Top Forex Brokers

The difference between success and failure in Forex / CFD trading is highly likely to depend on which assets you choose to trade each week and in which direction, and not on the methods you might use to determine trade entries and exits.

When starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments are affected by macro fundamentals, technical factors, and market sentiment.

Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 3rd December that the best trade opportunities for the week were likely to be:

- Long of the NASDAQ 100 Index following a daily close above 16166.

- Long of Cocoa futures following a daily close above 4277.

Neither of these trades set up, but both assets ended the week higher, so I was on the right track.

Last week was a mix. We saw a stronger US Dollar bolstered by stronger-than-expected US non-farm payroll data and a growing feeling that the Fed will not rush to start cutting rates. However, we also saw stronger US stock markets as we move toward a week which will see crucial US inflation data released and a Fed policy meeting, as well as policy meetings at other major central banks.

The Forex market was dominated by trading in the Japanese Yen. It saw very high volumes bought and sold following comments by Bank of Japan Governor Kazuo Ueda, triggering speculation of a monetary policy shift away from its years-old ultra-loose one.

There were several important data releases last week which impacted the market.

US Non-Farm Payrolls came in higher than expected, with a net 199k new jobs created. That was more than was expected. More significant was the unexpected decline in the US unemployment rate from 3.9% to 3.7% and a higher-than-expected rise in average hourly earnings, from 0.2% the previous month to 0.4% over the last month. Also, the US Preliminary UoM Consumer Sentiment was considerably stronger than expected. These point to a likely slower pace of rate hikes.

The Bank of Canada left its Overnight Rate unchanged at 5.00%, which was expected, but used some hawkish language in its statement, although it was not enough to keep the Canadian Dollar strong for very long.

The Reserve Bank of Australia left its Cash Rate unchanged at 4.35%, as expected, and the statement contained more dovish language on inflation.

Other important data releases within last week’s schedule were:

- US JOLTS Job Openings – lower than expected.

- US ISM Services PMI – very slightly higher than expected.

- Swiss CPI (inflation) – lower then expected, showing monthly deflation of 0.2%.

- Australian GDP – considerably lower than expected, showing economic growth of only 0.2% within the previous quarter.

- US Unemployment Claims – as expected.

- Chinese CPI (inflation) – showed stronger-than-expected annualized deflation of 0.5%.

The Week Ahead: 11th December – 15th December

The coming week in the markets is likely to see a considerably higher level of volatility, as there will be several highly important data releases, including the impactful US CPI and Federal Reserve policy meeting and policy meetings at three other major central banks. This week’s key data releases are, in order of importance:

- US CPI

- US Federal Funds Rate, Rate Statement, and Economic Projections

- European Central Bank Main Refinancing Rate and Monetary Policy Statement

- US PPI

- US Retail Sales

- Bank of England Official Bank Rate and Monetary Policy Summary

- SNB Policy Rate and Monetary Policy Statement

- UK GDP

- New Zealand GDP

- US, UK, German, French Flash Manufacturing & Services

- US Unemployment Claims

- US Empire State Manufacturing Index

- UK Claimant Count Change (unemployment claims)

- Chinese Industrial Production

Technical Analysis

US Dollar Index

The US Dollar Index printed a bullish candlestick last week, which continued the rejection of the support level shown in the price chart below, which I had identified at 102.38 the previous week. The weekly close was up on 3 months and down on 6 months ago, presenting a lack of long-term trend. However, the short-term momentum is bullish.

This recent Dollar bullishness is supported by stronger-than-expected US economic data points released last week. Much of the Dollar’s fortune will now depend upon US CPI data and the FOMC policy meeting this week.

The Dollar is very difficult to predict over the coming week. Monday and Tuesday may likely show continuing bullish momentum.

