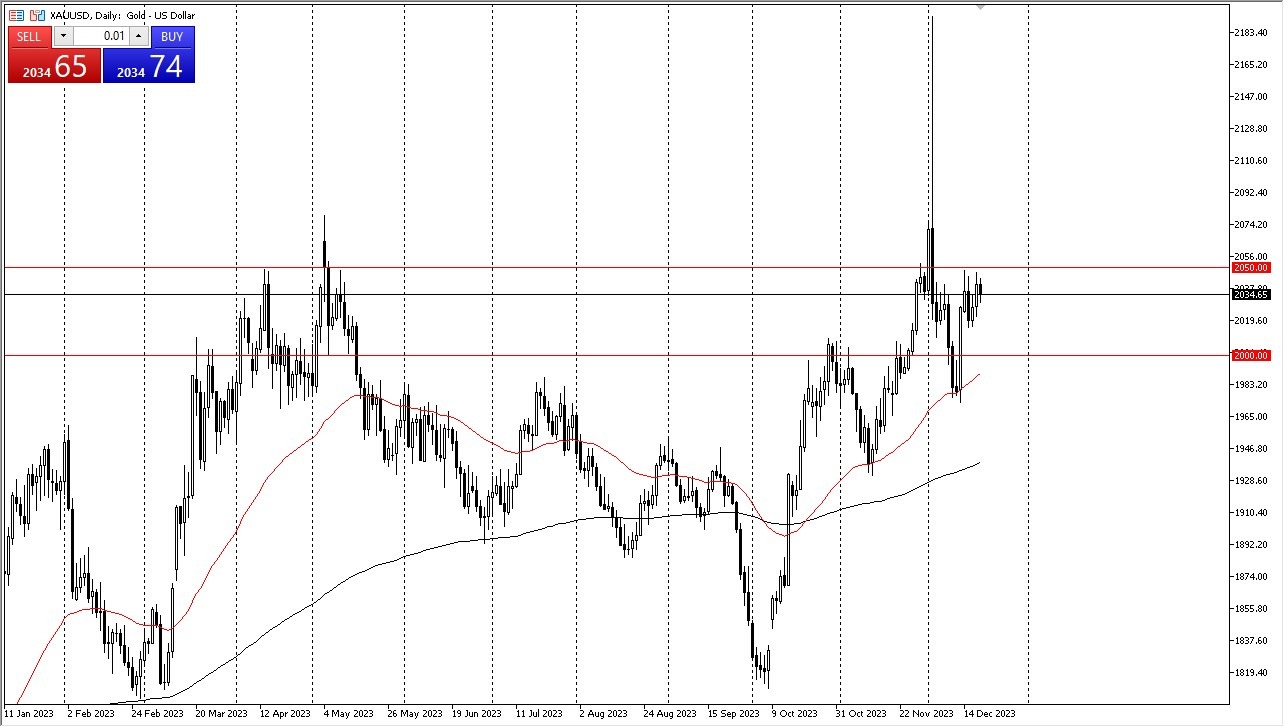

- The gold market showed a slight retreat in Wednesday's trading session, encountering resistance at the $2050 level.

- It's intriguing to observe whether we can surpass this obstacle.

- The market appears poised to oscillate between the $2000 support level below and the $2050 resistance level above.

- Beneath the $2000 mark lies the 50-day EMA, which serves as robust support, creating a formidable "floor" in the current market landscape.

Top Forex Brokers

Further Buying Expected

All things considered; upward pressure is expected to persist. The $2050 level remains a challenging hurdle, but as liquidity gradually exits the market, we find ourselves in a situation where maintaining the existing range is more probable than not. Despite the inevitable noise in the market, the buyers are expected to dominate. Presently, I am inclined towards buying during price dips, actively seeking opportunities during short-term declines. The $2000 level below holds substantial significance as a major support level, warranting close attention. The presence of the 50-Day EMA in proximity attracts algorithm-driven traders, further reinforcing market support.

The gold market's movements are notably influenced by interest rates. It is reasonable to anticipate fluctuations in the gold market, particularly given that gold typically performs well when interest rates decline—a trend expected to continue into 2024. Consequently, it is plausible that we will eventually surpass the highs set in the past, particularly the levels achieved during the significant wipeout candlestick. In this context, it is advisable to refrain from adopting a selling stance, at least until we witness a downward breach below the 50-day EMA.

In the end, the gold market experienced a modest setback as it encountered resistance at the $2050 level. Market dynamics suggest a recurring oscillation between the $2000 support and $2050 resistance. The 50-day EMA beneath the $2000 mark provides a sturdy foundation, attracting algorithmic trading activity and reinforcing market support. With interest rates in focus, gold's performance is likely to continue fluctuating, given its historical affinity for thriving in a low-interest-rate environment, a trend expected to extend into 2024. This scenario favors a bullish outlook for gold, making it prudent to avoid selling positions until a definitive breach below the 50-day EMA materializes. As we navigate these market dynamics, opportunities for buyers to capitalize on price dips are likely to emerge, further shaping the gold market's trajectory.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.