- Bitcoin experienced a slight pullback during the recent trading session, showing signs of confusion following the announcement of the ETF.

- The weekend witnessed a decline in Bitcoin's excitement, reminiscent of a similar scenario when the Bitcoin futures contract was introduced a few years ago.

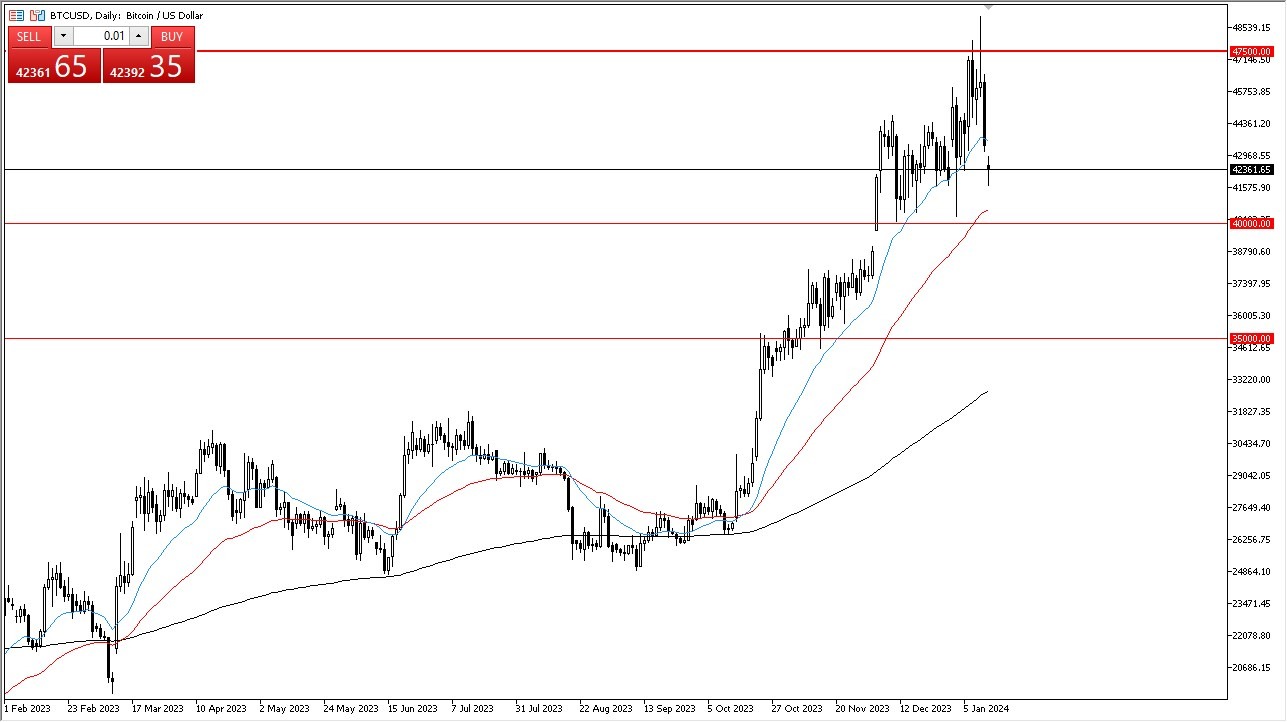

Investors tend to sell into news events, and the ETF announcement was no exception. While it remains uncertain whether the selling pressure has subsided, potential buying opportunities are identified at key levels. The $40,000 level is the most apparent, with additional support from the 50-day Exponential Moving Average just above it. The market also finds support around $38,000 and $35,000, indicating that despite recent significant selloffs, the overall positive trend persists.

Top Forex Brokers

Bitcoin will become “normal” now

Despite the recent fluctuations, Bitcoin is viewed as an asset subject to speculation rather than a religious or cult-like entity. The participation of large Wall Street firms in Bitcoin speculation suggests a shift towards a more typical asset market. This transformation contrasts with the desires of some Bitcoin enthusiasts but reflects the evolving nature of the cryptocurrency landscape.

Looking ahead, the next year is expected to provide insights into Bitcoin's trajectory. In the short term, indications point towards a potential resurgence of buyers, with the $40,000 level holding significance. However, caution is warranted, as the market's dynamics may not align with the overly optimistic predictions circulating on social media. The relationship between retail traders and Bitcoin, often portrayed as fervent and speculative, underscores the need for a measured approach in navigating the cryptocurrency market.

Bitcoin's identity as an asset for speculation rather than a mystical entity is emphasized. While social media may amplify extreme predictions, the reality is a nuanced market influenced by both retail and institutional participants. As Bitcoin price evolves into a more typical asset, the dynamics will likely reflect the complexities of traditional financial markets. As such, the coming year will serve as a crucial period for Bitcoin, determining its trajectory amidst changing market perceptions and influences. Whether or not Bitcoin never gets used for anything other than speculation needs to be solved rather quickly, because Wall Street will not hesitate to elevate the value of Bitcoin, only to leave retail traders hanging onto it at extraordinarily high levels. Remember, they do not care about the utility of Bitcoin, and don’t necessarily need to believe in it in order to make millions of dollars.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.