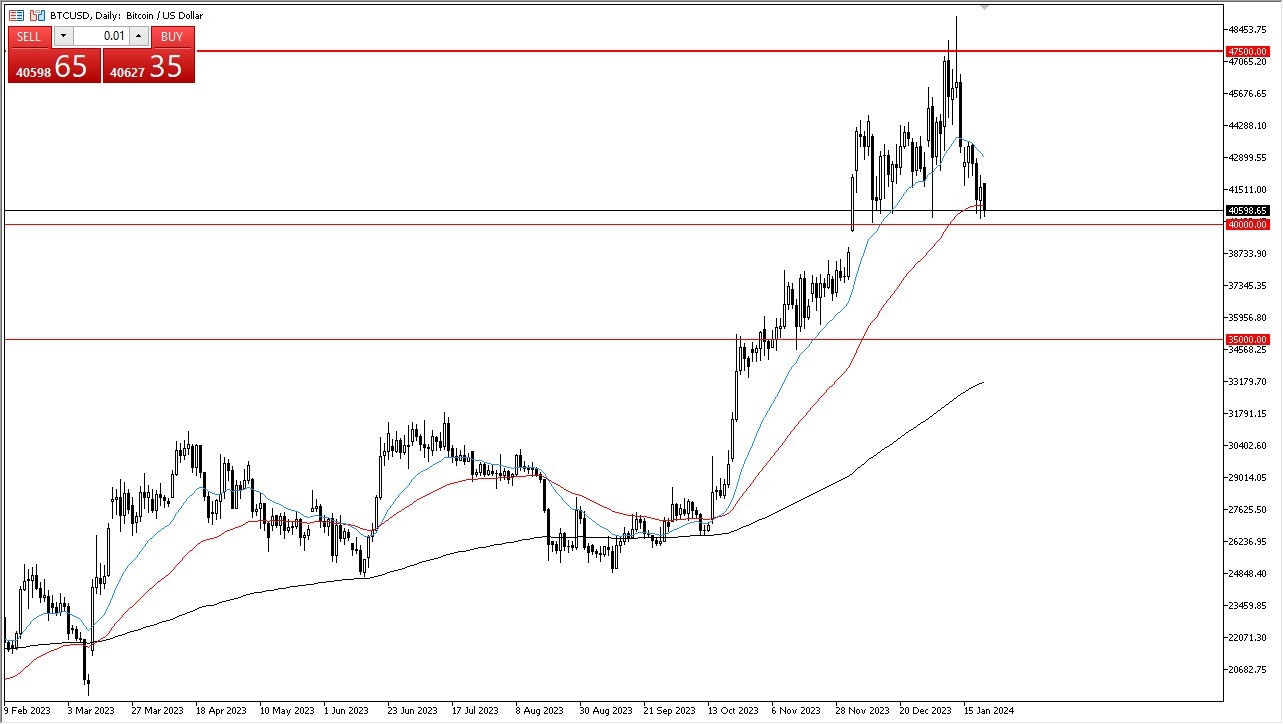

- The Bitcoin market initially fell during the trading session on Monday to reach down towards the $40,000 level.

- The $40,000 level is a major large, round number that a lot of people would pay attention to.

The 50-day EMA is an area that of course attracts a lot of attention as well, and the fact that we are hanging around that indicator comes into play as well. If we do break down below the $40,000 level, then I think Bitcoin has a real shot of dropping down to $38,000. What I find interesting is that the Bitcoin market has done nothing but fall since the announcement of the Bitcoin ETF.

I wondered whether or not this was going to be a “sell the news” type of event, and it certainly seems as if it has been exactly that. However, it should be noted that we are still very much in an uptrend, and I believe that will continue to be the case until we break down below the $35,000 level. With all of that being said though I’m not overly concerned about the trend obviously, but it does look like a market that desperately needs some type of catalyst or reason to go higher.

Top Forex Brokers

The Crucial $47,500 level

After all, the $47,500 level above was massive resistance previously so therefore I think we need some type of catalyst to break through it for a more sustainable move. Keep in mind now with there being a Bitcoin ETF institutional investors can and will short much easier than they could before. This could become a major issue as retail traders could be blindsided by this.

In other words, Bitcoin could go just as easily up as it could go down. It’s not like how it used to be where you had physical custody of a digital asset. And also, now institutions are going to start asking when will people actually start using Bitcoin? Most use case scenarios right now simply involve speculation. His lungs is going to be the case, I just don’t see how Bitcoin takes hold of the financial markets for anything more than just pumping and dumping. Nonetheless, certainly seems as if we are in a bullish market, and therefore need to look at it through that prism.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.