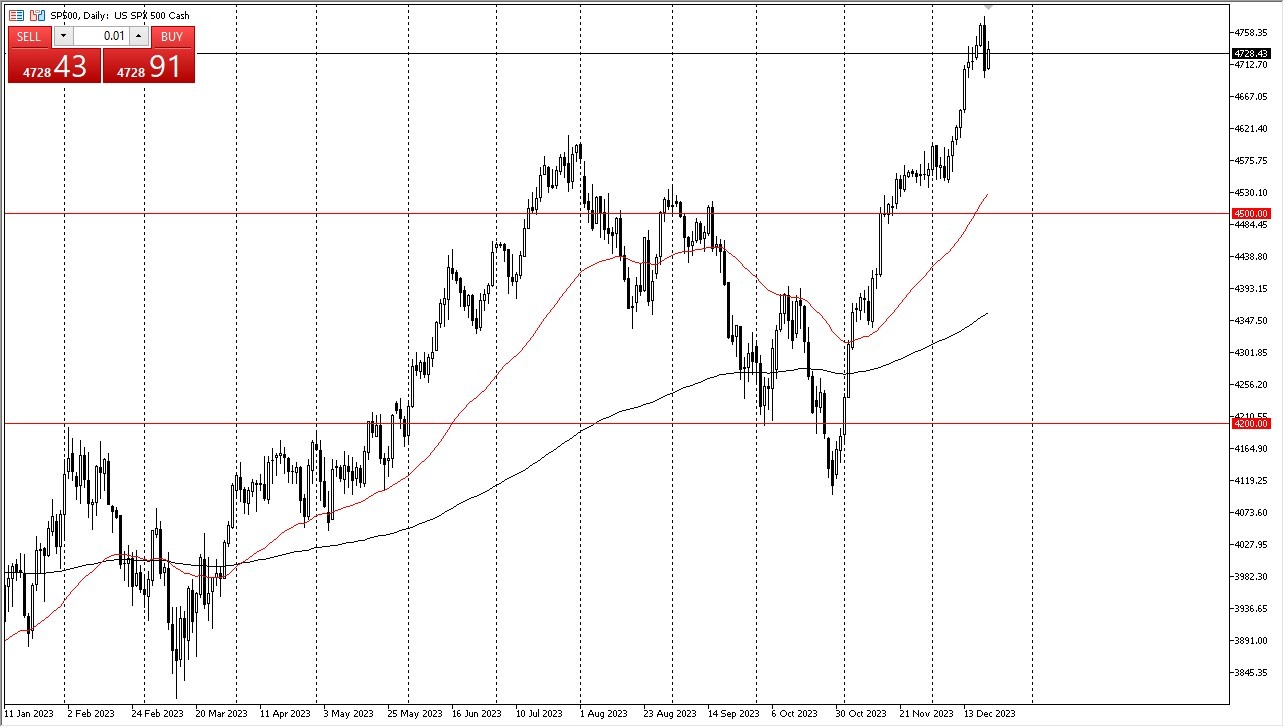

- The S&P 500 index rebounded slightly during the early hours of Thursday, following a significant drop late on Wednesday. My main concern at the moment is the availability of buyers and sellers in the market, a concept known as liquidity.

- I believe there's a possibility we might witness another downturn as traders could choose to cash in their gains following the recent drop.

- However, there's an opposing argument that suggests some investors are attempting to drive the market higher, as many individuals are looking to maximize their profits before the year ends.

Top Forex Brokers

Looking ahead, it's crucial to recognize that Christmas falls on Monday, and this is likely to be the dominant factor influencing market dynamics at the present time. As we approach Friday, trading activity is expected to thin out significantly, making it a challenging day to manage.

A Support Barrier Just Below

Should we see a breakdown below the lowest point of the Wednesday trading session's candlestick, it becomes conceivable that the market could descend towards the 4600 level. This level had previously acted as resistance, so it's reasonable to expect that market participants may recall this historical price point, a phenomenon known as "market memory." Just below this level, the 50-Day Exponential Moving Average is rapidly approaching, potentially offering a support zone for the market. However, it would require substantial selling pressure to reach that point. If such a scenario unfolds, I would cautiously consider investing in the market to capitalize on potential value opportunities. Nonetheless, if we observe such a move, I would exercise prudence and deploy capital gradually, as it might signal the beginning of a more significant downturn.

On the upside, if we surpass the previous session's candlestick to the upside, it opens up the possibility for the market to continue its ascent, potentially targeting the 5000 level. While I anticipate reaching that level eventually, it's important not to overlook the rapid rally that brought us to this point. This suggests that a pullback might be necessary to find attractive opportunities in the market. I do not incline to sell this market, but I am cautious about chasing it higher, especially considering the impending Christmas holiday, which will reduce market liquidity. With this, be careful as things could get strange quickly.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.