- The Bitcoin market experienced a modest retreat during Wednesday's trading session, reflecting the ongoing volatility in the broader cryptocurrency landscape.

Reviewing the BTC/USD pair, it is evident that we witnessed a slight pullback on Wednesday. Nevertheless, I maintain a bullish outlook for the long term. It's worth acknowledging that, like many financial markets, Bitcoin is currently navigating a period of uncertainty as it seeks direction.

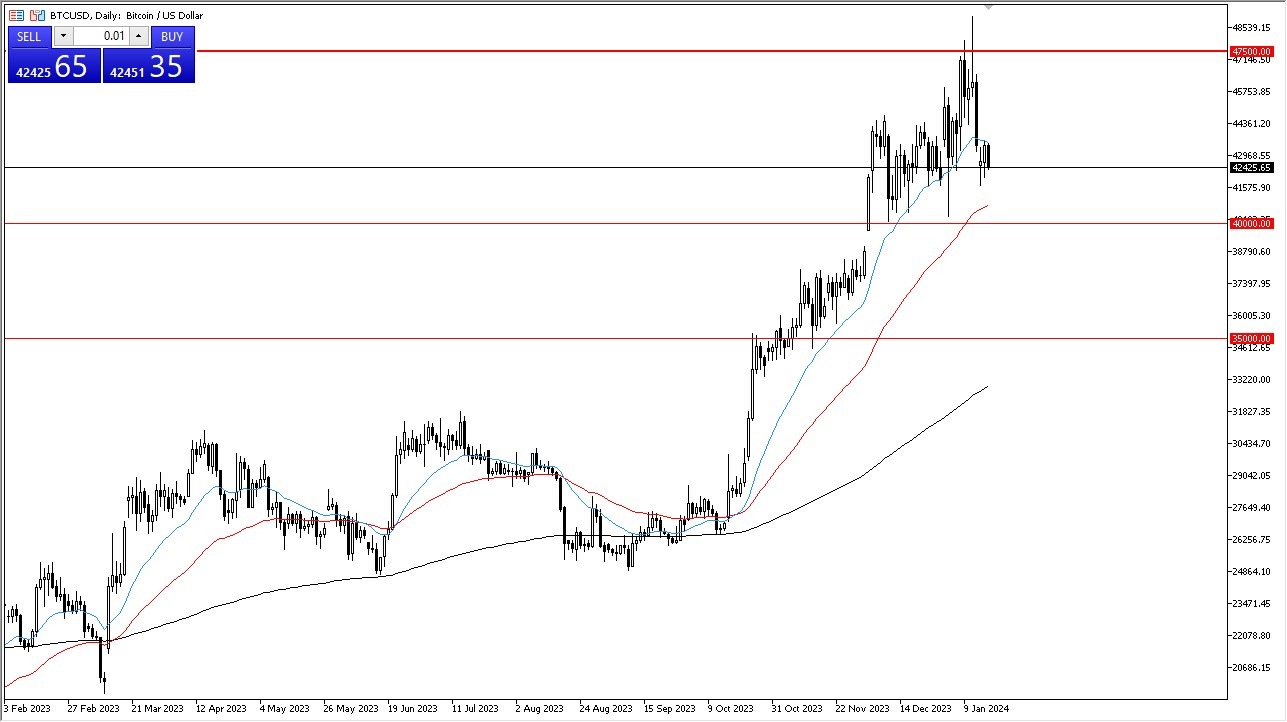

Beneath the current price, two crucial elements come into play. Firstly, the 50-day Exponential Moving Average (EMA) is an important support level. Secondly, the $40,000 mark holds significance and is expected to offer substantial support. Given the potential for extreme volatility in the Bitcoin market over time, it becomes essential to monitor these levels closely.

The recent surge in Bitcoin prices was partially driven by anticipation surrounding the introduction of a Bitcoin Exchange-Traded Fund. This development has likely been factored into the market, considering that the announcement has already been made. Consequently, we are now searching for the next catalyst that will influence Bitcoin's trajectory.

Top Forex Brokers

Under the Surface

Beneath the surface, there are likely numerous value-seeking investors ready to enter the market. However, the critical challenge lies in whether Bitcoin can overcome the formidable resistance barrier at 47,500. This level has posed significant resistance over an extended period, and market participants continue to view it as a formidable hurdle to surpass.

To maintain its upward trajectory, Bitcoin may need to gather momentum, which could help consolidate its position. Additionally, addressing the rapid ascent observed in recent times by working off excess enthusiasm appears necessary. It's worth noting that Bitcoin's rapid climb amounted to approximately a 90% rally, a significant move by any measure.

Furthermore, Bitcoin's transition into ETF form introduces the possibility of easier shorting, potentially altering its trading dynamics. Consequently, it may take on characteristics more akin to traditional indices. However, the precise impact of this transition remains to be seen and requires further observation.

In the end, Bitcoin experienced a minor pullback amid the ongoing noise in the cryptocurrency markets. While the long-term outlook remains bullish, Bitcoin faces a period of uncertainty as it searches for its next catalyst. Critical support lies at the 50-day EMA and the $40,000 level, while overcoming the 47,500 resistance presents a formidable challenge. Bitcoin's recent rapid ascent necessitates a period of consolidation and adjustment, given the potential implications of its ETF status. The market will continue to evolve, and we must await further developments to gauge its behavior accurately.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.