- Silver exhibited a modest rally in the early hours of Tuesday, hinting at a potential recovery after recent declines.

- The market appears to be in an oversold condition, making a rebound a logical possibility. However, the early positive momentum waned, as the metals cannot seem to get a break.

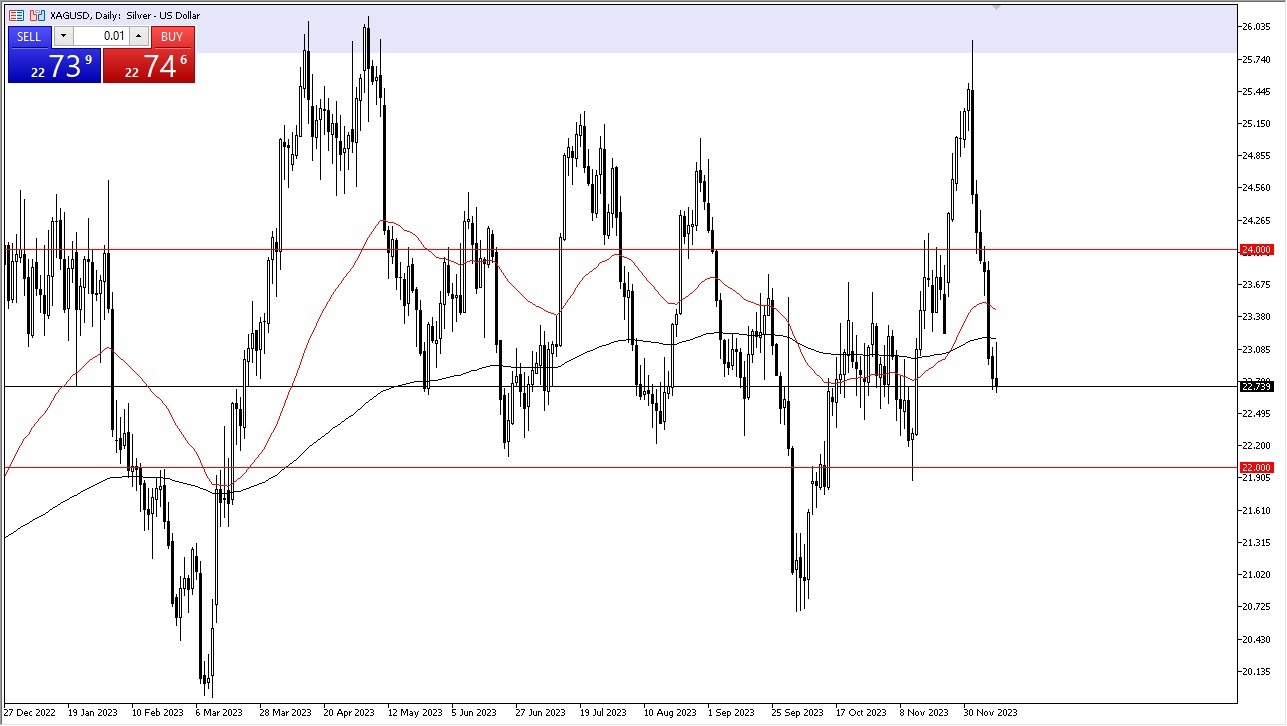

- The 200-Day Exponential Moving Average looms just above, potentially providing a level of resistance. A breakthrough at this point could open the door to a move towards the $23.50 level.

Top Forex Brokers

The notion of a market bounce to this area aligns with the typical response of value hunters during oversold conditions. Additionally, central banks are set to make interest rate decisions in the coming days, impacting bond markets. Traders who had previously shorted the silver market and profited from recent sessions may seize the opportunity to lock in quick gains.

It is essential to recognize that the silver market tends to be noisy, and with the Federal Reserve, Bank of England, Swiss National Bank, and the European Central Bank all scheduled to release interest rate statements and hold press conferences, it is likely that the precious metals markets will experience heightened activity. If these central banks adopt a dovish tone, it could be supportive of both gold and silver. However, silver also has industrial applications, so economic data suggesting a slowdown in the global economy could exert downward pressure on silver prices. I think that we are simply waiting to see what the central bank decisions are going to be, and the result effect on the bond market yields.

Support, Resistance, and Caution in a Volatile Market

Key support can be found at the $22 level, while the next significant resistance level sits near $24. Given the potential for increased volatility, traders should exercise caution and maintain small position sizes. The next few sessions hold the potential for rapid and unpredictable movements, making risk management a top priority.

In the end, silver is displaying signs of a bounce from oversold conditions, but its trajectory remains uncertain. The influence of central bank decisions and economic data cannot be underestimated in the precious metals market. While caution is advised, the oversold nature of silver suggests the potential for a rebound. As market participants navigate the upcoming central bank meetings, it is essential to remain vigilant and adaptable in response to evolving conditions.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.