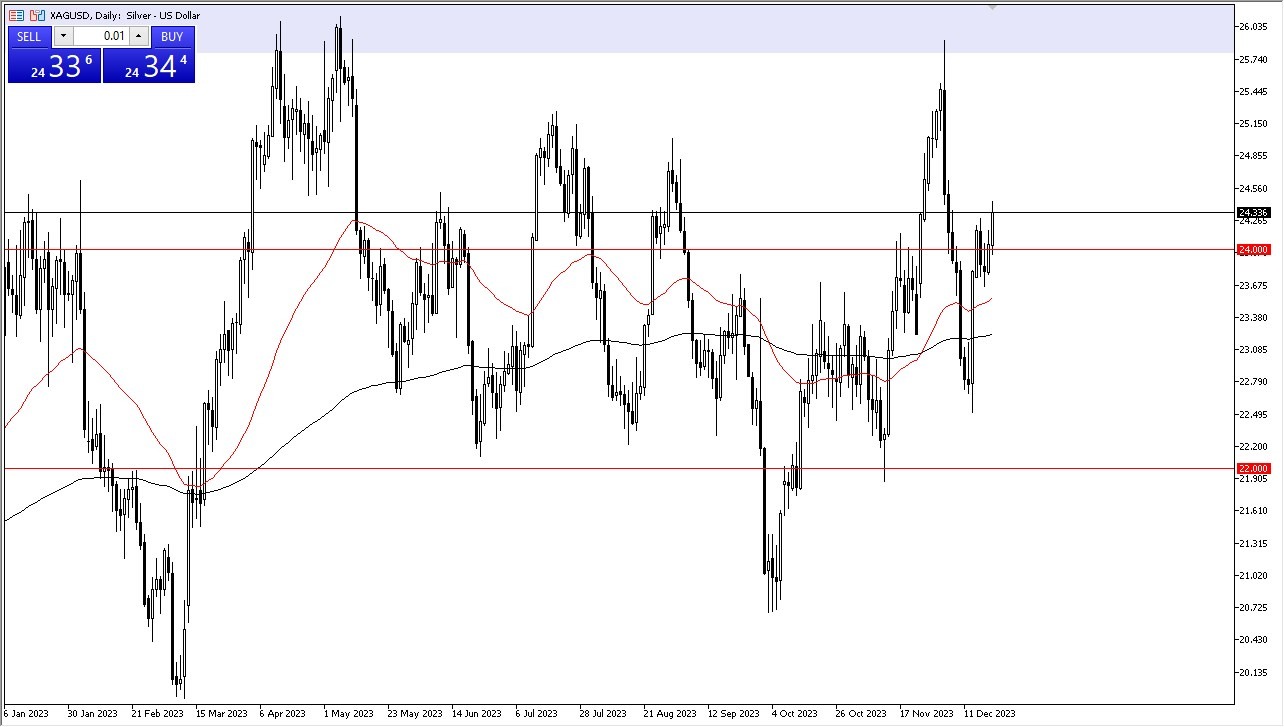

- Silver displayed a modest rally in Wednesday's session, riding a wave of upward momentum.

- It's a market where buyers eagerly step in whenever we see a return to lower price levels, akin to the allure of "sheet-metal."

- The trajectory of interest rates in the United States holds significant sway over the market's future course, necessitating vigilant monitoring of rate movements. A continued decline in rates may well propel silver toward the $26 mark once more.

Top Forex Brokers

The $24 level emerges as a magnet for price action, attracting considerable attention from traders. It enjoys support, particularly in the vicinity of the 50-Day EMA, located around the $23.50 mark. Silver's fortunes are intricately tied to not only U.S. interest rates but also the performance of the U.S. dollar. These factors are key indicators for gauging silver's future direction. Presently, the prevailing momentum strongly favors the upside, making it challenging to adopt a bearish stance. Most market participants are likely to view this market through the lens of buying opportunities during price dips.

2024 Should Be Positive

On the whole, the outlook for silver in 2024 appears promising. However, as we approach the holiday season, the possibility of dwindling liquidity looms. In such circumstances, it would not be surprising to witness short-term sideways movement, even though Wednesday commenced with a positive tone. As the week draws to a close, trading volume is expected to dwindle, rendering the market somewhat peculiar. It's worth noting that Christmas, occurring on Monday, will result in many traders hastening to conclude their business before the holiday.

At the end of the day, silver's recent rally, driven by substantial upward momentum, highlights the market's resilience and appeal to buyers eyeing opportunities during price retracements. The trajectory of U.S. interest rates, in addition to the performance of the U.S. dollar, plays a pivotal role in shaping silver's path. The $24 level serves as a focal point of interest and support. While the market is poised for a potentially positive 2024, the forthcoming holiday season may usher in a period of reduced liquidity and short-term sideways movement. As we navigate these market dynamics, the inclination for most remains to view silver as a market ripe for buying opportunities during price dips.

Potential signal: I am a buyer of silver, in small increments. I have no interest in shorting this market and believe that we are going to reach $26 before it is all said and done. I would have stop loss set at $23.45

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.