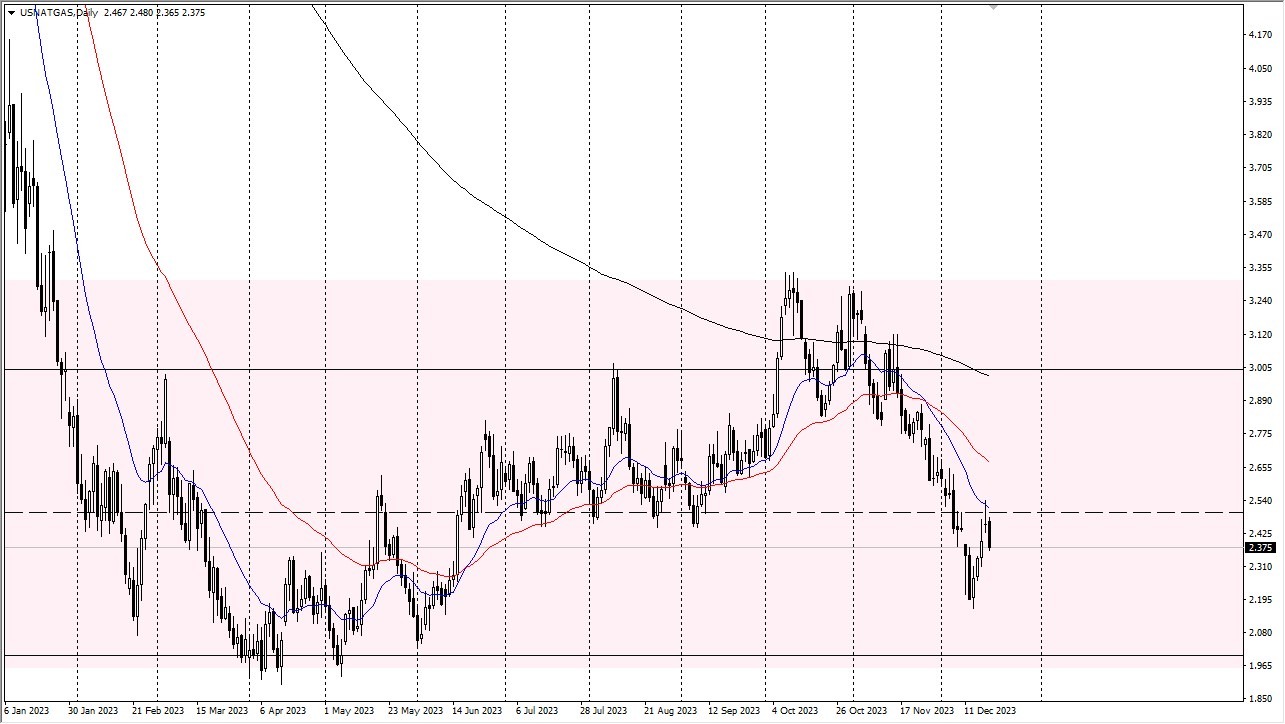

The Natural Gas market experienced a modest decline during the latest trading session, with the $2.50 level acting as a formidable barrier to further upward movement. This price point has served as a historical anchor of support, lending an element of "market memory" to the prevailing range. While this doesn't necessarily foretell an imminent breakdown, it underscores the market's current bearish stance, signaling the need for substantial groundwork before any potential rally can materialize.

Top Forex Brokers

However, the market's outlook isn't devoid of positive indicators. A break above the shooting star formation observed during Monday's trading session could herald a significant shift towards bullish sentiment. Though such a feat may not be easily accomplished, it holds the potential to propel prices toward the $2.75 level, offering a glimmer of hope for natural gas bulls. This is something that could happen given enough time, but as for now – we wait and see.

In the broader context, the market's future is clouded by volatility and noise, driven in part by diminishing liquidity as traders prepare to wrap up the year and secure their profits. Additionally, oversupply concerns continue to exert downward pressure, posing a significant headwind to price appreciation. This dichotomy of factors underscores the challenge facing natural gas traders as they navigate the final weeks of the year.

Longer Term Range? Maybe.

- Zooming out, it becomes evident that the market is attempting to carve out a range for a potential longer-term move.

- The $2.00 level below serves as a robust support threshold, while the $3.33 level above looms as a formidable resistance.

- This wide range encapsulates the market's persistent choppiness over the past week or two, further underscoring the uncertainty surrounding natural gas prices as the year draws to a close.

At the end of the day, the Natural Gas market grapples with resistance at the $2.50 level amid an overall bearish backdrop. While a breakout above Monday's shooting star formation could usher in a bullish phase, the market remains ensnared in the throes of volatility and noise, exacerbated by waning liquidity. Oversupply concerns cast a shadow over prices, complicating the prospects for a sustained rally. With a wide range defined by the $2.00 support and $3.33 resistance, traders face a complex landscape in the final weeks of the year.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.