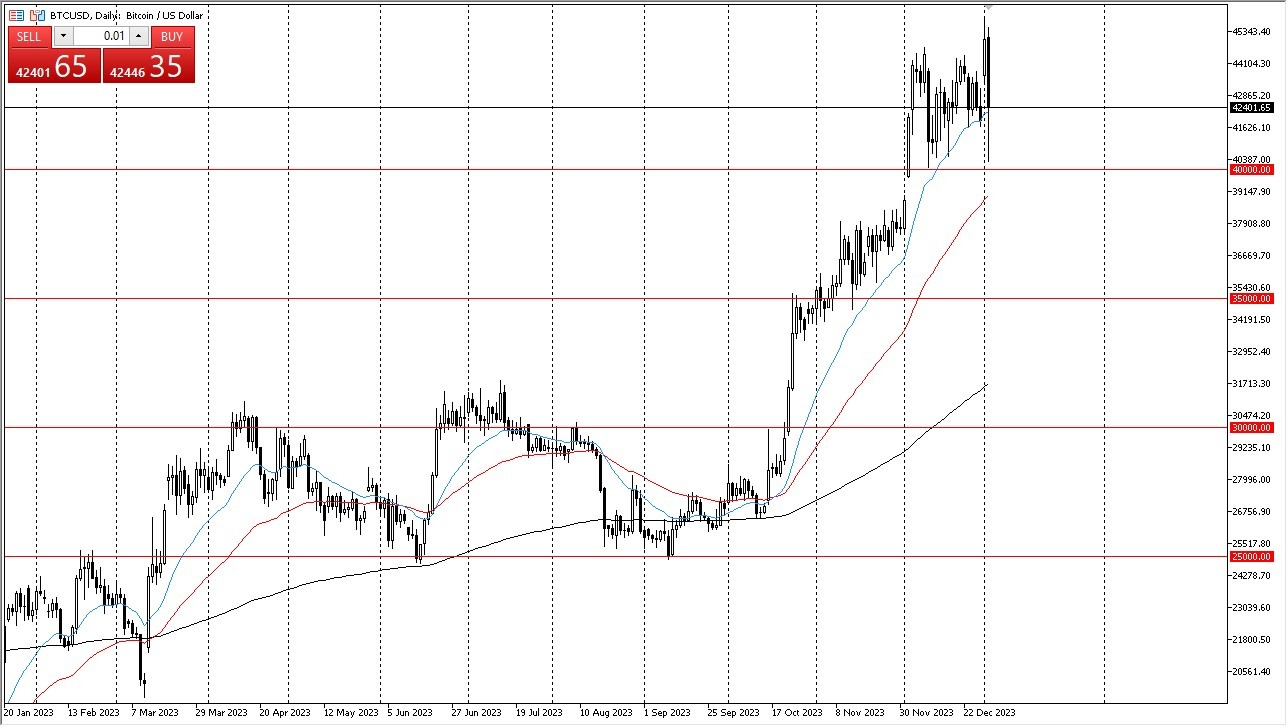

- Bitcoin experienced a significant drop in its value, plummeting to the $40,000 mark during the early hours of Wednesday. However, there are signs of a recovery underway.

- In this volatile cryptocurrency market, it's important to understand that sudden price fluctuations are common, but they often attract buyers seeking opportunities.

- This pattern is typical in the world of cryptocurrencies, where short-term turbulence can be followed by a return to the overall trend.

It's essential to consider the liquidity factor, which could pose some challenges. Additionally, keeping a close watch on the 10-year yield in the United States is crucial, as it serves as an indicator of potential shifts in the cost of borrowing money. The Federal Reserve has made adjustments to its projected interest rate changes, leading many to speculate that rates may be cut three times in the coming year. Such a move toward cheaper money tends to favor the cryptocurrency market, with Bitcoin often being the first choice for institutional traders.

Bitcoin’s Influence on the Cryposphere

Bitcoin plays a pivotal role in influencing the broader cryptocurrency market. Its movements tend to set the tone for other digital assets, pushing them either higher or lower. Despite the recent turbulence, it's important to note that overall sentiment remains bullish. A temporary pullback should not come as a surprise.

Top Forex Brokers

The fact that the $40,000 level has held up despite the recent dip is a testament to the market's resilience. If Bitcoin manages to break through the $45,000 threshold, it could pave the way for further gains, with potential targets at $47,500 and eventually $50,000. On the downside, the 50-day Exponential Moving Average at $35,000 provides significant support.

Caution is warranted when navigating this highly volatile market. Even in the most favorable conditions, cryptocurrency investments come with inherent risks. However, the current landscape appears to favor buyers, despite the sharp decline witnessed earlier in the session.

In the end, Bitcoin's recent price drop to $40,000 has rattled the market, but signs of a recovery are emerging. Cryptocurrencies are known for their wild price swings, but they tend to stabilize over time. Factors such as liquidity and the 10-year yield in the U.S. play a role in shaping the cryptocurrency market's direction. While the Federal Reserve's potential rate cuts may bode well for cryptocurrencies, it's important to approach this market with caution due to its inherent volatility. Nonetheless, the resilience displayed at the $40,000 level suggests that Bitcoin may have further upside potential, with key resistance levels at $45,000 and beyond.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.