Crude oil markets have shown positive signs at the beginning of 2024, indicating a potential resurgence in demand.

WTI Crude Oil

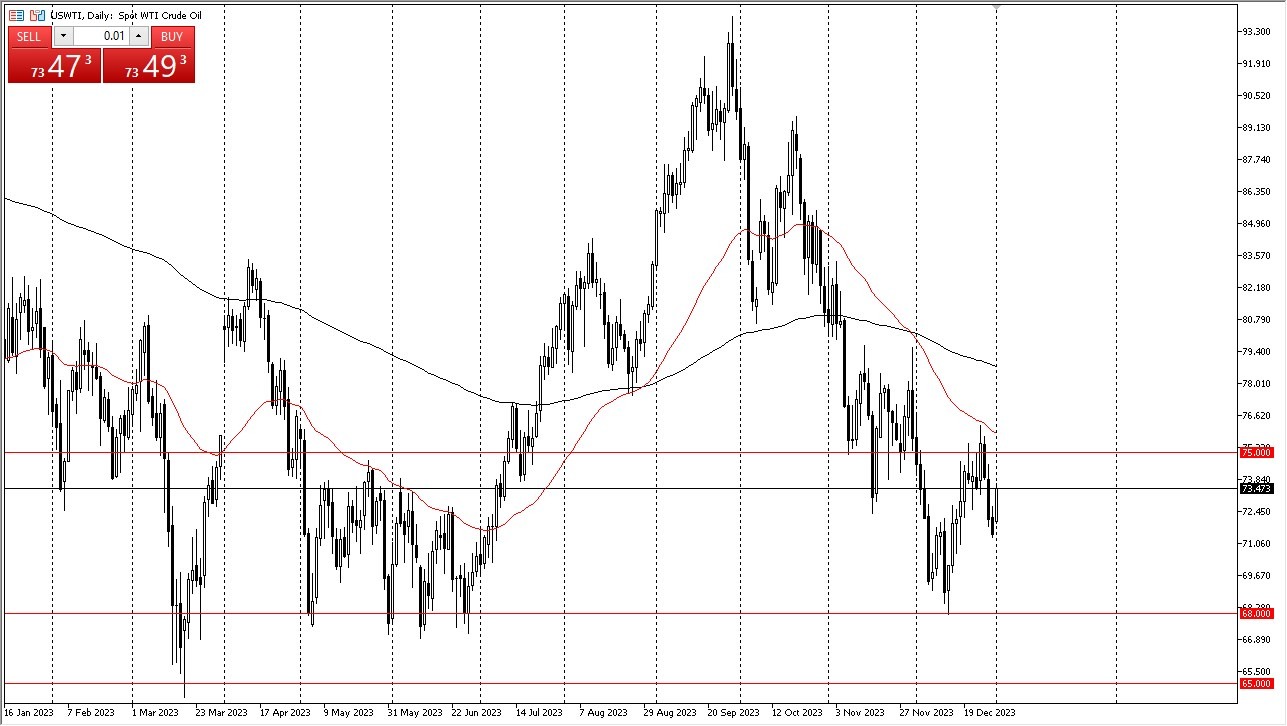

- In the West Texas Intermediate Crude Oil Market, Tuesday's performance was notably optimistic, as it appeared to strive towards the $75 mark.

- This level holds significance both as a psychologically round figure and due to the presence of the 50-day Exponential Moving Average.

- While resistance is expected to reappear around this level, traders are currently evaluating the crude oil market from various perspectives to determine if a bottom has been reached.

Breaking above the 50-day EMA could open the door to a move towards the $79 level. Short-term pullbacks, in the meantime, are likely to be viewed as potential opportunities for value-based trading. The $68 level underneath has proven to be a strong support, maintaining its significance not only in recent months but over the years as a steadfast support level.

Brent

In the Brent markets, a rally was observed, surpassing the $78 level and setting the stage for a potential challenge to the 50-day EMA, currently situated around $80.50. The market also boasts substantial support at the $72 level, which has held its ground for both months and years.

Top Forex Brokers

The prevailing question revolves around whether crude oil has been oversold, a sentiment that many are beginning to factor in. It prompts contemplation on whether a trading range for the year is in the process of being established.

Considering the substantial selling pressure endured in recent times, it would be reasonable to anticipate a relief rally for crude oil, particularly if central banks opt to loosen monetary policies. Such a move could stimulate economic activity. Based on the early indications, it seems likely that buyers will continue to enter the market whenever an opportunity arises to acquire oil at a relatively lower price.

In the end, the crude oil markets are displaying positive signs at the onset of 2024. Traders are cautiously assessing the situation, considering potential resistance at key levels and the enduring support offered by others. The prospect of a relief rally is on the horizon, with monetary policy decisions and economic conditions playing a crucial role in determining the market's trajectory. For now, the inclination appears to favor buyers seeking opportunities in the market.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.