- The S&P 500 had a rather uneventful trading session on Wednesday as we await the arrival of the holidays.

- Currently, traders find themselves in a situation where there isn't much incentive to actively participate in the markets. Liquidity tends to decrease during this time, so it's important to approach investments with caution.

- Moreover, there's the possibility of profit-taking occurring before the holidays, which could potentially lead to a market downturn. While this isn't guaranteed to happen, it's a reality that eventually, people seek to reap the rewards of their investments.

Top Forex Brokers

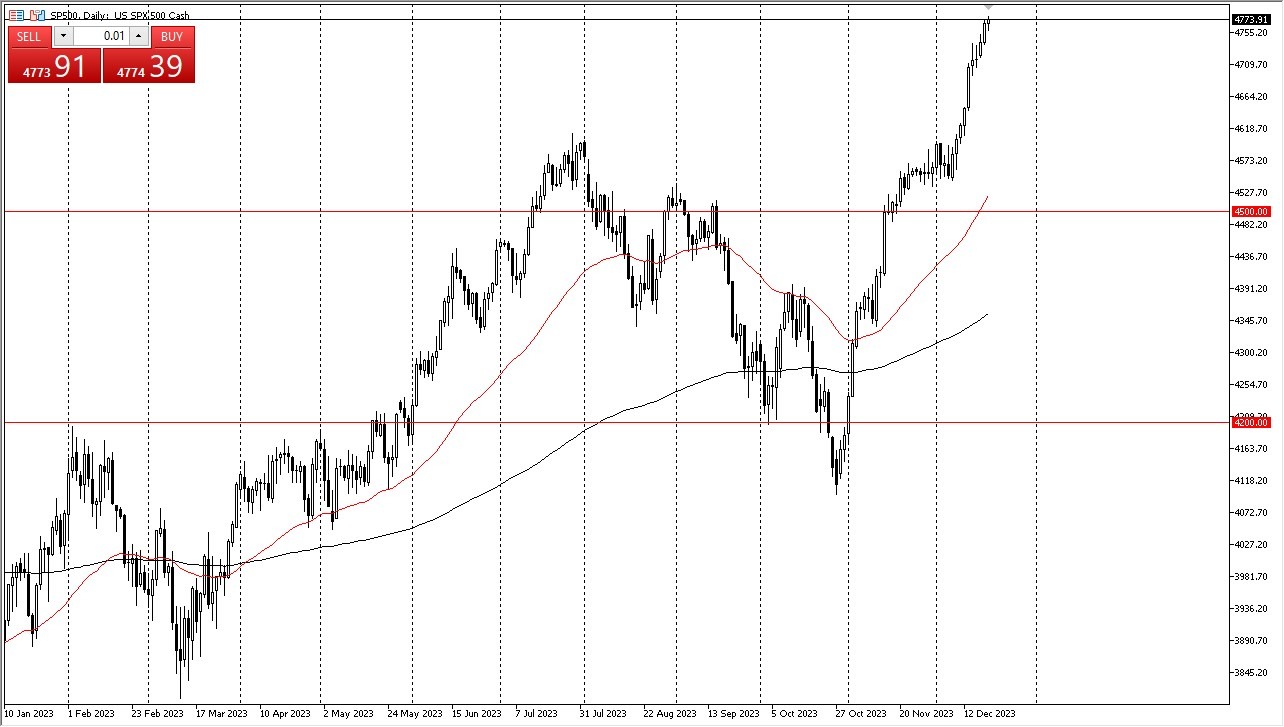

Looking at the technical side, the 50-day Exponential Moving Average is positioned above the 4500 level. It's gradually approaching the recent consolidation area just above that level. If the market manages to dip down to the 4600 level, it's an area that many investors may view as a potential opportunity to buy. The S&P 500 is expected to continue its upward trajectory, but it's essential to recognize that it has seen a substantial increase. Since the end of October, it has gained approximately 16.5%, which is considered a significant rise even in just a couple of months. This suggests that the market may be overextended, prompting caution when considering investments, holiday season notwithstanding.

Longer-term Target: 5000

In the broader picture, the market's likely goal is to reach the 5000 level. However, between now and then, we can anticipate a fair amount of market fluctuations and occasional sell-offs. It's crucial to view these temporary declines as potential buying opportunities, especially considering the Federal Reserve's recent indications of a possible easing of monetary policy. Wall Street tends to favor lower interest rates, which could support further stock market gains, particularly among the most popular companies that significantly influence the index's movements, rather than the entire spectrum of the 500 represented companies.

At the end of the day, the S&P 500 markets are presently in a waiting mode, with the holiday season approaching. Investors should exercise caution given the anticipated decrease in market liquidity and the potential for profit-taking. While the path to the 5000 level may not be without its challenges, opportunities for buying on dips are likely to arise. Moreover, the backdrop of potential monetary policy adjustments by the Federal Reserve suggests that the stock market could continue to see positive momentum, driven by investor optimism and a preference for lower borrowing costs.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.