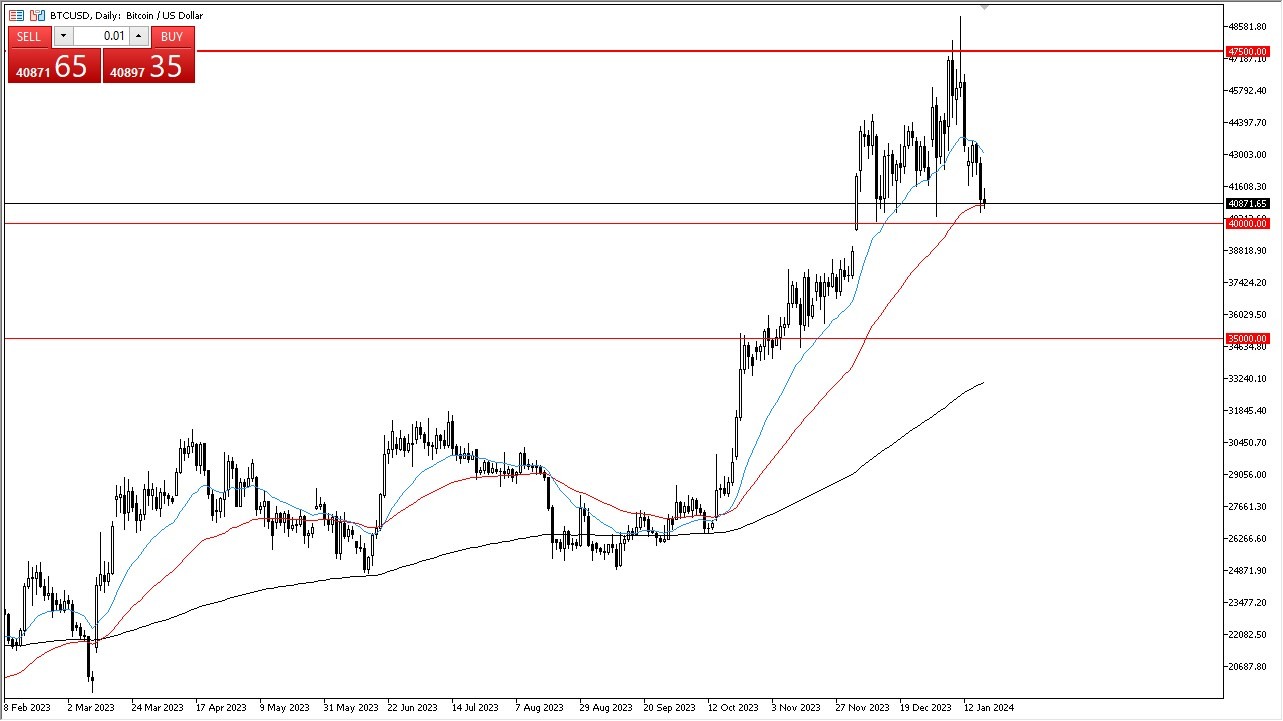

- Analyzing the Bitcoin market, Friday exhibited a pattern similar to previous days, as we endeavored to maintain the $40,000 price area, a level of considerable importance.

- This area is the central area of importance on the chart at the moment, however – there are other levels of support to pay attention to overall.

The trading session for Bitcoin on Friday moved rather uneventfully, likely attributed to the market's ongoing quest to ascertain its course following the ETF announcement. What seems to be emerging is a phase of significant consolidation, necessitating an exploration of slightly lower price points to discover a solid support base. Notably, the $40,000 mark stands out as a significant, psychologically important figure, capturing the attention of a multitude of traders. Presently, the market appears to be defining a trading range, with the $40,000 level potentially serving as a trigger point for algorithmic trading strategies.

$40,000 Continues to Matter

Top Forex Brokers

In the event of a breach below the $40,000 mark, it would be prudent to consider the $38,000 level as a potential support zone. However, it is noteworthy that market participants have demonstrated a proclivity for buying during price declines. The Bitcoin market has consistently exhibited robustness, exhibiting no discernible signs of deceleration. Consequently, I am not interested in shorting this market, unless we witness a breakdown below the $35,000 threshold, at which point such a strategy of shorting might merit consideration. Until then, its not really much of a thought.

In this particular context, market participants appear to be cautiously entering the market during downturns, gradually augmenting their positions over an extended timeframe. My belief is that we may ultimately revisit the $47,500 price level, and should that level be surpassed, the next target could potentially be $52,000. Taken as a whole, my perspective on Bitcoin is fairly optimistic; however, we are currently in anticipation of a catalyst that will propel the market forward.

This analysis reflects the intricate dynamics at play in the Bitcoin market, where price movements are scrutinized, support levels are carefully considered, and traders remain vigilant for potential opportunities to navigate this ever-evolving landscape. It is essential to keep a watchful eye on developments in this space, as they may provide the impetus needed to steer the market in a definitive direction.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out