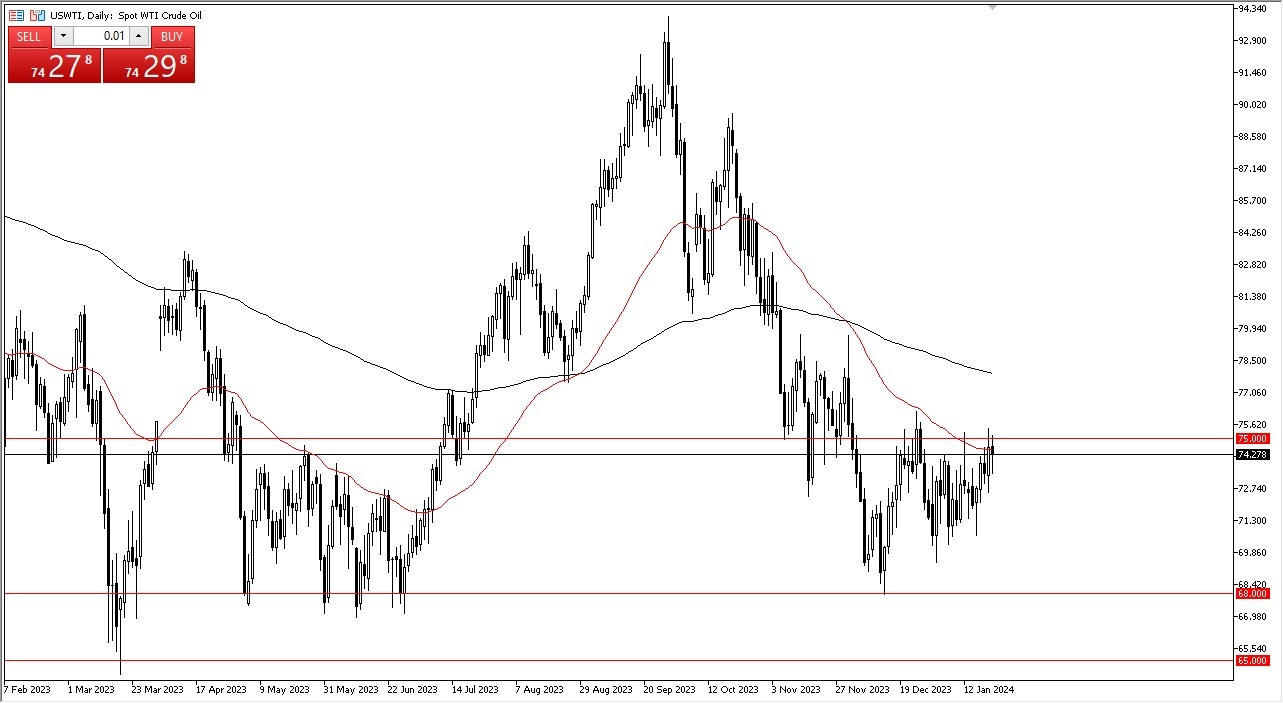

Crude oil

Crude oil initially fell during the session on Tuesday and does look a bit threatened at this point in time, but I think given enough time, we will continue to pay close attention to the $75 level.The $75 level, of course, is a large round number that a lot of people pay close attention to, not only due to the fact that there is a serious amount of options barriers there, but there's a lot of psychology attached to it as well.

So, with that being said, and the fact that the 50 day EMA is sitting right here, I think you've got a situation where it is probably only a matter of time before we see some type of break one way or the other. Ultimately, I think you have to look at this through the prism of “Will we break above $75 on a daily close?” Only time will tell but that will obviously capture a lot of attention.

I think at that point in time, you get a lot of people out there trying to push the WTI grade to the 200 day EMA. In the meantime, I think short-term pull banks continue to be buying opportunities, with the $71 level being particularly interesting.

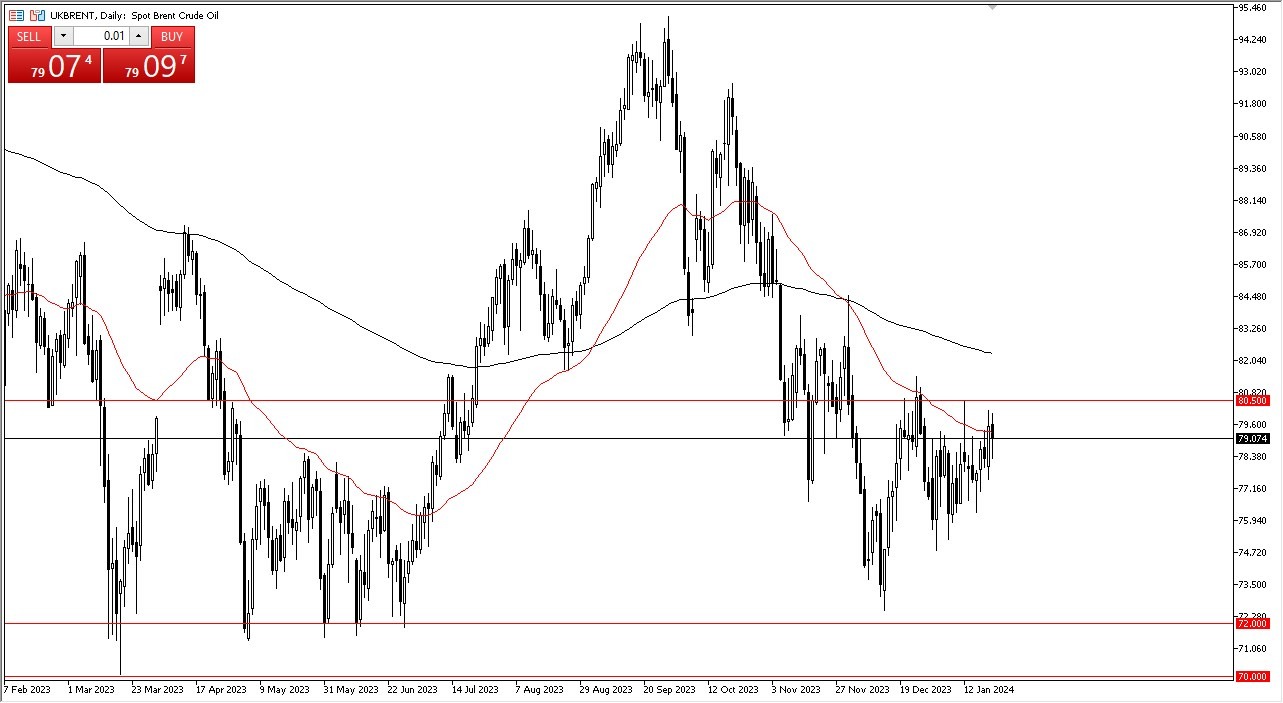

Brent Oil

Top Forex Brokers

Brent, very much the same situation. It looks like we are trying to do everything we can to find buyers after initially selling off early in the day, the $80.50 level continues to be an area that I think you will have to pay close attention to. And therefore, if we can break above there, then much like in the WTI grade, I expect to go looking to the 200-day EMA. The downside, of course, is protected by the psychologically important $75 level, and then again, at $72.

A lot of the oil situation right now comes down to attacks in the Red Sea and quite frankly, whatever's going on with the global economy. There are concerns right now that we are producing about three million barrels per day more than we need and eventually that does flood the market. That being said, I think this is a situation where market participants will continue to look at this as a buy on the dip base building exercise.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.