The crude oil market experienced a initial decline during Wednesday's trading session but rebounded as we await the Johnson number scheduled for Friday.

WTI Crude Oil

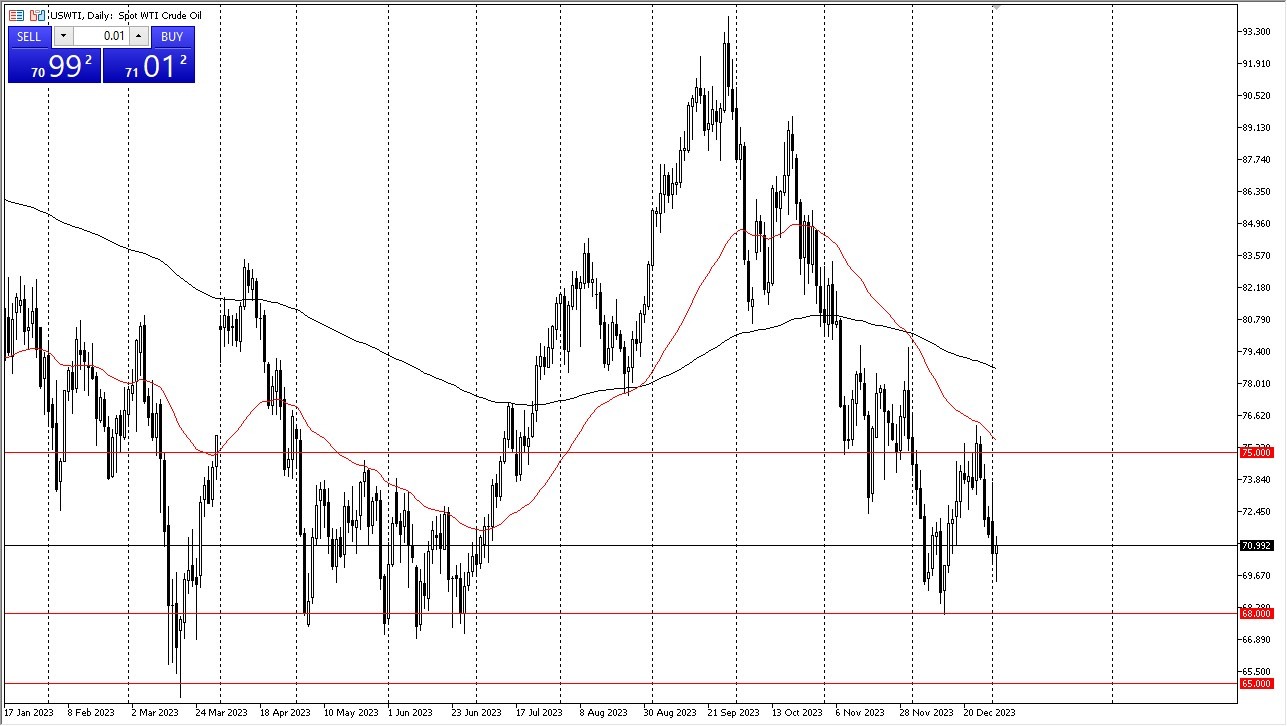

- WTI Crude Oil initially pulled back slightly on Wednesday, only to find buyers once more.

- The market appears to be navigating a range, with significant support beginning at the $68 level and notable resistance at $75.

- The upcoming jobs report on Friday will also influence market dynamics.

- However, the market will likely continue to fluctuate within this range shortly, although it's important to note that attacks in the Red Sea could swiftly impact prices.

Brent

The Brent market follows a similar pattern, with a floor at the $72 level and a ceiling at $81. The proximity of the 50-day Exponential Moving Average to the ceiling adds further weight to this range. Wednesday's substantial turnaround suggests that investors are seeking opportunities to acquire oil at lower prices. The oil market remains highly sensitive to the overall economic outlook, which currently presents mixed signals. Many are focusing on the potential for the Federal Reserve to ease monetary policy in the coming year, potentially stimulating economic demand. However, the actual implementation of such a policy remains uncertain. Additionally, the transportation of oil through the Red Sea faces geopolitical challenges, including multiple attacks on shipping.

Top Forex Brokers

Taking all these factors into account, it will be intriguing to observe how the situation unfolds. The current price level aligns with historical support, suggesting a strong possibility of a significant rebound from this point.

In the end, the crude oil market encountered an initial decline during Wednesday's trading session but rebounded as we anticipate the Johnson number report on Friday. WTI Crude Oil navigates a range, with notable support at $68 and resistance at $75. Similarly, Brent has a floor at $72 and a ceiling at $81, with the 50-day EMA reinforcing the upper limit. Economic conditions and the potential for Federal Reserve policy changes are key factors impacting oil prices. Geopolitical challenges in the Red Sea add further uncertainty to the market. The historically supportive price level increases the likelihood of a substantial rebound from the current point.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.