and economic conditions. As long as it looks like the Federal Reserve is going to remain loose with its monetary policy, it looks like gold will continue to see buyers based on the idea that the rates will continue to drop.

At the end of the day, the gold market is showing signs of strength, with potential for further gains shortly. While challenges and fluctuations are expected, the overall outlook remains positive, making it an interesting market to watch for investors and traders in the coming year.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.