- Bitcoin rallied significantly during the early hours on Wednesday, but the $40,000 level seems to be an area that is causing some issues.

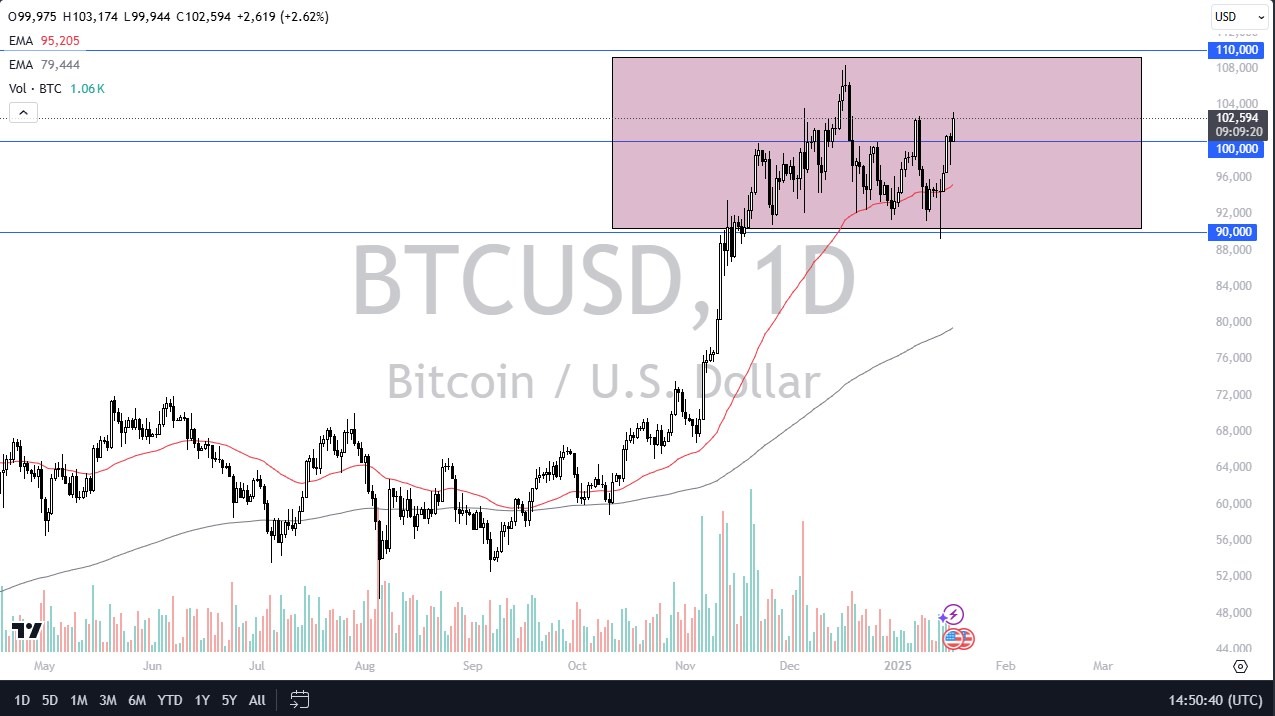

- Furthermore, we have the 50-day EMA just above that comes into the picture as potential resistance, and it is worth noting that we have pulled back from that moving average, at least so far.

This tells me that the market is going to have to put serious effort in, in order to take off to the upside. If we can get a daily close above that 50 day EMA, then I think it's very likely that Bitcoin will continue to go higher. After all, it is worth noting that Bitcoin has done nothing but sell off since we got the Bitcoin ETF announcement, which is much like when we had the new futures contract come out a few years ago we saw Bitcoin fall apart. It was more or less a sell the news type of event. With this, I think you have a situation where retail traders may have a little bit of a sour taste in their mouth because a lot of retail traders thought that Bitcoin would skyrocket. The reality is Bitcoin already rallied about 80% before the announcement came. In other words, somebody knew something before you did.

Top Forex Brokers

Can We Recover?

Now the question is whether or not we can recover. If we break above that 50 day EMA, then I think the market may try to get to the $43,500 level and then eventually the $47,500 level. At that point, I think we see massive amounts of resistance, so it'll be very difficult to get beyond there, but $52,000 would be the next target. Underneath the $35,000 level is massive support.

I think the 200 day EMA approaching that level makes it the bottom of the overall, um, the overall bottom of the longer term trend. And if we break that, then it would be very bad for Bitcoin. Right now, though, it still looks bullish over the longer-term, so I think it’s a situation where there will be plenty of buyers out there willing to buy the dips, but that doesn’t necessarily mean that it is going to be an easy path forward. With that being the case, you need to be cautious with your position sizing more than anything else right now.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.