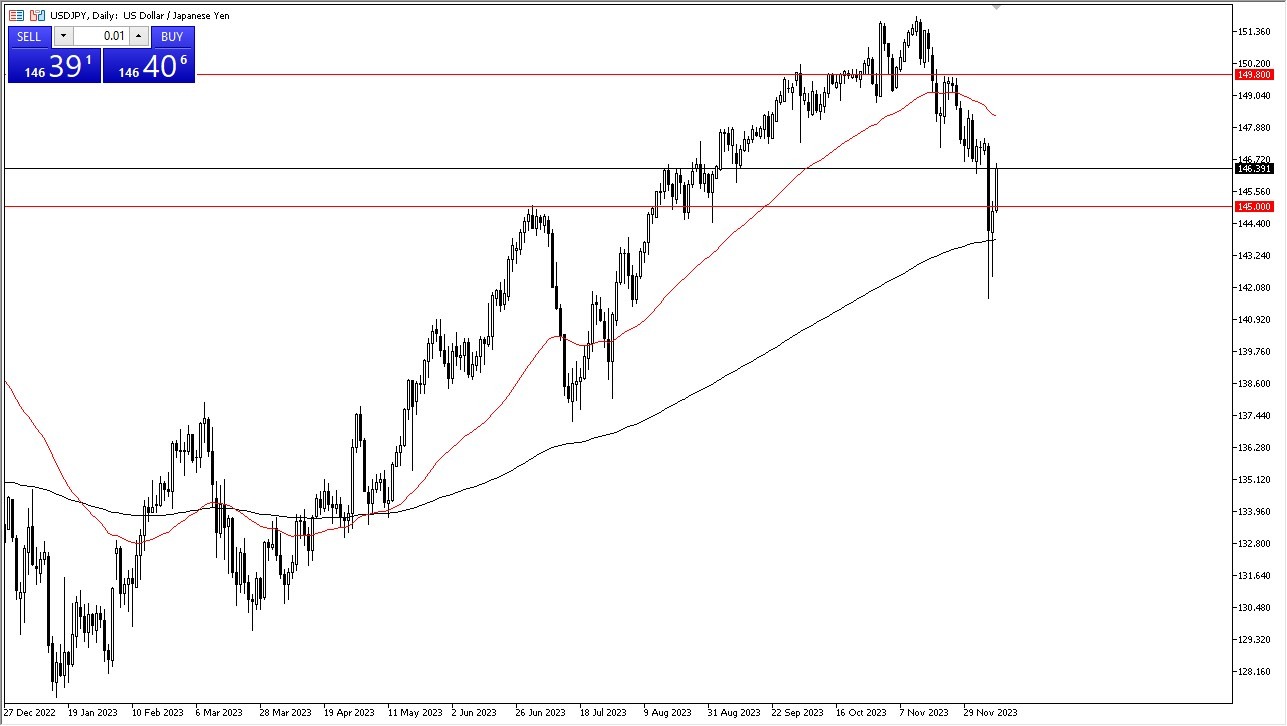

- The USD/JPY displayed a modest rally during Monday's trading session, part of a broader trend of dollar recovery. Notably, the 200-Day EMA positioned below has served as a source of support in recent days.

- Consequently, the primary question revolves around the possibility of breaching the ¥147 area.

- Should this happen, the market could see a substantial uptrend towards the ¥149.80 level. Historically, this level has proven to be a formidable resistance, akin to a brick wall.

Top Forex Brokers

Conversely, a short-term retracement seems plausible and would be in line with market dynamics. Such a retracement could potentially send this currency pair towards the ¥145 level. The significance of the ¥145 level is obvious, and market participants will undoubtedly watch it closely, particularly alongside the 200-Day EMA.

The Federal Reserve is scheduled to make an interest rate decision this week, a pivotal event with the potential to move this currency pair. Additionally, the subsequent week brings the Bank of Japan and its own interest rate decision, which carries similar implications. Given the unfolding events, exercising caution in managing position sizes is advisable. It is noteworthy that the interest rate differential continues to favor the US dollar. Despite recent fluctuations, the broader trend remains bullish.

Fed Meeting

Expectations regarding the Federal Reserve's actions are somewhat muted for the upcoming week, but market attention will be focused on the accompanying statement and press conference. The other question revolves around whether the Bank of Japan will initiate moves toward normalizing interest rates, a topic of considerable debate among market participants. Consequently, anticipations of an eventful and potentially volatile week ahead are warranted, followed by the next week being more of the same. Furthermore, as the holiday season approaches, concerns regarding diminishing liquidity loom on the horizon.

At the end of the day, the US dollar witnessed a moderate rally during Monday's trading session, reflecting a broader trend of dollar resurgence. Support from the 200-Day EMA has been noteworthy. The focus now centers on breaching the ¥147 level, which could catalyze an upward surge. Conversely, a short-term retracement to the ¥145 level is conceivable. The upcoming Federal Reserve and Bank of Japan interest rate decisions will play a pivotal role in shaping the pair's trajectory. Caution in managing position sizes is prudent, especially in light of the enduring US dollar advantage in the interest rate differential. While the Federal Reserve's imminent actions may not yield significant surprises, attention will pivot to their statements and press conferences. The potential for the Bank of Japan to commence interest rate normalization introduces an element of uncertainty and sets the stage for an eventful week ahead, further compounded by liquidity concerns as the holiday season approaches.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.