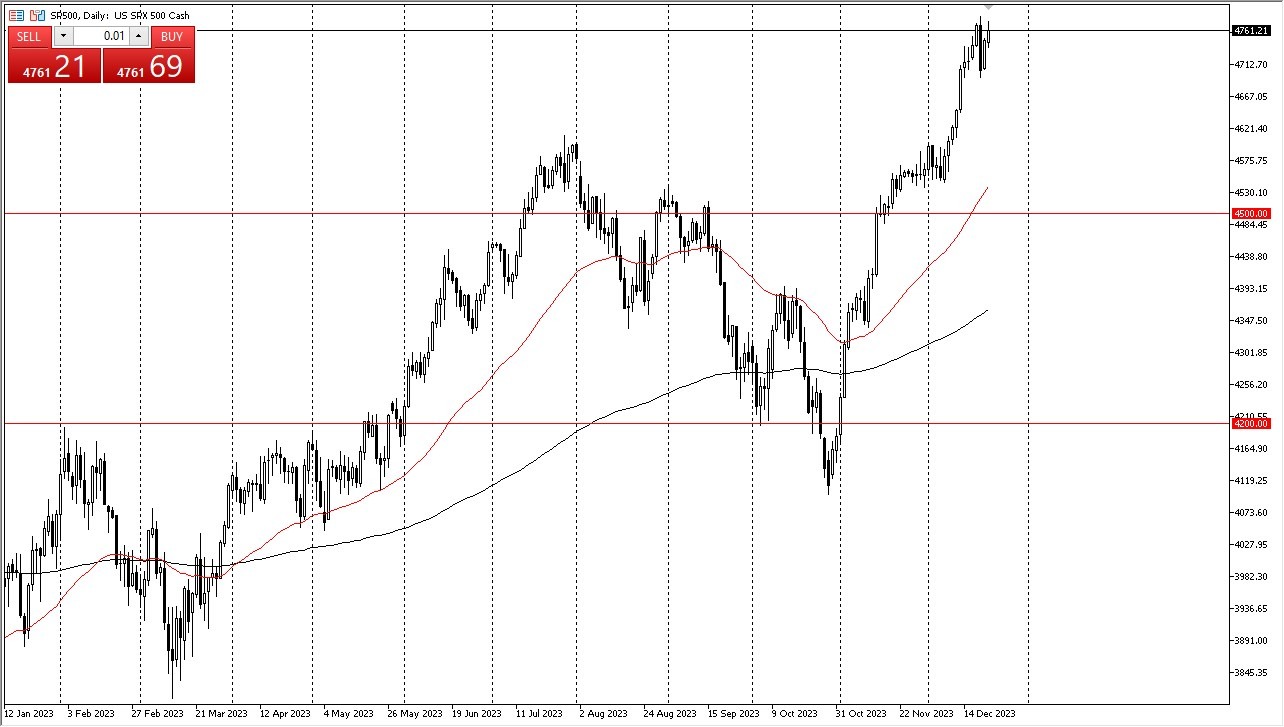

- The S&P 500 index exhibited a marginal rally during Friday's trading session as the holiday season approached. In the broader context, it's reasonable to anticipate a continued upward trend in the market over the long term.

- However, it's essential to note that the upcoming week is expected to be characterized by thin trading activity due to the holiday period.

- During such times, market behavior tends to be relatively unpredictable.

Top Forex Brokers

In principle, the idea of buying on price dips remains appealing. Nevertheless, the market has become significantly overextended, warranting a much-needed pullback. Should the market indeed experience a downturn from its current position, it could potentially descend to the 4,600 level. The 4,600 level is anticipated to draw considerable attention from traders. Subsequently, the $4,500 level is viewed as a solid "floor" for the market, though the likelihood of such a pullback occurring remains uncertain.

Consolidation?

At the very least, a period of sideways movement is required to alleviate some of the excessive market froth. It's worth considering that markets have advanced significantly in a remarkably short timeframe, prompting caution regarding aggressive trading strategies. Since Halloween, the market has achieved an impressive 17% gain, indicating that it may be somewhat overextended. Consequently, while the possibility of further market gains exists, it's increasingly necessary to anticipate a substantial correction eventually, as investors may opt to secure profits.

Furthermore, it is prudent to monitor the prospect of a slowing economy, as concerns about corporate earnings may arise shortly. For now, however, it appears that market participants are primarily focused on the notion of the Federal Reserve implementing accommodative monetary policies, providing a compelling reason to invest in stocks once again. Nevertheless, it's crucial to remember that, in the grand scheme of things, market forces such as gravity inevitably come into play, necessitating a prudent investment approach.

Ultimately, the S&P 500 index displayed a minor rally as the holiday season neared. While the long-term outlook suggests an upward trajectory, the holiday week is expected to bring limited trading activity and increased market unpredictability. Buying in price dips remains a viable strategy, but the market's substantial overextension and the need for a significant pullback should not be underestimated. Caution is advised, especially considering the rapid market gains in recent months. Eventually, a notable correction may materialize, as the focus shifts from Federal Reserve policy to potential economic slowdown and earnings concerns. Amid these considerations, a thoughtful and balanced approach to investment remains paramount.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.