- The USD/JPY experienced a significant drop during Thursday's trading session, primarily driven by the continuous decline in interest rates within the United States.

- This situation is strongly influenced by signals emanating from the bond market, which suggests that the Federal Reserve is inclined to adopt a more accommodative monetary policy in the upcoming year.

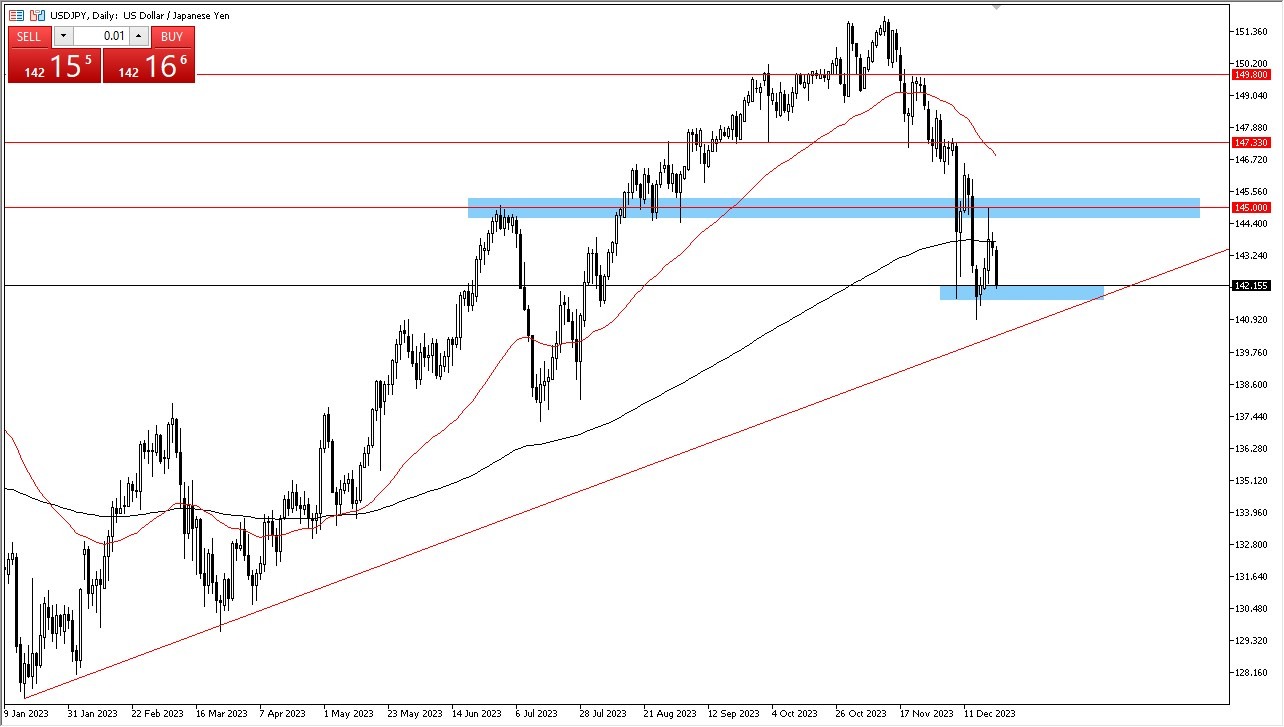

- Consequently, the US dollar will likely continue its trend of depreciation. The key support levels to watch in this scenario are the uptrend line and the ¥142 level.

Top Forex Brokers

It is important to highlight that the size of the candlestick for this trading session appears decidedly negative. However, it is essential to be aware that a breakdown below the uptrend line could potentially trigger a more substantial correction in the market. Investors and traders are paying particularly close attention to the 200-day Exponential Moving Average. A convincing breakthrough above this level would serve as a robust bullish signal, opening the door to the possibility of an upward move toward the ¥145 level.

Lightweights in the Currency Markets?

The currency market in this instance is essentially a battleground between two central banks that have opted for loose monetary policies. On one side, the Bank of Japan shows no inclination to tighten its monetary stance. On the other side, the Federal Reserve in the United States is actively pursuing a more relaxed approach to monetary policy. Consequently, it is expected that both currencies will continue to lose value when compared to most other currencies in the global market. In other words, this is a fight between two potential lightweights.

In the end, the market for this currency pair is marked by significant levels of volatility and choppiness, which can pose challenges for traders. It is my belief that other currencies are more likely to outperform the US dollar when paired with the Japanese yen. Nevertheless, it remains to be seen whether the current market area will offer substantial support. Overall, this market is poised for a significant move, but at present, it appears that the support level beneath is facing substantial pressure. In general, it is advisable to exercise caution and await a clearer direction in the market before actively engaging in trading activities. This is probably good advice for most markets at the moment, not just this one.

The USD/JPY experienced a significant drop during Thursday's trading session, primarily driven by the continuous decline in interest rates within the United States. This situation is strongly influenced by signals emanating from the bond market, which suggests that the Federal Reserve is inclined to adopt a more accommodative monetary policy in the upcoming year. Consequently, it is highly likely that the US dollar will continue its trend of depreciation. The key support levels to watch in this scenario are the uptrend line and the ¥142 level.

It is important to highlight that the size of the candlestick for this trading session appears decidedly negative. However, it is essential to be aware that a breakdown below the uptrend line could potentially trigger a more substantial correction in the market. Investors and traders are paying particularly close attention to the 200-Day Exponential Moving Average. A convincing breakthrough above this level would serve as a robust bullish signal, opening the door to the possibility of an upward move towards the ¥145 level.

Lightweights in the Currency Markets?

The currency market in this instance is essentially a battleground between two central banks that have opted for loose monetary policies. On one side, the Bank of Japan shows no inclination to tighten its monetary stance. On the other side, the Federal Reserve in the United States is actively pursuing a more relaxed approach to monetary policy. Consequently, it is expected that both currencies will continue to lose value when compared to most other currencies in the global market. In other words, this is a fight between two potential lightweights.

In the end, the market for this currency pair is marked by significant levels of volatility and choppiness, which can pose challenges for traders. It is my belief that other currencies are more likely to outperform the US dollar when paired with the Japanese yen. Nevertheless, it remains to be seen whether the current market area will offer substantial support. Overall, this market is poised for a significant move, but at present, it appears that the support level beneath is facing substantial pressure. In general, it is advisable to exercise caution and await a clearer direction in the market before actively engaging in trading activities. This is probably good advice for most markets at the moment, not just this one.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.