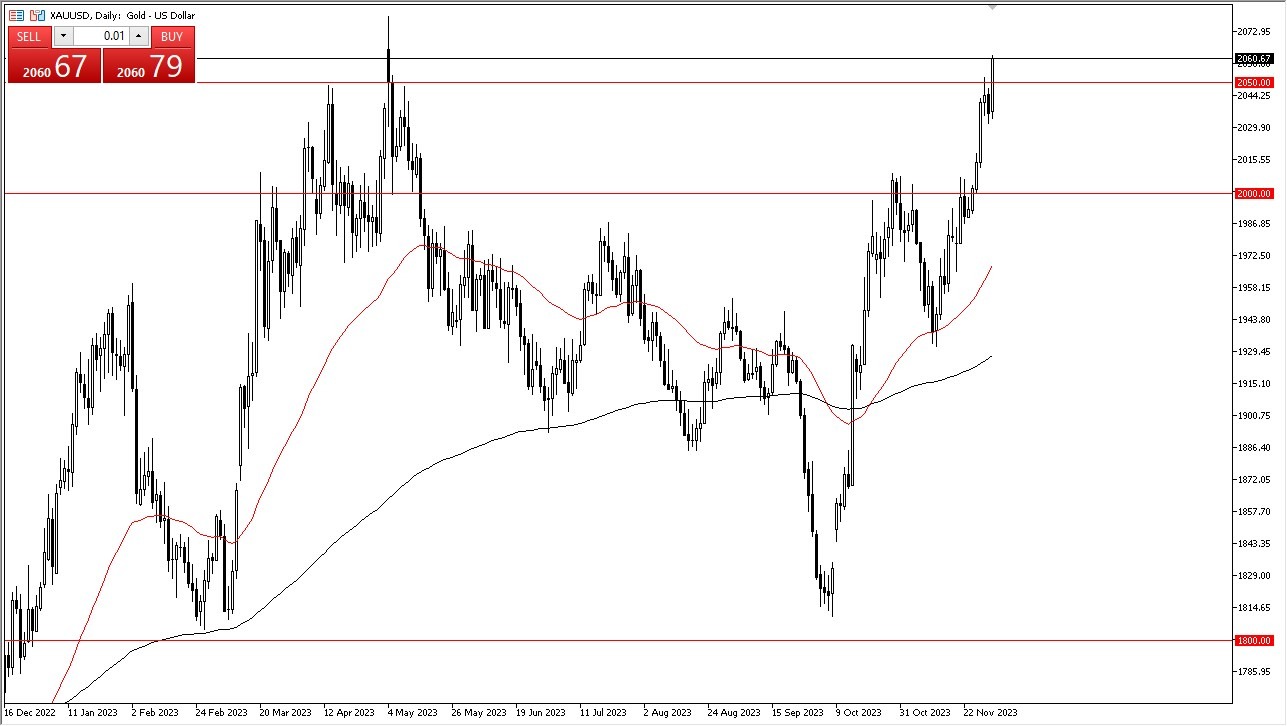

- The gold market made an initial attempt to rally during the most recent trading session on Friday, but it encountered significant resistance around the $2050 level.

- That being said, we are trying to break out above it as I write this. This level has consistently played a crucial role in the past, so it comes as no surprise that gold faced a formidable challenge here. Moreover, it's worth noting that almost every conceivable metric indicates that gold is currently overbought.

- Consequently, a market pullback appears to be a logical move, providing traders with an opportunity to secure profits.

Top Forex Brokers

Conversely, if the $2050 resistance is convincingly breached, it is highly probable that we will witness a substantial upward surge. In such a scenario, gold would likely be on the brink of a definitive breakout, prompting traders to eagerly chase after it. Despite some signs of exhaustion, caution should be exercised when considering short positions in this market. Instead, a more prudent strategy may involve capitalizing on buying opportunities during market dips. Historically, this approach has proven fruitful, and it seems only a matter of time before it regains its appeal.

The Big Figure Below

In the grand scheme of things, the $2000 level remains a critical focal point. This price level possesses significant psychological and historical significance, serving as a substantial resistance barrier in the past. In essence, it holds a significant place in the collective memory of market participants.

In a broader context, it appears that this market may have experienced a degree of exuberance, leading to an understandable pullback. This becomes particularly apparent when we consider the recent resurgence of bullish sentiment in the US dollar, as observed during Friday's trading session. Additionally, close attention must be paid to interest rates, as a further increase could exert substantial downward pressure on gold. At present, these rates seem to have reached a level of relative excess.

As a result of these factors, it seems likely that a market pullback is on the horizon. However, it's important to emphasize that the overall upward trend remains robust and resilient. In conclusion, the gold market, characterized by its recent volatility, presents both opportunities and challenges for traders. While a temporary retreat may be in the cards, the enduring upward trajectory suggests that it is only a matter of time before gold resumes its ascent.