- Bitcoin has done very little during the trading session on Thursday, which is not a huge surprise considering that we had almost doubled in price in the very end of 2023. So, with that being said, I think you've got a situation where the market is just now trying to look for its next catalyst.

- Granted, the Bitcoin ETF was the major catalyst previously, but at the end of the day, everybody knew that, and once the SEC announced that they were going to approve the ETF, there was nothing else to move the market.

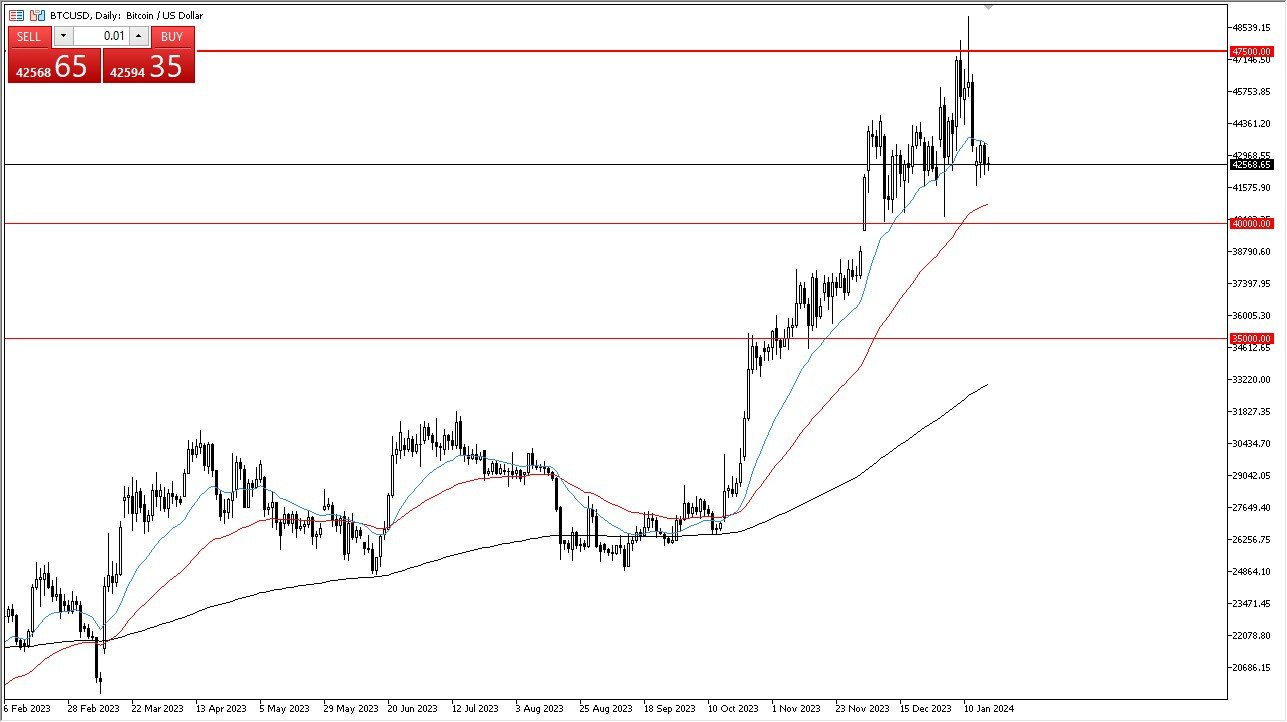

- Above, I see the $47,500 level as a major resistance barrier that will be very difficult to overcome. It's been important multiple times in the past.

So, it's not a huge surprise to see that we have pulled back from there. Underneath, we have the 50 day exponential moving average offer and support right along with the $40,000 level. Short-term pullbacks should be buying opportunities, but I also recognize that we may be stuck in a range for a while with that. I look at this between $47,500 and $38,000 as where we are going to be.

Breakdown Scenario

If we break down from here, I'm not overly concerned about the overall trend of the price of Bitcoin until we break down below the $35,000 level. The 200-day EMA underneath also would offer support, and it looks like it is going to reach that $35,000 level as well. Pay close attention to the bond markets because interest rates have a influence on Bitcoin, but really at this point, interest rates dropping does help Bitcoin, but they start to rise. That works against it right now. I think you're just in a state of flux trying to sort out what to do next.

Top Forex Brokers

At this point in time, everybody that was going to jump in and byy Bitcoin and of her fist has already done it, so I don’t think it’s a time to be overly aggressive at this point. The SEC has already done its job as far as approving the ETF is concerned, so now we need to find some type of reason for Bitcoin to become bullish again. A real-world use is probably something that’s going to be needed, something that has eluded Bitcoin so far for most of the world.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.