- On Friday, Bitcoin experienced a slight pullback, primarily influenced by the volatile jobs data.

- Nevertheless, one consistent trend in the Bitcoin market is the eagerness of buyers to seize opportunities when prices dip.

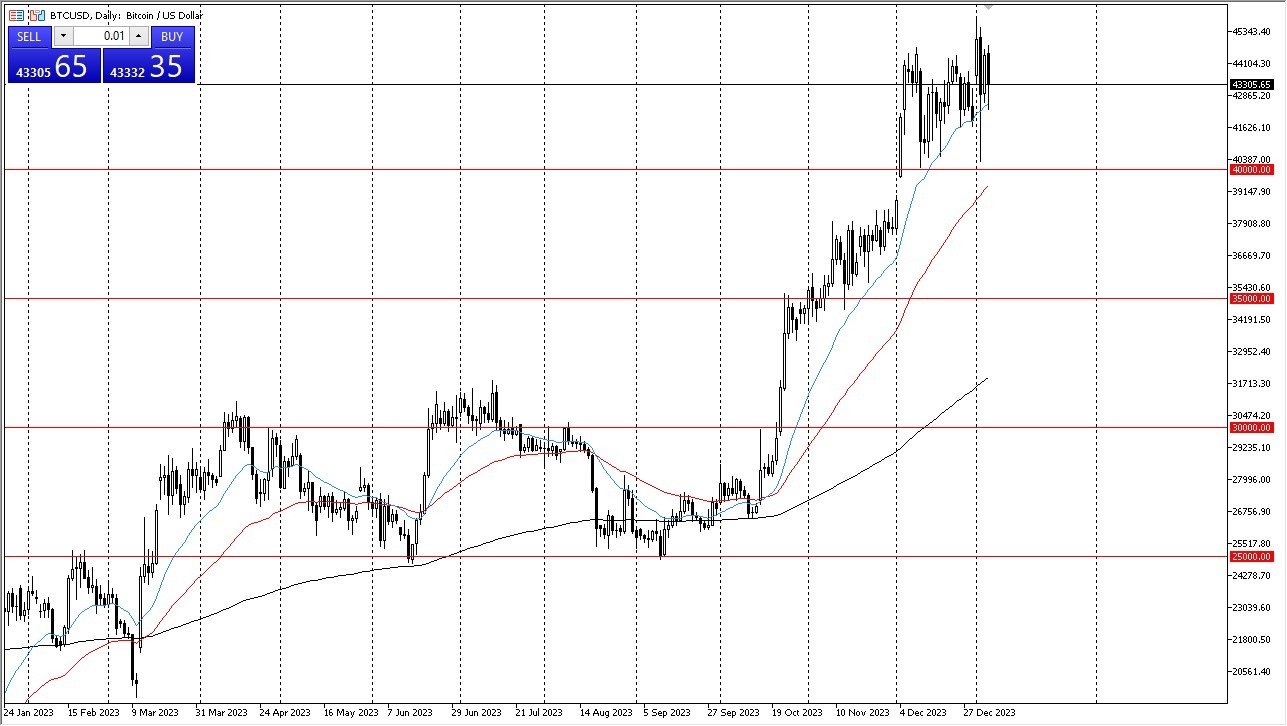

The $40,000 level has emerged as a crucial support, particularly after a notable candlestick pattern observed on Wednesday. Adding to its significance is the presence of the 50-day Exponential Moving Average (EMA) in the same vicinity, attracting attention from traders. In the foreseeable future, it appears that Bitcoin may target levels around $46,000 and potentially $47,500. However, caution is warranted as liquidity remains a concern, and there are apprehensions about potential profit-taking if a Bitcoin Exchange-Traded Fund is introduced, a development that has generated substantial buzz within the crypto sphere.

The $40,000 level has emerged as a crucial support, particularly after a notable candlestick pattern observed on Wednesday. Adding to its significance is the presence of the 50-day Exponential Moving Average (EMA) in the same vicinity, attracting attention from traders. In the foreseeable future, it appears that Bitcoin may target levels around $46,000 and potentially $47,500. However, caution is warranted as liquidity remains a concern, and there are apprehensions about potential profit-taking if a Bitcoin Exchange-Traded Fund is introduced, a development that has generated substantial buzz within the crypto sphere.

The Bigger Picture

In the bigger picture, the outlook for Bitcoin remains optimistic. It seems unlikely to consider selling unless the critical support level at $35,000 is breached. Presently, the market is firmly defended around the $40,000 mark, an aspect that should not be disregarded. After all, the market continues to prove itself in this region, so as long as that is the case, is difficult to imagine that sellers are going to gain the upper hand. $40,000 continues to be a major signal in the market as to underlying strength.

Top Forex Brokers

Many traders are closely monitoring the prospect of a promising year for cryptocurrencies, with Bitcoin poised to maintain its leadership role. As institutional investors show increasing interest in entering the Bitcoin arena, it is rational to expect a continuous influx of buyers throughout the year. Unless there is a substantial downturn below the $35,000 threshold, which currently appears improbable, the market is poised to retain its bullish stance.

At the end of the day, despite minor fluctuations and external factors such as job data volatility and the potential ETF announcement, Bitcoin remains resilient. The $40,000 support level remains robust, and market sentiment is buoyed by the anticipation of a prosperous year for cryptocurrencies. As long as key support levels hold, Bitcoin is poised to continue its upward trajectory in the coming months. It would not surprise me at all to see this market go reaching toward the $50,000 level before it’s all said and done, but it doesn’t mean that we get there overnight.

Ready to trade Bitcoin to the dollar? We’ve made a list of the best Forex crypto brokers worth trading with.