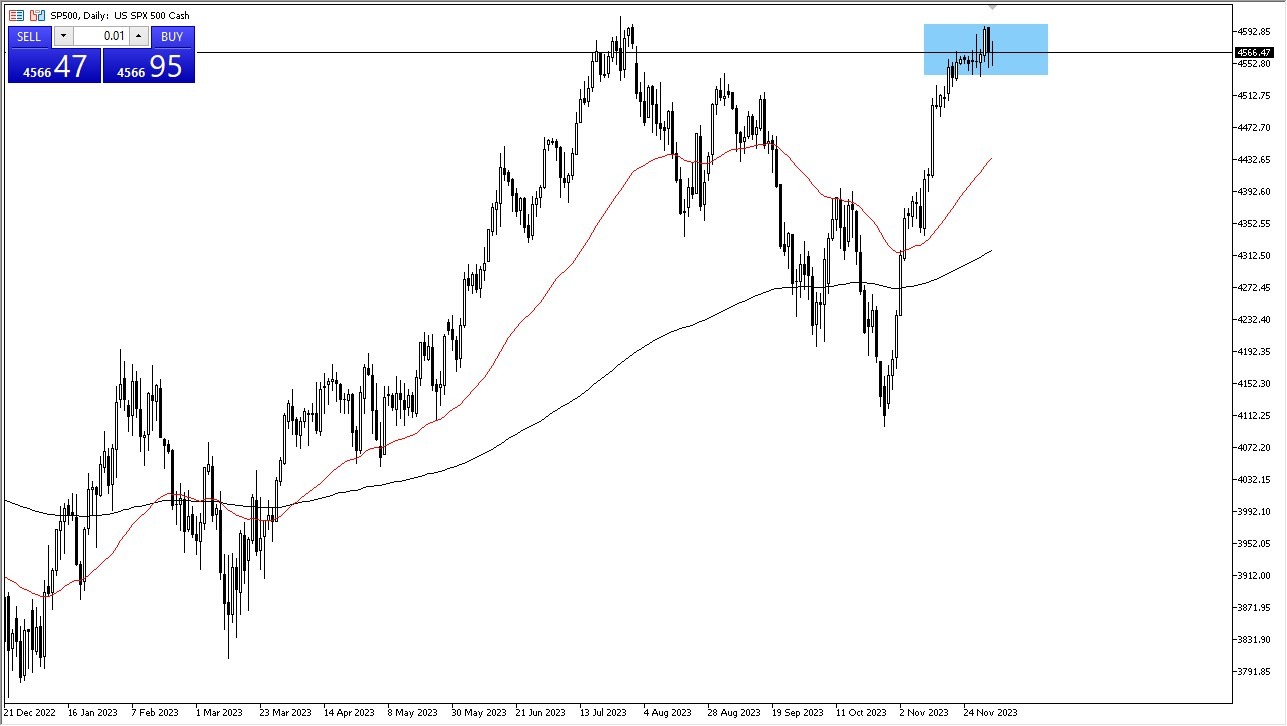

- The S&P 500 experienced a slight decline during Tuesday's early trading hours, continuing a pattern of volatile and unpredictable behavior. The market's movements are reflective of expectations surrounding the Federal Reserve's monetary policy.

- Many on Wall Street anticipate that the Fed will eventually ease its policy, potentially leading to a "Santa Claus rally," where investors engage in a buying spree.

- However, there's a notion that this rally might have already occurred, given the rapid surge in the market recently.

Top Forex Brokers

Looking ahead, a pullback wouldn't be surprising, with the 4500 and 4400 levels identified as potential support zones. In such a scenario, the strategy of retreating to these support levels and then attracting buyers seems likely. This market environment presents opportunities to find value, and many investors, including myself, are on standby with significant funds ready to be invested. A correction appears overdue, which could provide a prime opportunity for traders to capitalize on any dips that appear. I wouldn’t like to open massive positions, at least not after the huge rally we have already had over the last several weeks.

More Upside? Maybe.

Alternatively, if the market were to break above the 3600 level, it could lead to a continued upward trend, although this is not expected to occur easily. A more probable scenario is the market fluctuating between the 4500 and 4600 levels over the forthcoming weeks. As the month progresses, heightened volatility could emerge, primarily due to decreased market liquidity. This prospect necessitates a cautious approach to position sizing, as the market is likely to remain erratic between now and the end of the week – let alone the year as we are heading towards the holiday season.

In the end, the S&P 500 is navigating through a phase of uncertainty, influenced by speculation about the Federal Reserve's policies and the broader economic outlook. While there's potential for a continued rally, the possibility of a correction and subsequent opportunities for value buying are also on the horizon. Investors should remain vigilant and strategic, particularly in managing position sizes, to effectively navigate the potential swings in the market. The end of the year could bring increased volatility, and being prepared for a range of scenarios will be key for traders looking to capitalize on the evolving market dynamics.

Ready to trade the S&P 500 Forex? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.