- The USD/CHF struggled to find direction most of the day on Thursday as the markets have embarked on quite a bit of volatility.

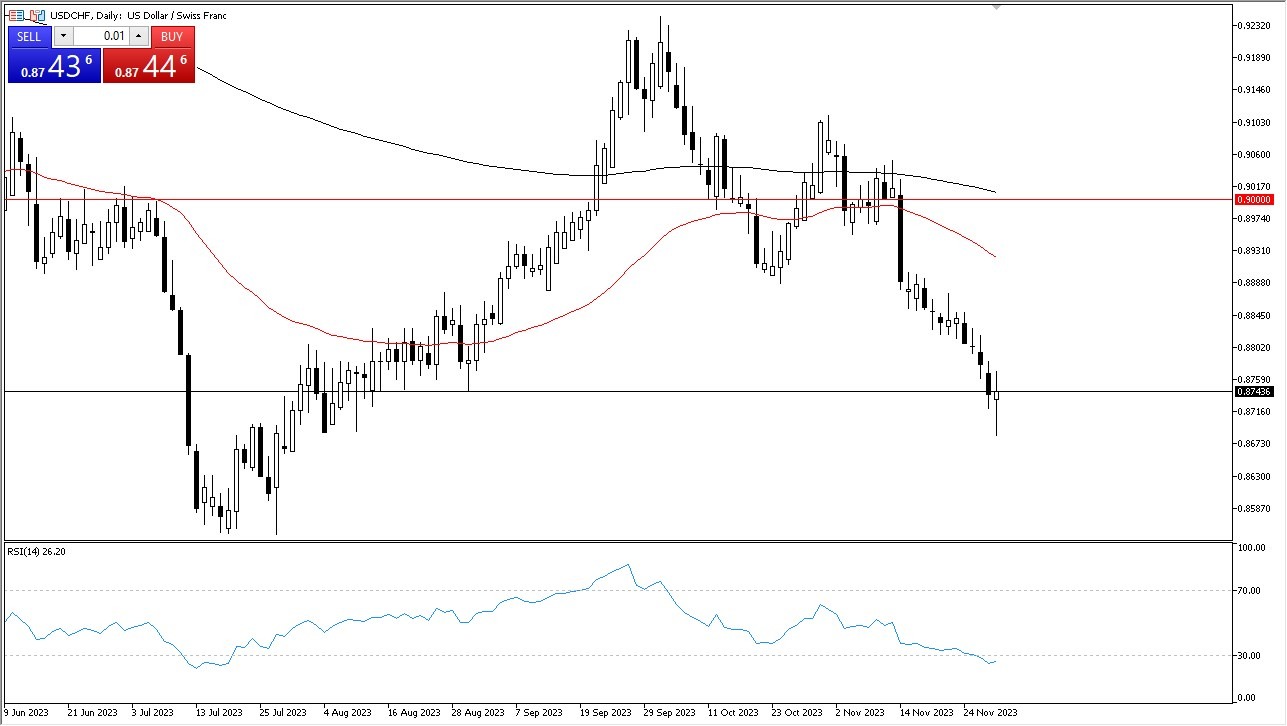

- That being said, it does look as if the oversold condition on the RSI, or Relative Strength Index is starting to show up in pricing as well.

- Because of this, I anticipate that we will see a lot of volatility over the next couple of days as the 0.87 level seems to be a fulcrum for buying pressure and noisy behavior overall.

Top Forex Brokers

If we can break above the highs of the candlestick for the Thursday session, it’s very likely that the market turns around and tries to break above the crucial 0.88 level. Above there, the market then finds itself looking for the significant 50-Day EMA indicator, which is currently sitting near the 0.8920 level.

US Dollar Oversold

In general, the US Dollar has oversold, and a bit of a bounce is probably due at this point. Nonetheless, it does seem as if traders around the world are trying to price in the idea of the Federal Reserve reversing its monetary policy, despite the fact that it seems very unlikely or unwilling to do easily. Bond markets have been seeing yields drop dramatically, and that has made the US dollar a lot less attractive. Whether or not the Swiss franc becomes the go to remains to be seen, because the Swiss franc of course is a low yielding currency in and of itself.

When you look at the RSI, we are in the oversold condition and starting to turn off a little bit, so it does suggest that perhaps buyers will return. However, I would not get overly aggressive to the upside at this point, because it would be fighting what has been a massive drop. If we break down below the bottom of the candlestick, then it’s likely that the US dollar will trade down to the 0.86 CHF level in short order.

Potential Signal: if the US dollar drops below the 0.8650 CHF level, then it’s likely that the Swiss franc will continue to appreciate in value. I would be a seller at that point, looking for the 0.8525 CHF level, with the stoploss near the 0.8722 level.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.