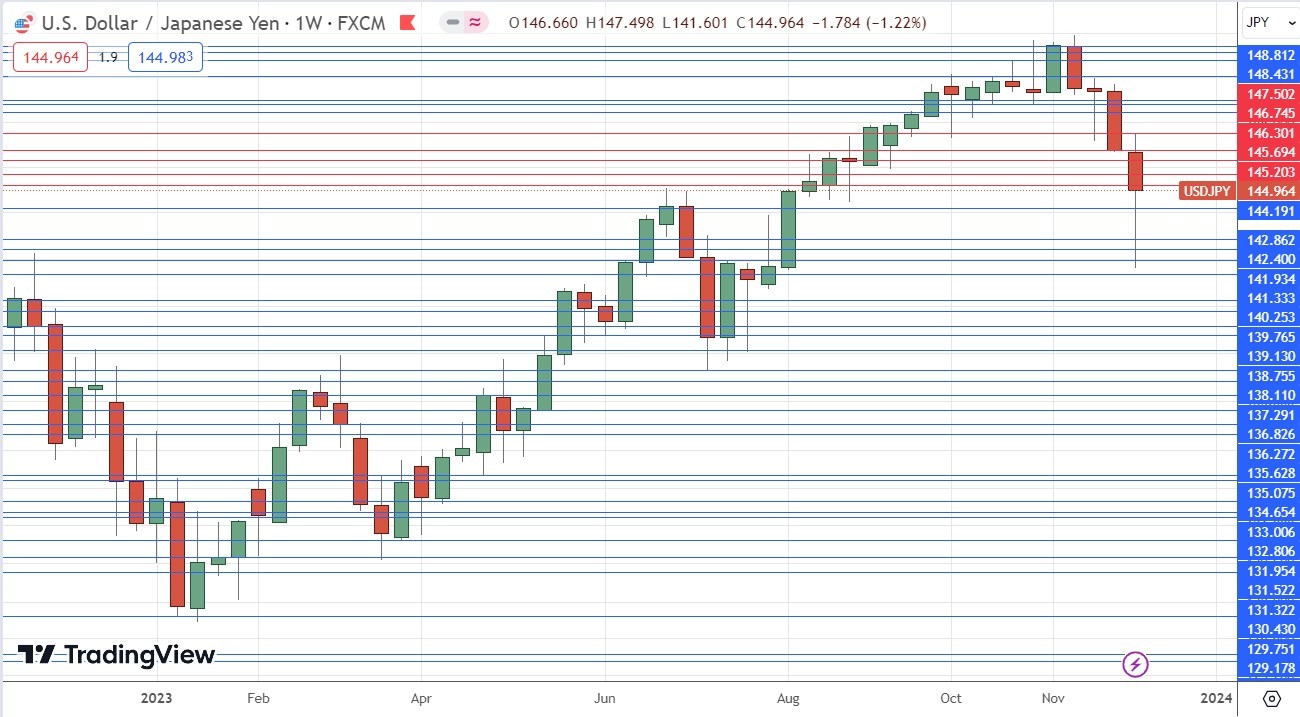

USD/JPY

USD/JPY

The USD/JPY currency pair made a strong downward move last week, with the Japanese Yen the strongest of all the major currencies over the week before the Yen eventually gave up much of its gain against the greenback.

Overall, it is a bearish candlestick, but the Yen may find it hard to make bigger gains now against the US Dollar. We cannot say there is a long-term trend here, bearish or otherwise.

The Yen is very strong right now as the Bank of Japan begins to signal that they will be able and willing to abandon their ultra-loose monetary policy during 2024, assuming wages rise as expected.

The Yen held much of its gains in the crosses, notably against the British Pound and the Australian Dollar. If risk-off sentiment strengthens next week, we could see great short trades in such Yen crosses, but not here in the USD/JPY.

BTC/USD

Bitcoin against the US dollar printed a strong, solid, bullish candlestick over the week, closing very near the high end of its range. The price ended the week, making its highest weekly close in 19 months.

These are bullish signs, given a tailwind because the price is in a long-term bullish trend after clearing the big round number at $40k.

However, bullish momentum here likely continues over the coming week. I am happy to be long of Bitcoin. Shorter-term traders on the long side should watch out for the $50k price area, which might be resistant when first reached.

NASDAQ 100 Index

The NASDAQ 100 Index printed a sixth successive bullish candlestick, making its highest weekly close in almost 2 years, although it did not trade at a new high. Bullish momentum renewed last week, and we have a bull market here.

The NASDAQ 100 Index has historically been a great investment on the long side, especially during a bull market.

I am happy to be long of the NASDAQ 100 Index, especially now that we have seen a simple moving average crossover with the 50-day crossing above the 100-day.

Cocoa Futures

Cocoa futures have been in a strong bullish trend for over a year and made another firm rise last week. The price chart below applies linear regression analysis to the past 63 weeks and shows graphically what a great opportunity this has been on the long side.

The weekly candlestick was again bullish. It was an inside bar.

It is always a bit aggressive to enter without a pullback, especially with the price action above the upper band of the linear regression channel. However, this strong trend shows no sign of stopping the ever-increasing global demand for the superfood cocoa.

Trading commodities long on breakouts to new 6-month highs has been a very profitable strategy over recent years.

Bottom Line

I see the best trading opportunities this week as:

Long of the NASDAQ 100 Index.

Long of Bitcoin in US Dollar terms.

- Long of Cocoa futures.

Ready to trade our weekly Forex analysis? We've listed the best brokers to trade Forex worth using.

USD/JPY

USD/JPY