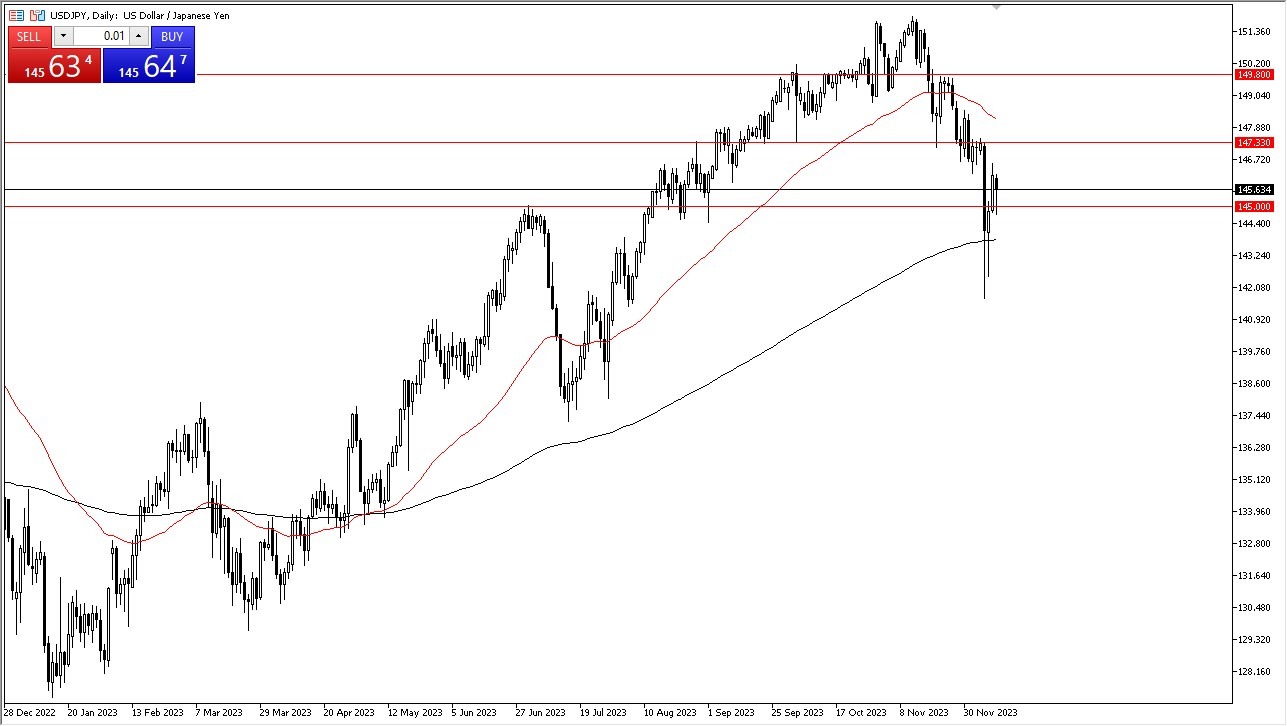

- The USD/JPY embarked on a remarkable journey in Tuesday's trading session, initially experiencing a sharp decline before testing the ¥145 level.

- The market's behavior at this juncture holds significance and is closely monitored by investors.

- Over time, there is a potential target at the ¥147.33 level, but a key factor in this trajectory will be the outcome of the Federal Reserve's central bank meeting on Wednesday.

Top Forex Brokers

Market participants eagerly anticipate signals of loose monetary policy from the Federal Reserve, aligning with the desires of Wall Street. Should the central bank convey intentions of accommodating monetary measures, it could prompt a retreat towards the 200-Day Exponential Moving Average (EMA) situated around the ¥143.50 level. The formation of a significant hammer pattern during Friday's trading session in proximity to this level suggests an ongoing search for stability.

Conversely, a breakthrough above the ¥147.33 level following the Federal Reserve meeting could propel the market towards the ¥149.80 level. However, it is crucial to bear in mind that the upcoming Bank of Japan meeting next week is likely to take center stage as the primary market driver. These two events might be the most important factors going forward in this pair, as the market will be paying attention to interest rate differences between the two.

Balancing Central Bank Actions and Interest Rate Dynamics

The market will be closely monitoring the Bank of Japan's actions, as questions persist about the possibility of the Japanese central bank normalizing rates. Nevertheless, this endeavor seems challenging given Japan's substantial debt burden, which makes it challenging for the government to finance reasonable interest rates. This predicament necessitates a delicate balance between controlling inflation and managing the ballooning debt levels—a tightrope walk that the Bank of Japan has been navigating for years.

At the end of the day, the US dollar finds itself in a dynamic situation influenced by central bank decisions and interest rate differentials. The outcome of the Federal Reserve and Bank of Japan meetings will be pivotal for this currency pair. As the market anticipates these events, investors should remain attentive to signals of monetary policy direction, as they are likely to guide the US dollar's trajectory. The interest rate differential continues to be a significant factor, and maintaining a position in this environment offers certain advantages. The path forward may present challenges, but it also holds opportunities for those closely monitoring the developments.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.