- Crude oil markets are currently ensnared in a period of consolidation, a situation applicable to both types I track.

- The complexities within this market necessitate a prudent approach.

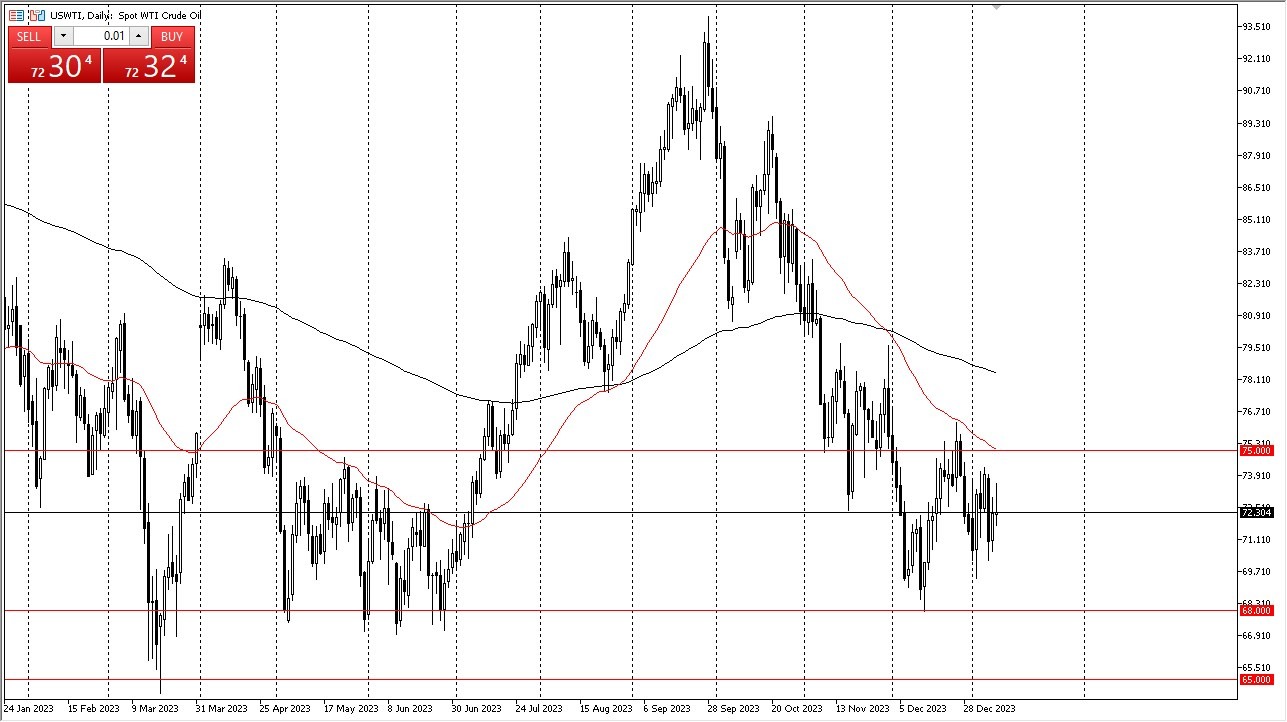

WTI Crude Oil

Regarding WTI Crude Oil, the recent trading session has witnessed modest positive movements. However, the market faces substantial resistance levels. The 50-day EMA represents a formidable barrier, while the presence of $75 further amplifies the challenge. A breakthrough of these levels could potentially direct the market's focus toward the 200-day EMA below. The $68 mark continues to serve as a steadfast support level, having proven its resilience previously. West Texas Intermediate remains in a consolidation phase as it endeavors to establish a stable foundation.

Brent

Turning to Brent, a parallel narrative unfolds. Brent too grapples with a cacophony of market noise. The $80.50 threshold above acts as a resistance point, closely associated with the 50-day EMA, while $72 serves as a reliable support. Brent confronts analogous issues such as the WTI market, marked by concerns surrounding global demand and pricing power, exacerbated by a substantial surplus. Nevertheless, the existence of a major support level beneath offers a degree of reassurance. The prospect of oil's resurgence hinges on economic revival or the potential escalation of conflict in the Middle East, spurred by Red Sea incidents.

Although the crude oil markets are expected to eventually stabilize and discover a bottom, the present scenario implies a considerable task ahead. In light of this, exercising caution in position sizing is paramount. Additionally, it is imperative to acknowledge that external factors are exerting a significant influence on crude oil markets. Therefore, meticulous attention to these external variables is crucial for market participants.

Top Forex Brokers

Ultimately, the crude oil market finds itself in a consolidation phase, applying to both WTI and Brent. Resistance levels are formidable, with the 50-day EMA playing a key role. Support at $68 and $72 for WTI and Brent, respectively, provides some stability. The complex interplay of global demand, pricing power, and surplus issues underscores the challenges ahead. The resurgence of oil markets depends on economic recovery or potential Middle East conflicts. Caution in position sizing and vigilance toward external factors are essential for navigating the current landscape.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.