- On Monday, the gold markets started off relatively quietly. However, looking ahead, there's a strong likelihood of an upward trend, influenced by various macroeconomic factors.

- A key driver here is the Federal Reserve's stance on monetary policy.

- If the Fed continues its current policy direction, this could exert considerable upward pressure on gold prices over the long term. This could be the trajectory most of the year for 2024.

Top Forex Brokers

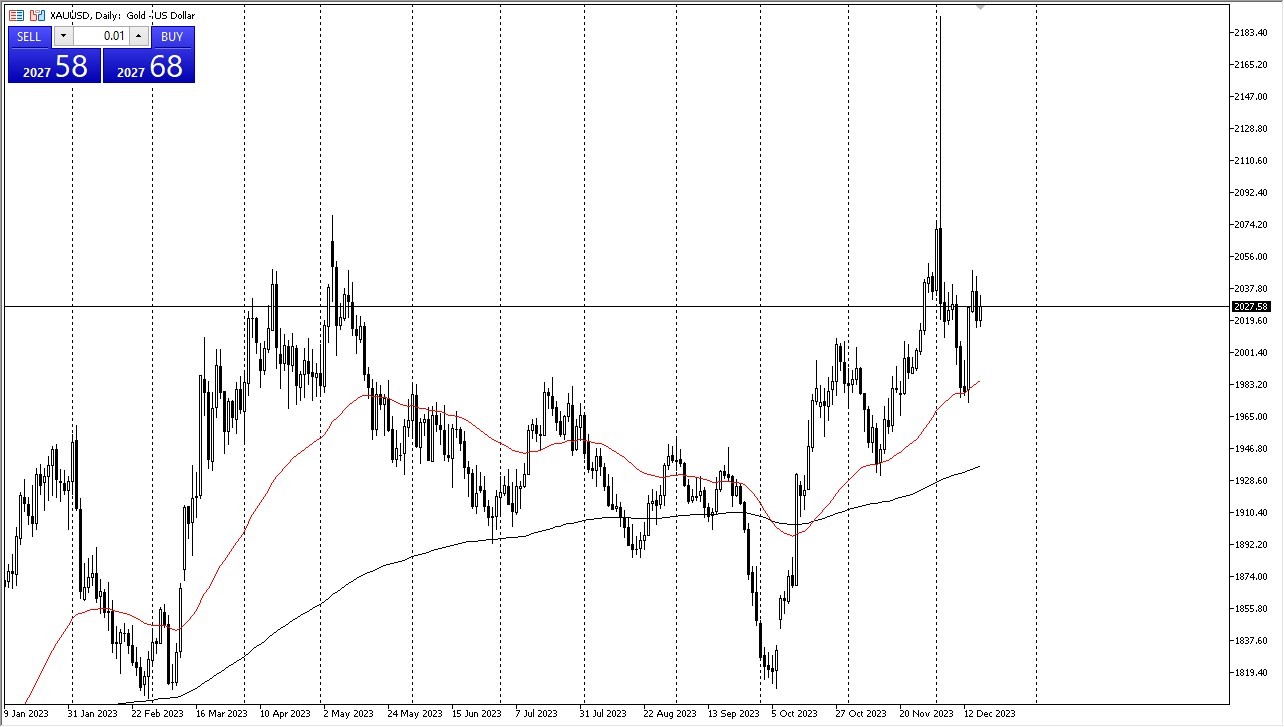

Currently, the 50-Day EMA is around the $1980 level and appears to be on an upward trajectory, suggesting it might serve as a potential support level. This scenario is likely to encourage traders to capitalize on any dips in the gold market, bolstered by the overall bullish momentum. Additionally, the US dollar is expected to face downward pressure, which typically benefits gold. Furthermore, the anticipation of falling interest rates makes gold an increasingly attractive investment option. However, you should be cautious about leverage.

Geopolitics and Safety

Another crucial aspect to consider is the current geopolitical climate, which is quite unstable. In light of ongoing conflicts, potential recessionary trends, and global economic slowdowns, investors are likely to seek ways to protect their wealth. Gold, known for its safe-haven status, could become a particularly appealing option for traders navigating these uncertain times.

All factors considered; it seems probable that gold will eventually target the $2075 level. This level represents the top of the body from a previous candlestick pattern observed just before the significant liquidity reduction in early December. Therefore, it's expected that gold will see a range of upward movement in the short term. However, a rapid and substantial surge in gold prices is not anticipated between now and the end of the year.

In the end, the outlook for gold is influenced by a combination of factors, including the Federal Reserve's monetary policy, the strength of the US dollar, anticipated interest rate trends, and the broader geopolitical environment. These elements collectively suggest a bullish trend for gold, with potential increases in its value. Investors in the gold market should monitor these evolving situations closely, as they can significantly impact the attractiveness and pricing of this precious metal. As always, careful analysis and strategic decision-making will be crucial for those looking to invest in gold in the current economic landscape.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.