- In Friday's trading session, gold initially experienced a minor pullback, only to rally once again.

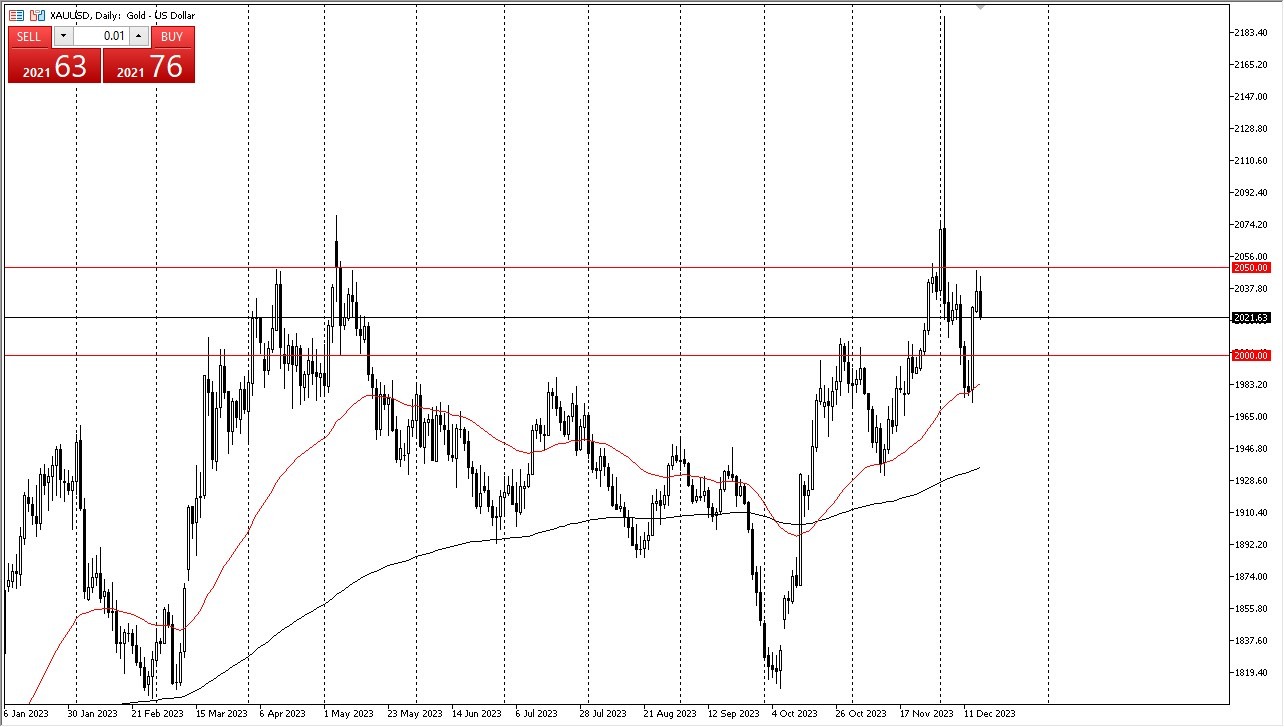

- The key level to watch is $2050, which has acted as a formidable resistance zone, as evident from the Thursday candlestick.

- However, a potential breakout above this level is on the horizon, driven by the ongoing crash in interest rates in the United States.

Top Forex Brokers

Gold is poised to be a major beneficiary of the declining interest rates. The recent massive candlestick from two weeks ago serves as an essential reference point. Although it may pose potential resistance, the prevailing momentum suggests that the market is determined to climb higher. While the journey may not be without its challenges, the overall trajectory points upwards.

Beneath the current levels, the $2000 mark has transformed into a solid support level. The 50-Day Exponential Moving Average (EMA) is gradually approaching this area, making it a focal point for many traders. As such, any short-term pullbacks should be viewed as opportunities to purchase gold at a discounted price.

Rates in America

It's crucial to note that declining interest rates in the United States are expected to continue providing tailwinds to the gold market. Consequently, it's only a matter of time before buyers reenter the market, driving gold prices higher. Given the bullish momentum seen in recent sessions, there is little incentive to consider shorting gold.

Furthermore, as we approach the year-end period, the possibility of decreased market liquidity comes into play. This potential lack of liquidity could present an opportunity for nimble traders to enter the market. This could be based on value, or just simply people trying to catch up with the idea that the Fed is flipping the script as it were. Ultimately, central banks and investors alike are favoring gold overall at the moment.

In conclusion, the gold market continues to exhibit resilience and a strong upward bias. While $2050 represents a significant resistance level, the prevailing momentum suggests a potential breakout. With the backdrop of declining interest rates in the United States, gold remains an attractive asset. Investors should view short-term pullbacks as buying opportunities and refrain from shorting gold, given its recent bullish run. As the year-end approaches, monitoring market dynamics and potential opportunities is advisable.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.