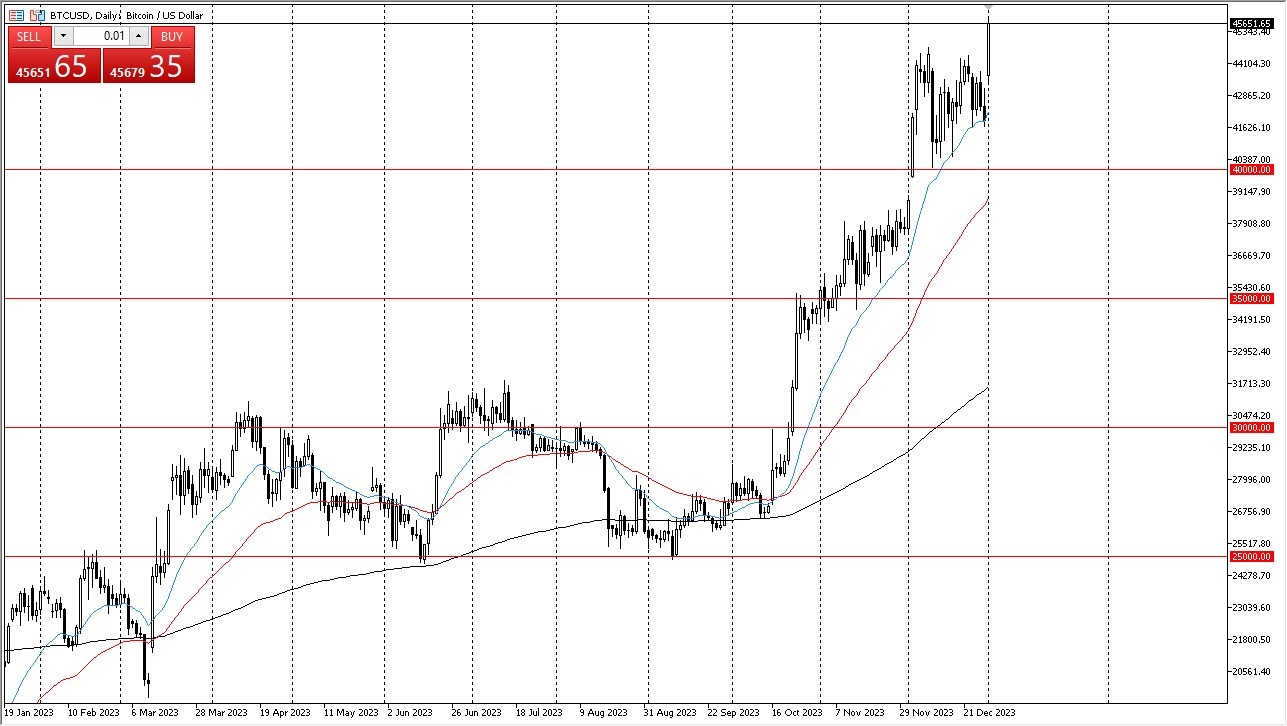

- The Bitcoin CFD market experienced a notable upward gap as it commenced Tuesday's session. This surge suggests a potential for further upward movement, primarily due to the breach of the crucial $45,000 level.

- Consequently, there is a growing possibility of the market reaching the $47,500 mark in the long run. Historically, this price region has posed significant resistance, making it an appealing target for traders.

- It's important to acknowledge that recent market activities have been influenced by reduced liquidity due to the holiday season. As such, the cryptocurrency market continues to exhibit considerable volatility, emphasizing the importance of prudent position sizing.

The market has maintained a bullish outlook for an extended period. However, a prudent approach involves considering this from the perspective of a "buy on the dip" strategy, given Bitcoin's robust performance. An intriguing observation is that both Bitcoin and the US dollar have demonstrated early rallies during the trading session. This development signals a departure from the anti-US dollar sentiment, indicating growing confidence in Bitcoin in 2024. Consequently, the year appears promising for Bitcoin, at least in its initial stages.

Traders Should be Cautious with Short Positions

In light of this, any pullback in the market should be regarded as a potential buying opportunity. Support levels to watch include the $40,000 mark, the 50-day EMA, and possibly even the $35,000 level. Nonetheless, substantial pullbacks are not anticipated, and a gradual approach to building positions is advisable. This market is certainly not conducive to short positions unless it undergoes a substantial decline below the $35,000 threshold, a scenario that is unlikely to occur easily. The market moving under that level would of course shock the overall market participants. This is a situation where it would more likely than not be a major “risk off event.”

Top Forex Brokers

In the end, the CFD market displayed early strength, propelled by the breach of the $45,000 level. While holiday-related factors have influenced recent market dynamics, Bitcoin's resilience and the concurrent rise of the US dollar bode well for Bitcoin's prospects in 2024. Consequently, traders should view pullbacks as potential buying opportunities, keeping an eye on key support levels. Short positions should be approached cautiously and are best considered if the market drops below $35,000, a scenario that remains unlikely for the time being.

In the end, the CFD market displayed early strength, propelled by the breach of the $45,000 level. While holiday-related factors have influenced recent market dynamics, Bitcoin's resilience and the concurrent rise of the US dollar bode well for Bitcoin's prospects in 2024. Consequently, traders should view pullbacks as potential buying opportunities, keeping an eye on key support levels. Short positions should be approached cautiously and are best considered if the market drops below $35,000, a scenario that remains unlikely for the time being.

Ready to trade Bitcoin USD? Here are the best MT4 crypto brokers to choose from.