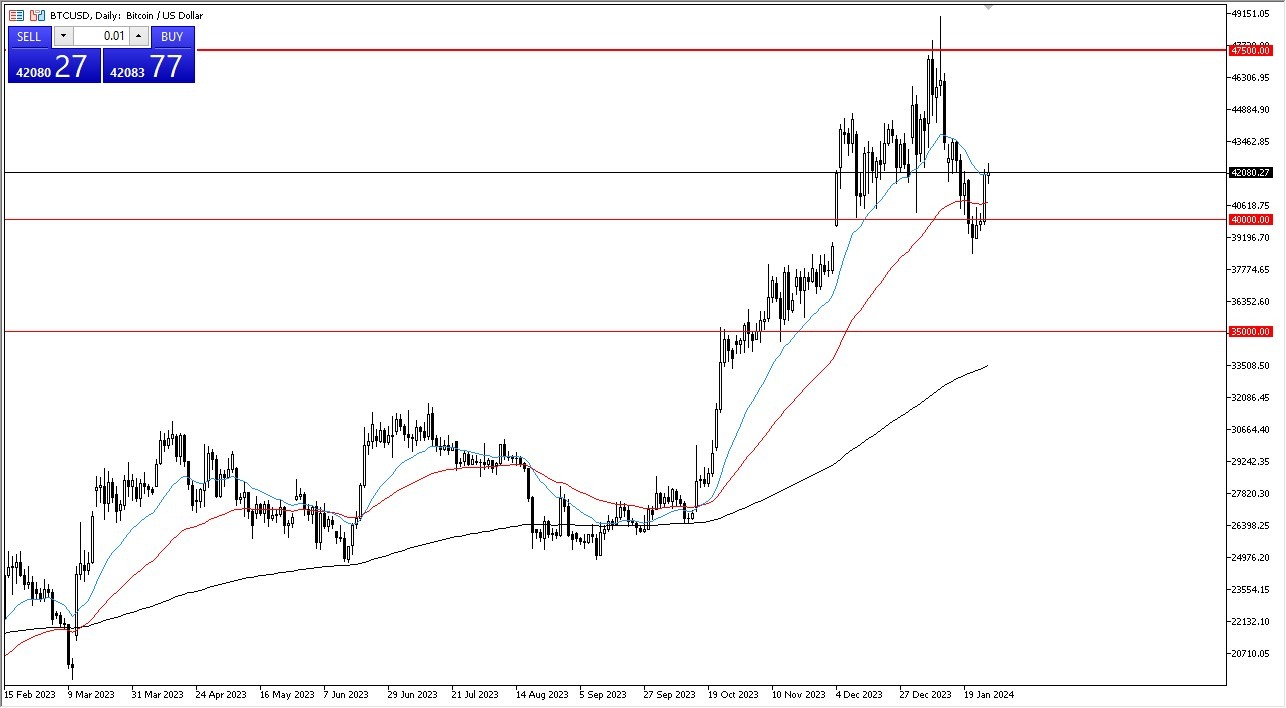

- Bitcoin was a bit noisy during the trading session on Monday as we are hanging around the 20-day EMA.

- It's not a huge surprise considering just how much momentum we expended last week to recover, but at this point in time, I do think that there are signs that buyers are going to come back in and take advantage of cheap Bitcoin anytime they get the opportunity.

I think the $40,000 level offers support, but above there we have the 50 day EMA doing the same. We also have seen the $38,000 level offer support, and I think that is essentially what traders are paying the most attention to at the moment. Underneath there, then we have the $35,000 level where the 200 day EMA is racing towards. That is the bottom of the overall uptrend as far as I can see. Whether or not that actually ends up being the case remains to be seen, but it is most certainly an area that a lot of people will be paying close attention to.

Top Forex Brokers

Bitcoin ETF

We now have the Bitcoin ETF and a lot of people have celebrated this, but it's probably worth knowing that until the very end of last week, we had done nothing but sold off since that was announced. This is typical sell the event type of news trading. Longer term, Bitcoin probably tries to consolidate between the $38,000 level and the $47,500 level above, which is a major barrier. If we can break above there, then it makes quite a bit of sense that we would see a lot of “FOMO” enter the marketplace.

If we can break above there, then we could go looking to the $52,000 level. I don't necessarily think that Bitcoin is going to suddenly sell off, but I think a lot of the momentum has probably just been sapped out of the market. After all, Bitcoin rallied something like 90% heading into the ETF announcement. So, at this point, you have to ask the question as to who is out there that would be willing to put money in this market, we need another catalyst. That catalyst would be loose monetary policy coming out of the central banks. So the Wednesday FOMC meeting will be watched very closely by crypto enthusiasts.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.