- The Australian dollar has a bit of fluctuation during the Thursday trading session, characterized by erratic trading activity.

- This trend is not unique to the Australian dollar but is prevalent in various markets.

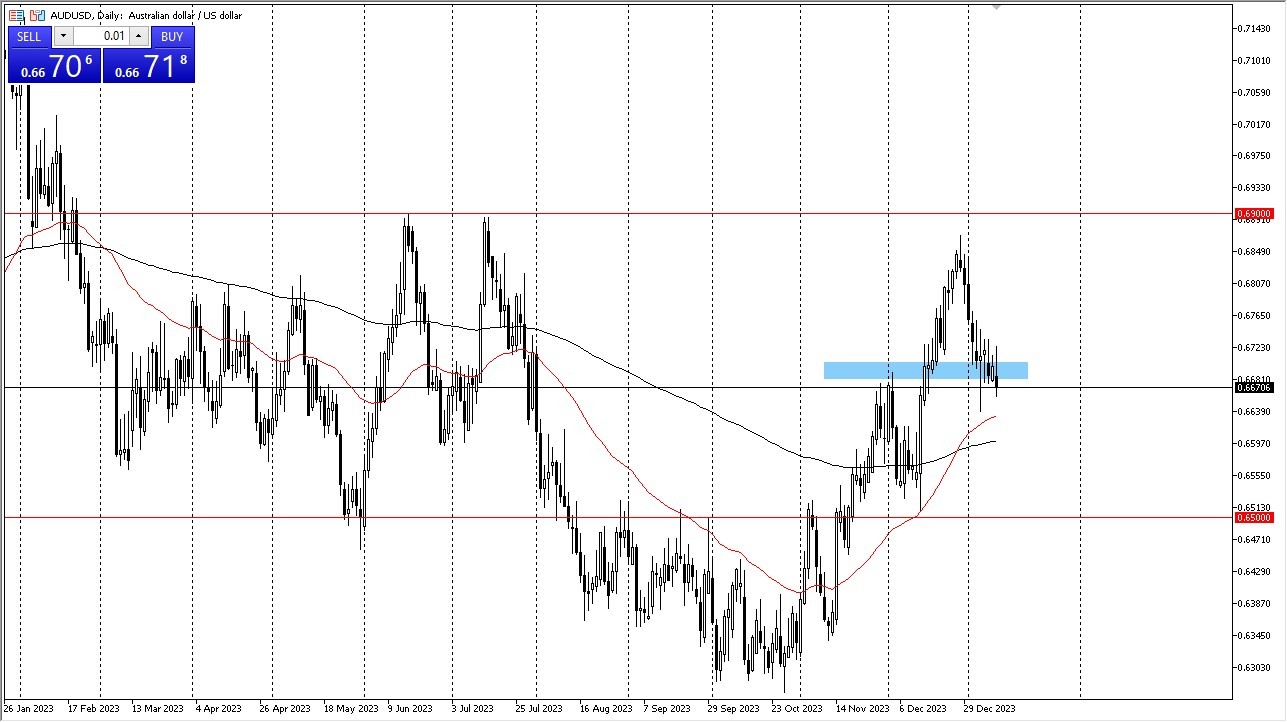

Looking at this pair it attempted an initial rally during the trading session but did not exhibit significant directional movement one way or the other. The exchange rate is currently hovering around the 0.67 level, and the 50-day Exponential Moving Average below is expected to provide ongoing support. Many market participants closely monitor this indicator. Consequently, we will probably continue to witness a range-bound trading pattern, similar to the recent past.

This development is not unexpected, as the 50-day EMA is a widely observed indicator. Given the current circumstances, it is advisable to engage in short-term trading within this range-bound system. However, it is not advisable to enter large positions or maintain them for swing trading purposes. The reality is that the market is currently exhibiting a stagnant pattern, and it is prudent to acknowledge this fact.

A Breakout?

If the 0.6750 level is breached, there may be an opportunity for an upward movement towards the 0.69 level. Conversely, a breakdown below the 200-day EMA could pave the way for a decline towards the 0.65 level. This level holds significance due to its status as a major psychological barrier and previous price activity. This wouldn’t surprise me at all.

Top Forex Brokers

In the longer term, a more substantial decision may be required. However, it appears that the market is not yet prepared to make such a move. Consequently, it is not advisable to oppose the current market sentiment. The prevailing sentiment appears to favor a neutral stance, with the market content to maintain its current position.

Ultimately, the AUD/USD has been subject to a pattern of oscillation during the recent trading session, reflective of broader market behavior. The AUD/USD pair is currently trading within a range, with the 0.67 level serving as a focal point. Traders are encouraged to adopt short-term strategies within this range, recognizing the current market reality. A decisive move in either direction may be needed in the future, but for now, the market appears content to remain stagnant.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.