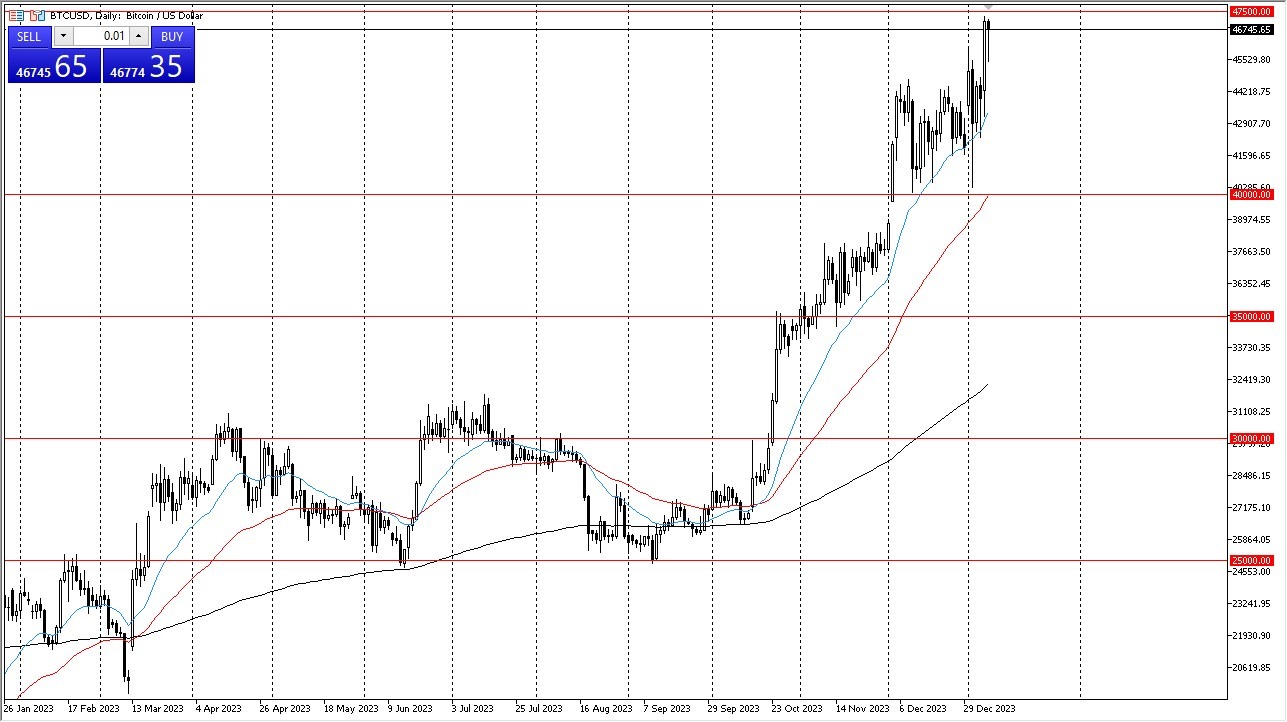

- The Bitcoin market experienced a slight decline during Tuesday's trading session, with its value hovering around the crucial $47,500 level.

- This price point has repeatedly proven significant on longer-term charts, aligning with my previous target.

- Currently, I am hesitant to invest further in this market. I believe it is essential to witness a modest retracement in order to identify potential value.

Bitcoin has demonstrated remarkable bullishness over an extended period. Despite the favorable news and headlines surrounding cryptocurrency, we may still be in the process of accumulating enough momentum to overcome a significant resistance level. We recently broke out of a narrow consolidation zone, where the $45,000 level had acted as a substantial barrier. This region, or at least the vicinity, is now likely to provide support during pullbacks, further reinforced by the 20-day Exponential Moving Average positioned just below.

Seeking Opportunities Underneath

Below this level, we encounter the $40,000 mark, which has maintained its importance for approximately five to six weeks. This represents the next critical support level that should be anticipated to hold. Additionally, the 50-day EMA coincides in this area, amplifying its significance.

Top Forex Brokers

Regarding potential buying opportunities, my strategy involves seeking opportunities during dips in the market. However, a daily close above $48,000 could potentially open the door for a move toward the $50,000 level. It is important to note that much of this speculation revolves around the anticipated release of a Bitcoin Exchange Traded Fund. Nevertheless, the market will likely have already factored in this development by the time it is officially announced. Therefore, when the ETF news is finally disclosed, we might witness a surge in Bitcoin's value, only to be followed by a "sell the news" phenomenon. This event is not expected to alter the overall market trend but may catch some traders on the wrong side of the trade.

At the end of the day, the Bitcoin market currently faces a pivotal point near the $47,500 level, with potential support at $45,000 and $40,000. Investors should exercise caution and consider waiting for a dip before entering positions. While an ETF announcement looms on the horizon, its impact may be short-lived, serving as a reminder of the unpredictable nature of cryptocurrency markets. After all, we still haven’t seen cryptocurrency used in the real world on any type of major scale.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.