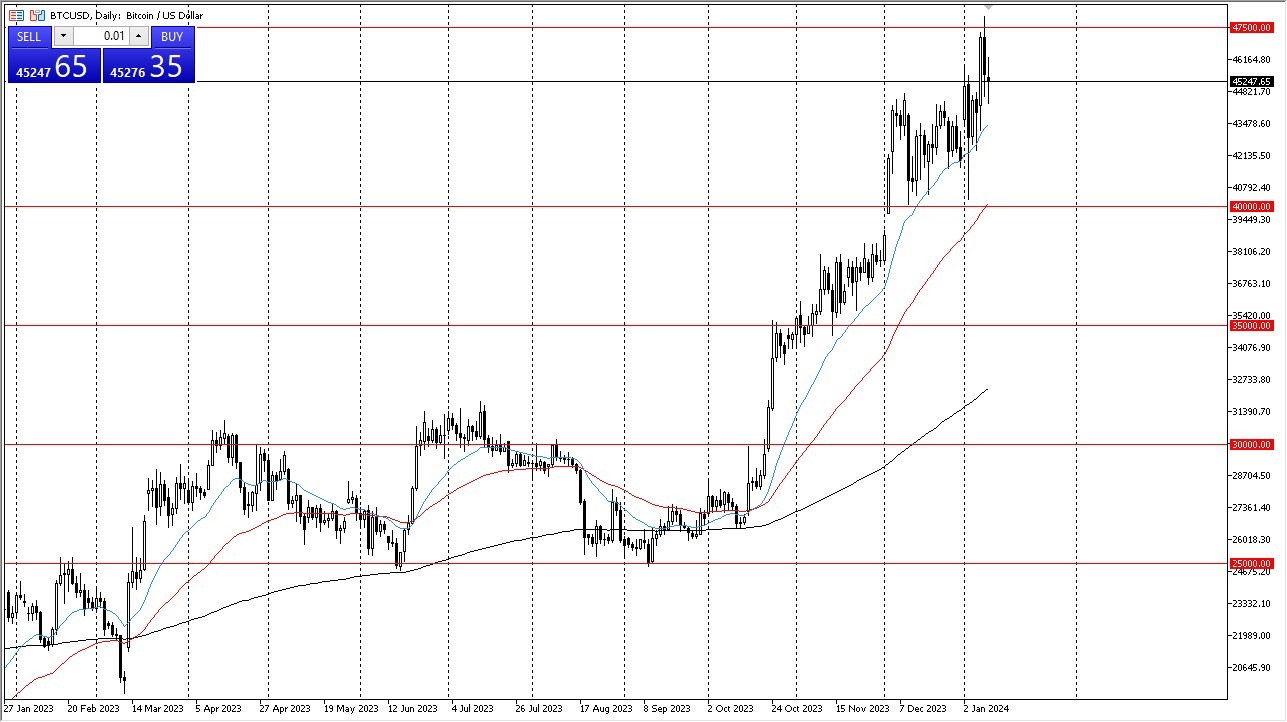

- Bitcoin experienced a slight pullback during Wednesday's trading session.

- However, it remains well-supported, reinforcing the potential for a future Bitcoin breakout.

- This being the case, I remain bullish, but I also recognize there is a lot of froth to chew through at the moment.

Within the Bitcoin market, recent price movements have been characterized by back-and-forth fluctuations as market participants search for stability. Nonetheless, the prevailing sentiment still favors a "buy on the dip" approach. This sentiment aligns with Bitcoin's sustained uptrend over an extended period. While the market exhibits signs of bullishness, the possibility of a breakout largely hinges on the emergence of a significant catalyst.

A notable obstacle resides at the $47,500 level, presenting a significant barrier to Bitcoin's ascent. The $47,500 level is likely to pose challenges to any upward movement. Nevertheless, if this barrier is successfully breached, the next target could be the $50,000 level. In the event of pullbacks, the 20-day Exponential Moving Average may provide support, followed by the $40,000 level, which appears to function as a substantial market floor. The proximity of the 50-day EMA to this range garners considerable attention.

BTC ETF?

It's worth noting that the market buzz revolves around the potential launch of a Bitcoin exchange-traded fund, generating excitement among investors. However, it's not uncommon for markets to react with a dip once such announcements are made, as the saying goes, "sell the news." Nevertheless, the long-term outlook remains bullish, supporting the notion of Bitcoin as a viable investment. Short-term prospects are largely contingent on the ETF announcement or significant movements in the US dollar. A significant depreciation of the US dollar could result in Bitcoin benefiting from the currency's weakness.

Top Forex Brokers

In the end, Bitcoin recently witnessed a minor pullback, but it remains well-supported, suggesting the potential for a future breakout. The market's recent fluctuations underscore the ongoing search for stability. The prevailing sentiment favors buying on dips, aligning with Bitcoin's long-term uptrend. Overcoming the $47,500 level presents a challenge, with potential targets at $50,000. Pullbacks may find support at the 20-day EMA and the $40,000 level. Market excitement surrounding a Bitcoin ETF announcement may lead to temporary price dips, but the long-term outlook remains bullish. The short-term trajectory depends on the ETF announcement or significant US dollar movements, with Bitcoin's shorting prospects considered a distant possibility.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.