Crude oil markets experienced a modest retracement during Tuesday's session, marking a shift from the recent exuberant moves in the past couple of weeks. Consequently, we anticipate a resurgence of interest from value-seeking investors in the market.

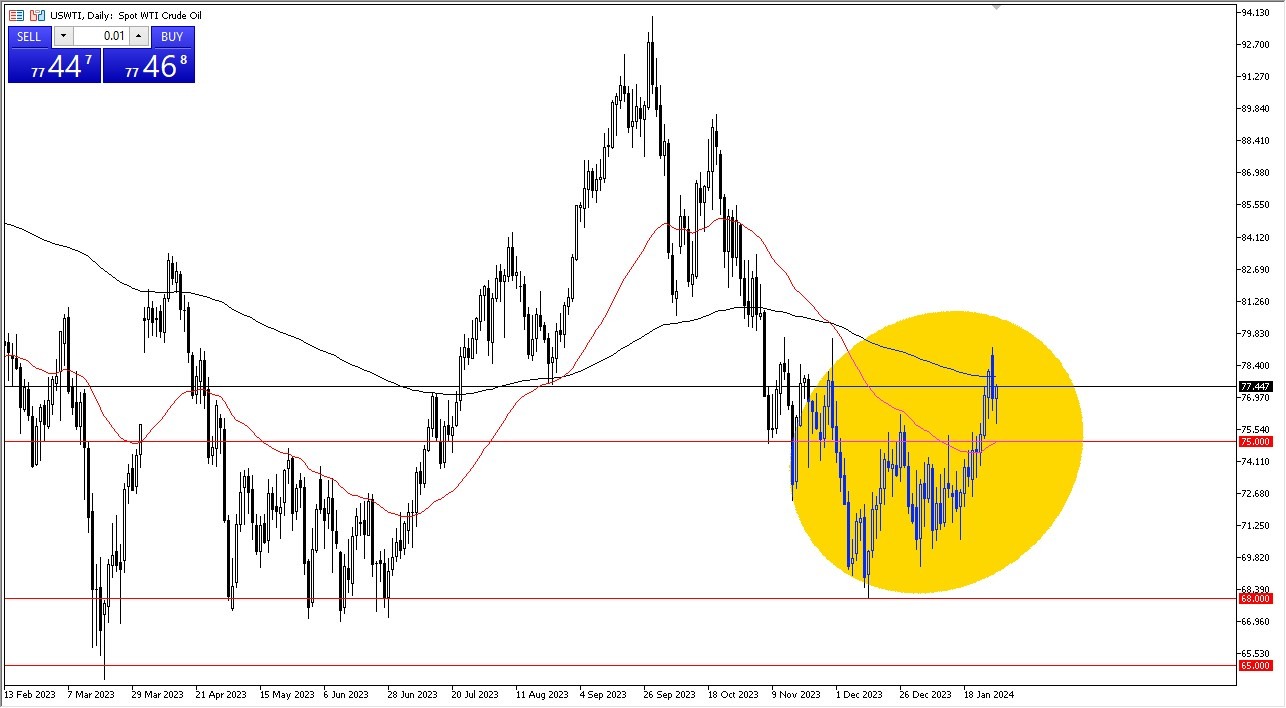

Turning our attention to WTI crude oil, we observed a slight pullback in the past 48 hours, with Tuesday exhibiting a more negative tone. Nevertheless, it's essential to recognize the presence of robust support levels, particularly around the $75 mark. In this context, we expect this level to serve as a foundation for a potential buying opportunity.

Bounces are important

Top Forex Brokers

It would be prudent to wait for a bounce before committing to positions. Subsequently, we anticipate continuing the "buy-on-the-dip" approach, which could propel crude oil toward the $80 level. In the event of a breakdown below $75, it would signify a breach of the 50-day Exponential Moving Average, signaling a bearish shift. In such a scenario, we would explore potential support levels within the larger choppy consolidation, with $71 as a notable point for value hunting.

Shifting our focus to the Brent market, we also observed a pullback, with attention directed towards the $80.50 level as a potential support zone due to its prior role as resistance. Additionally, the 50-day EMA resides just below, amplifying its significance as an indicator for market participants.

A breakdown below this level could pave the way for a decline toward $77, where we anticipate increased buying interest driven by the allure of relatively cheaper oil. It's crucial to note that shorting this market holds no appeal, as my outlook leans towards potential upward movements. This is a market that I think goes higher this year – at least for the next several months.

Despite the expected volatility on the path higher, we hold a positive view on both the Brent and WTI crude oil markets. Over the coming months, we foresee the possibility of Brent oil reaching the $90 level. A similar sentiment applies to the WTI crude oil market.

In essence, our outlook for oil markets is underpinned by two factors. Firstly, the market appears oversold, creating a ripe environment for a rebound. Secondly, the anticipated loosening of monetary policy by central banks worldwide is expected to boost the oil market, cementing our positive outlook for the commodity.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.