During Friday's trading session, the crude oil markets displayed a lack of significant movement, primarily due to the holiday focus.

West Texas Intermediate

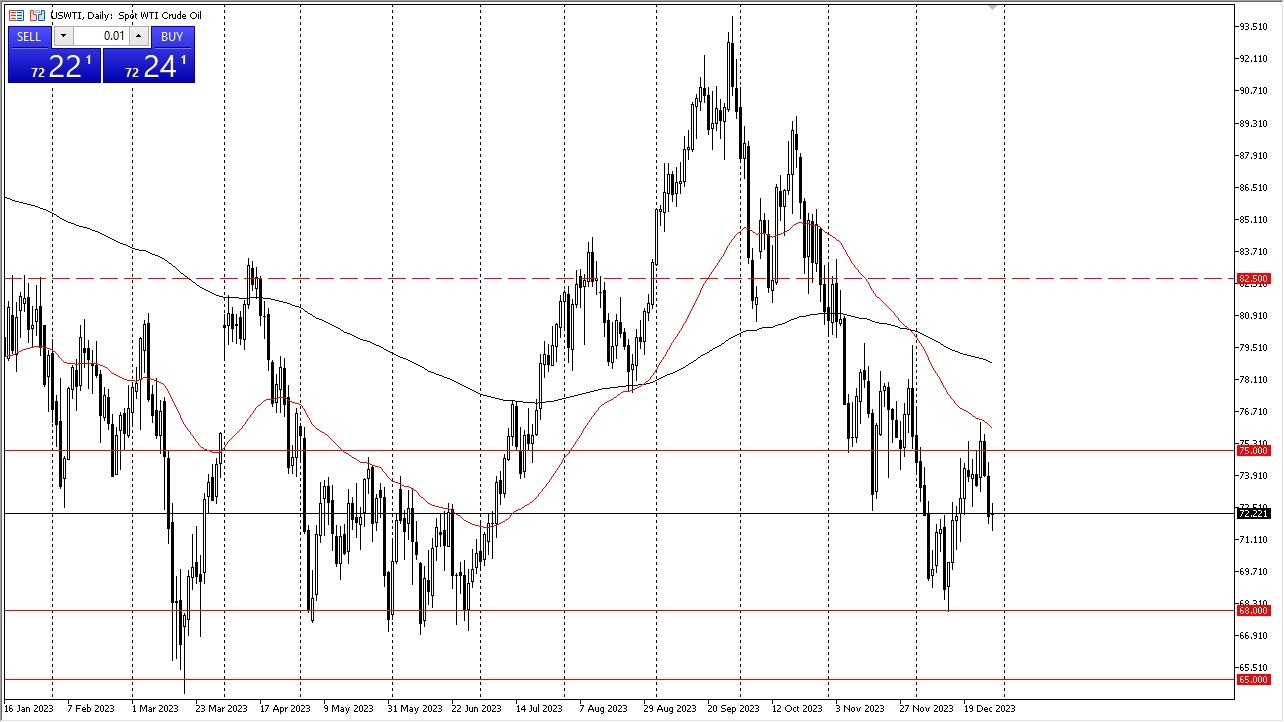

In the WTI market, the price action revealed limited activity as it found itself positioned between two critical levels. The $75 level above has been established as formidable resistance in recent days, while below, the $68 level signifies the commencement of substantial long-term support. The current market situation suggests a quest for buyers and stability. Looking ahead, there is potential for an upward surge in the longer term, but some groundwork is required.

It is reasonable to expect that any substantial market shift is unlikely to materialize at year-end, primarily due to the insufficient liquidity typically associated with this period. Questions surrounding supply and demand dynamics come into play. If the economy undergoes a slowdown, it is anticipated that the demand for crude oil will decrease accordingly. However, if the Federal Reserve opts to inject substantial liquidity into the markets, this could potentially stimulate economic activity.

Brent Crude

Turning to the Brent market, the price hovers around the $77 mark. Above, the $80 level serves as a point of resistance, while below, the $72 level represents a notable long-term support zone. Buyers will probably emerge at some point, but the key question is whether this phase will resemble an accumulation period akin to what was observed in May 2023. Based on longer-term charts, this possibility seems plausible.

In the current market climate, exercising caution about position sizing is prudent. Overcommitting at this juncture could lead to significant losses. Commencing with smaller-than-usual positions and gradually increasing them as the market evolves in your favor is a sensible strategy, particularly when confronting the prospect of a potential shift in trend or a significant inflection point.

This scenario ultimately hinges on the actions of central banks and their efforts to bolster their respective economies. Theoretically, such initiatives should benefit the oil market, although there are no guarantees. It is crucial to bear in mind that this region has previously generated substantial interest, which adds complexity to the ongoing market dynamics.

In the end, the crude oil markets have exhibited limited activity during the recent trading session, primarily due to the holiday season. While there is potential for longer-term developments, it is essential to proceed with caution and remain vigilant, given the existing uncertainties and potential inflection points.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.