Top Forex Brokers

BTC/USD

Bitcoin had a little bit of a pullback during the week, but it looks as if the $40,000 level will continue to be important. It has held as nice support, and I think at this point in time there will be value hunters down in that region willing to pick up “cheap bitcoin.” That being said, I also recognize that we are heading into the end of the year and liquidity could be a serious problem. Because of this, you will have to be very cautious with your position sizing, especially when it comes to cryptocurrency.

USD/CAD

The US dollar has plunged against the Canadian dollar as the Federal Reserve looks like it is ready to cut rates next year. This obviously has a lot of traders out there “front running” the idea of lower rates in America. That being said, it is probably only a matter of time before the Bank of Canada follow suit, as the 2 economies are so heavily intertwined. However, pay close attention to crude oil because it is starting to make signs of bullish pressure again, so that could also help this market breakdown below the crucial 1.33 level that offers support.

WTI Crude Oil

The West Texas Crude Oil market initially plunged during the course of the trading week, but has seen a lot of buying pressure sense, suggesting that perhaps we are getting close to reaching some type of bottom. If that ends up being the case, then I suspect we have a situation where traders will start to build longer-term positions. If that is going to be the case, you will have to be very cautious and deal with a lot of volatility, because not only is making a bottom very noisy, you also have a lack of liquidity heading into the end of the year. Underneath, the $65 level is still a major support level.

USD/CHF

The US dollar fell during most of the trading week against the Swiss franc, but it looks like the 0.87 level is offering a bit of support. Because of this, we have to question whether or not we are in the midst of forming some type of massive “double bottom”, which could keep the market supported. Keep in mind that the Federal Reserve looks likely to pivot for 2024, meaning that rates could go lower. However, that then brings up the question: “are we heading into a global recession?” If that’s the case, the US dollar could pick up a bit of momentum.

Gold

Gold markets have been all over the place during the week, and quite frankly ended up closing on a rather sour note as it looks like we are going to continue to see plenty of pressure. The 2000 level underneath is support, but the fact that we gave up so much on Friday suggests that perhaps gold is going to struggle to go further from here. The Federal Reserve is pivoting and that should end up helping helped gold, but quite frankly I think the world is starting to sniff out some kind of major problem. Gold remains neutral between now and the end of the year with a slightly negative bias.

