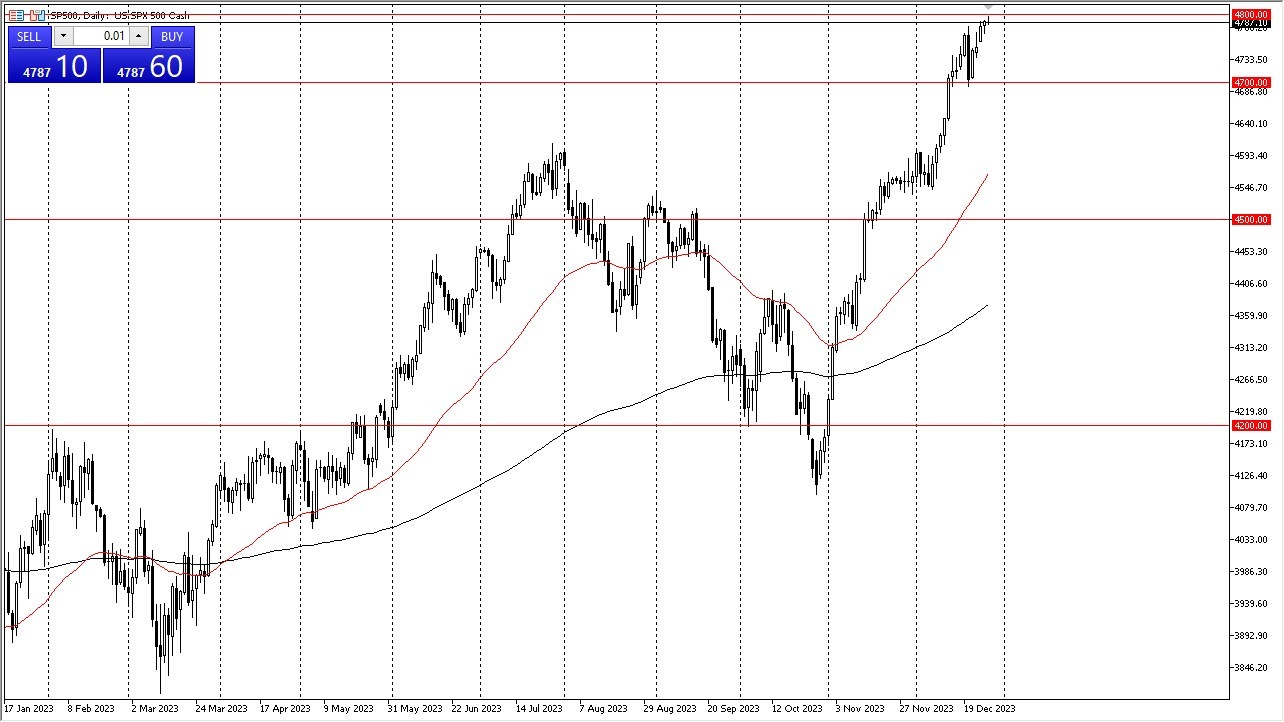

- The S&P 500 index attempted to rally overnight but encountered resistance around the 4,800 level, which represents an all-time high.

- While this record-breaking level suggests the potential for a breakout, there are also concerns regarding market liquidity.

- Caution is warranted during this period as the market can exhibit erratic and unconventional movements.

Top Forex Brokers

The current timeframe, positioned between the Christmas and New Year's Eve holidays, raises questions about the availability of sufficient trading volume to support substantial price movements. This period of the year often sees traders winding down their activities, which can impact market dynamics.

In terms of trading strategies, a preference for buying during pullbacks is reasonable. However, it's important to note that the market is currently overbought, having rallied approximately 17% since Halloween. Such an upward trajectory is atypical, and a pullback to the 4,700 level could potentially usher in a consolidation phase, allowing traders to recalibrate their positions and alleviate some of the excess momentum.

Should the market decline below the 4,700 level, the 50-day Exponential Moving Average (EMA) near the 4,550 level serves as a notable support zone. Additionally, the 4,500 level represents another significant support area. All these levels are considered viable support zones, reinforcing the notion that selling in this market is not a prudent strategy.

Patience = Value and Gains

For those who exercise patience, there may be opportunities to acquire value during a pullback, rather than chasing the market at these elevated levels. The alternative scenario involves a continuation of the uptrend, potentially leading to a breakthrough of the 4,800 level and a move toward the 5,000 mark. However, given the current state of the market, a pullback is increasingly seen as necessary to recalibrate and restore a more balanced and sustainable trajectory.

Ultimately, the S&P 500's recent attempt to rally encountered resistance at the 4,800 level. The market's all-time high raises questions about liquidity and the potential for erratic movements during this holiday season. A preference for buying during pullbacks remains a reasonable strategy, but it's important to recognize the market's overbought condition. A pullback to the 4,700 level could lead to a consolidation phase. Support levels at 4,550 and 4,500 are also noteworthy. While the possibility of further upward movement exists, many market participants are anticipating a necessary pullback to restore balance in the market.

Potential signal: While I prefer a pullback to enter the market, I recognize that a daily close above 4800 is a buy signal. At that point, I would put a stop loss at 4725 and aim for 4950 above.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.