The crude oil market experienced a rally during the early hours of Tuesday as it attempts to establish a trading range for the year 2024. However, the situation remains characterized by a persistent back-and-forth pattern.

WTI Crude Oil

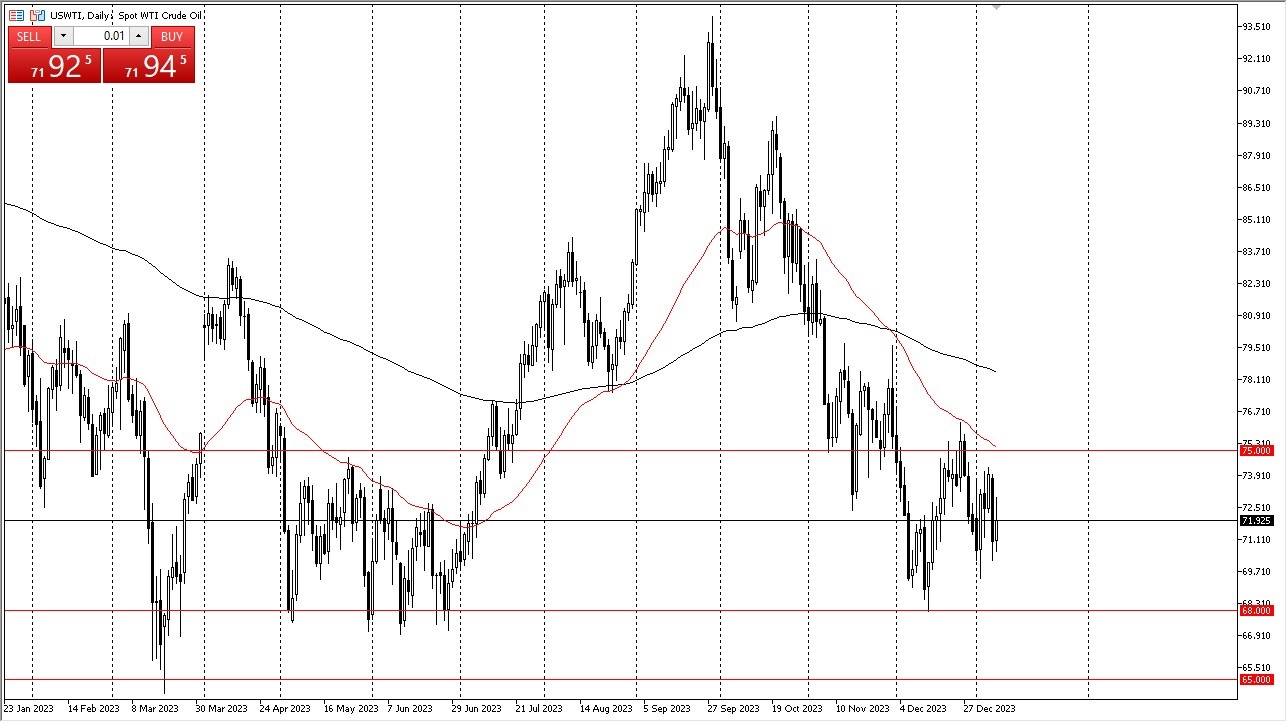

In Tuesday's trading session, crude oil demonstrated a rally as it continued to fluctuate within the same consolidation range. The WTI grade managed to surpass the $72.50 mark during early New York trading. There is a possibility of further upward movement towards the $75 level, which has proven to be a substantial resistance point. Notably, the 50-day Exponential Moving Average also converges at this level. Consequently, breaching this barrier would likely require a significant amount of momentum.

As things stand, breaking above this resistance appears to need a catalyst. For the time being, the market seems to be confined within the range of $70 to $75, with additional support available at the $68 level below. Current conditions suggest that breaking out of this range may not be a straightforward task. I suspect that we will continue to see plenty of choppiness in this market for most of the year.

Brent

The Brent market also displayed a rally during the trading session, mirroring the behavior observed in the crude oil market. It managed to breach the $77.50 level, and the 50-day EMA is situated just below the $80.50 level. This particular price point is a notable resistance zone in this pair. The market is likely to continue experiencing considerable noise, and at this juncture, accumulation seems to be the prevailing sentiment among longer-term traders.

Top Forex Brokers

Longer-term traders may be inclined to purchase oil with the expectation that it will eventually break out to the upside. Beneath the market, a substantial support level can be identified at $72. It is essential to keep this level in mind. In the short term, traders are likely to engage in sideways movement in both the Brent and WTI markets until a more significant, longer-term catalyst emerges. Concerns about economic demand persist, but at the moment, there are apprehensions about potential attacks on shipping lanes in the Red Sea.

At the end of the day, the crude oil market is currently navigating a range as it experiences intermittent rallies and consolidations. Significant resistance levels exist for both WTI and Brent that must be paid close attention to. The longer-term outlook may be influenced by various factors, including economic demand and geopolitical concerns. However, in the short term, sideways trading is likely to persist until a decisive catalyst emerges to shape the market's direction.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.