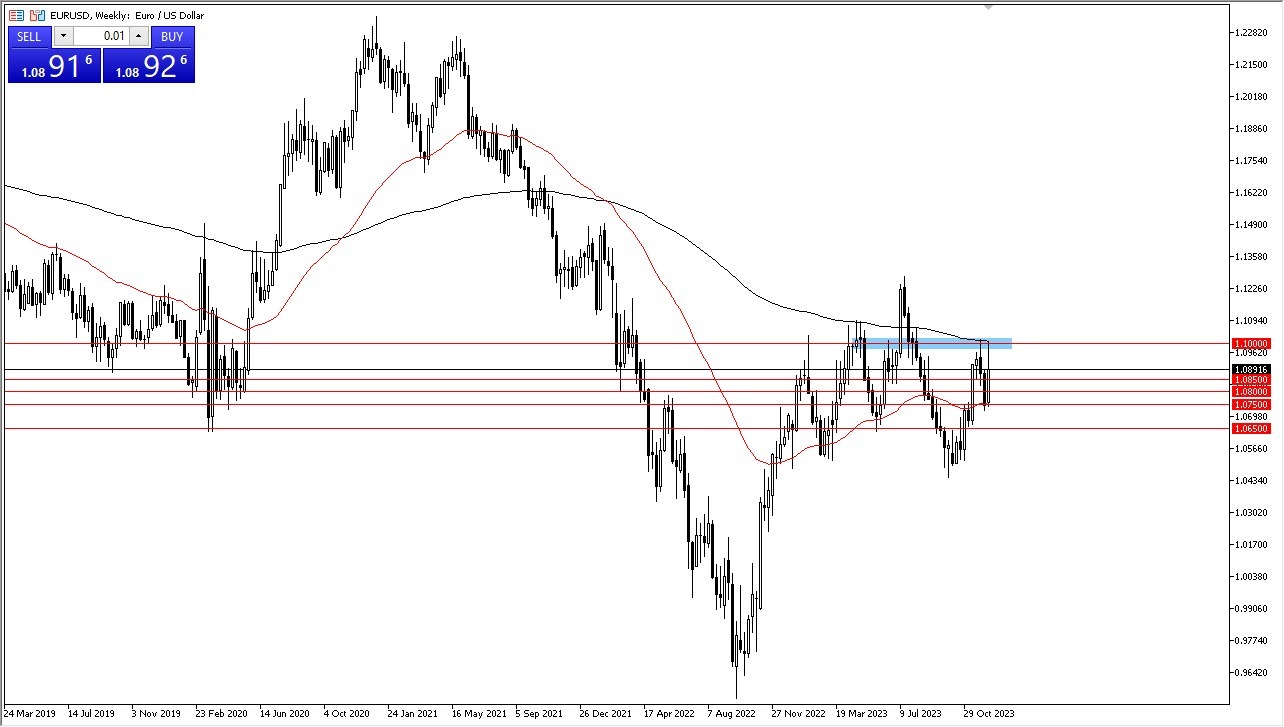

EUR/USD

The EUR/USD shot higher during the course of the week to test the 1.10 level, but Friday was a horrible session. Because of this, I think we are trying to sort out whether or not the idea that the Federal Reserve is going to start pivoting is actually good news. Ultimately, looks like we are stuck between the 200-Week EMA at the 1.10 level, and the 50-Week EMA near the 1.0750 level again. What looks so promising at the beginning of the week suddenly doesn’t look so thrilling.

DAX

The German DAX initially tried to rally during the week but ended up forming a nasty looking shooting star. Quite frankly, this is a market that has been overdone for some time, right along with many other stock indices globally. I also recognize that even though we are overbought, the real culprit might be the fact that it’s the end of the year and traders will want to book gains. In order to do so, they will have to sell their position. If we break down below the lows of the week, we could see the DAX dropping down to the €16,500 level.

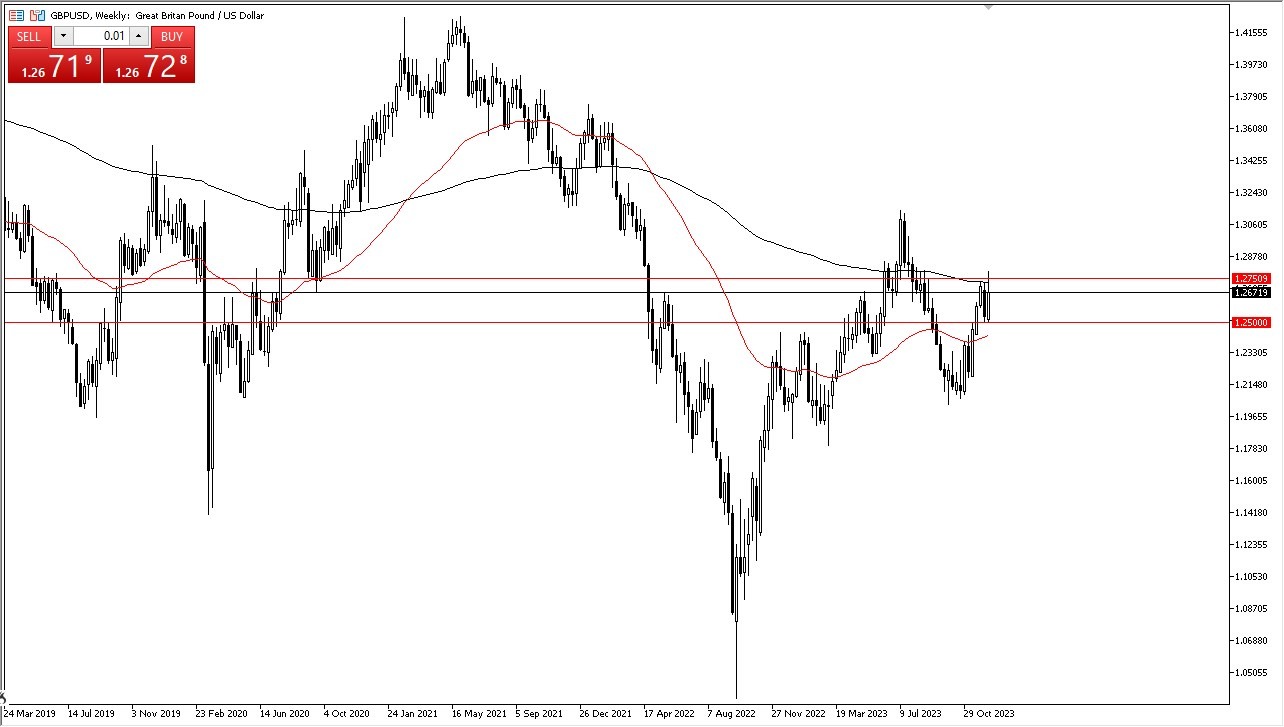

GBP/USD

The British pound shot higher against the US dollar during the week as it’s obvious that the Federal Reserve is going to start pivoting. However, looks like the 1.2750 level has offered enough resistance to keep the market down. At this point, it is very much like the euro, in the sense that we are just simply banging around between the 200-Week EMA and the 50-Week EMA indicators as we drift through the end of the year.