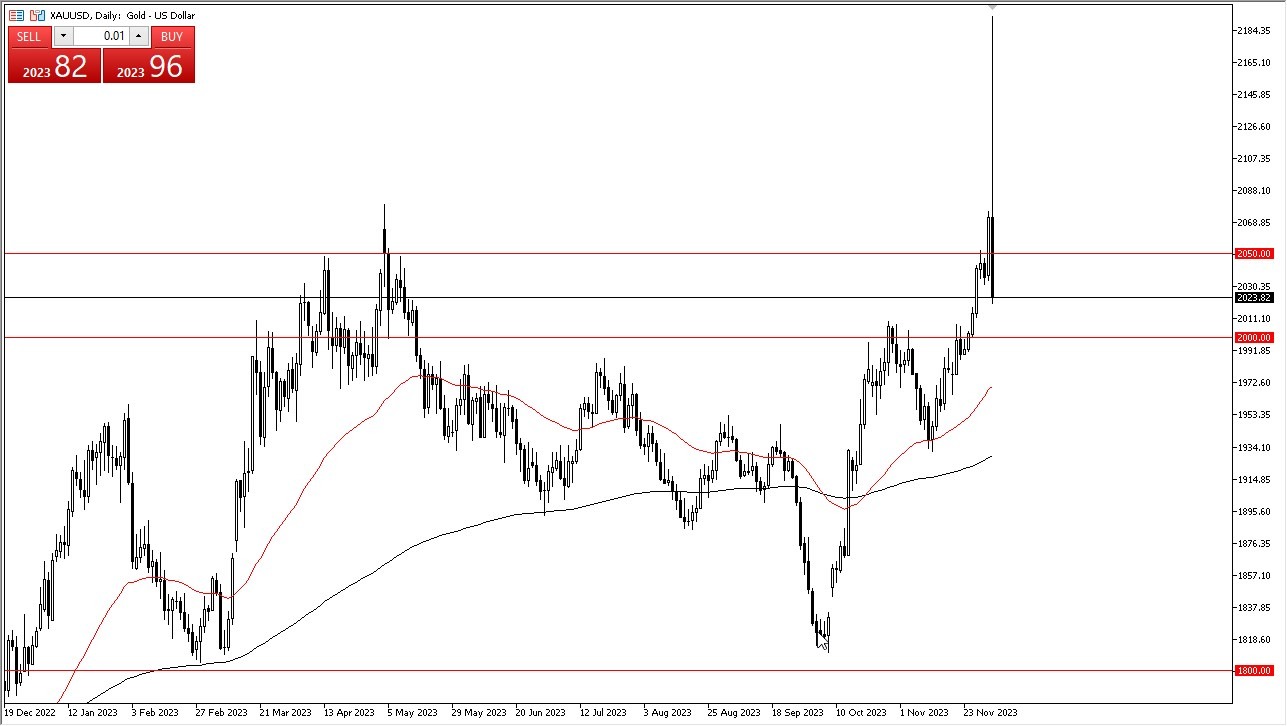

- Gold markets experienced a tumultuous session on Monday, witnessing a sharp increase of over $100, followed by a complete reversal.

- This volatility suggests the market might have triggered stop-loss orders and subsequently faced liquidity issues at higher levels.

- Despite this erratic movement, the market generally seems to favor the upside for gold. Short-term pullbacks are expected to find support, particularly around the $2050 level. However, the exact trajectory of the market remains uncertain due to the unusual nature of the recent movements.

Top Forex Brokers

The drop-in interest rates in the United States is perceived as a positive factor for the gold market. Nonetheless, there is a viewpoint that the market might be overextended. Current market sentiment is influenced by the expectation that the Federal Reserve may commence interest rate cuts by March. While some consider this anticipation to be somewhat premature, it is logical to assume that gold would benefit from lower interest rates. The market has been factoring in this possibility for some time, suggesting that gold might gain momentum in the longer term as a preferred hedge against lower interest rates.

So, Now Gold Pulls Back Just as Quickly

However, the immediate reversal of the gold market's initial spike raises questions about its sustainability and whether there will be adequate follow-through. This uncertainty leads to a cautious approach towards investing heavily in gold at this juncture. The abnormal spike, occurring at the onset of Asian trading—a time typically characterized by lower volume—adds to the ambiguity, making it challenging to draw definitive conclusions from this recent activity.

At the end of the day, while the gold market retains a bullish outlook, the recent extreme volatility and the unusual reversal of gains warrant a careful and measured approach to investment in the short term. The market's future movements will likely be influenced by further developments in interest rates in the United States and the broader global economic context. As such, close monitoring of these factors will be essential for investors looking to navigate the complexities of the gold market effectively. This is a market that is a complete mess, so the best route is probably a situation where you look for pullbacks for value down the road. I like gold, but there is no reason to chase the trade, as a lot of traders found out during the Asian session on Monday.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.