- Crude oil markets experienced a significant decline during Monday's trading session, marking an unfavorable start to the week.

- The crude oil market currently contends with a complex array of factors that may prove challenging to navigate.

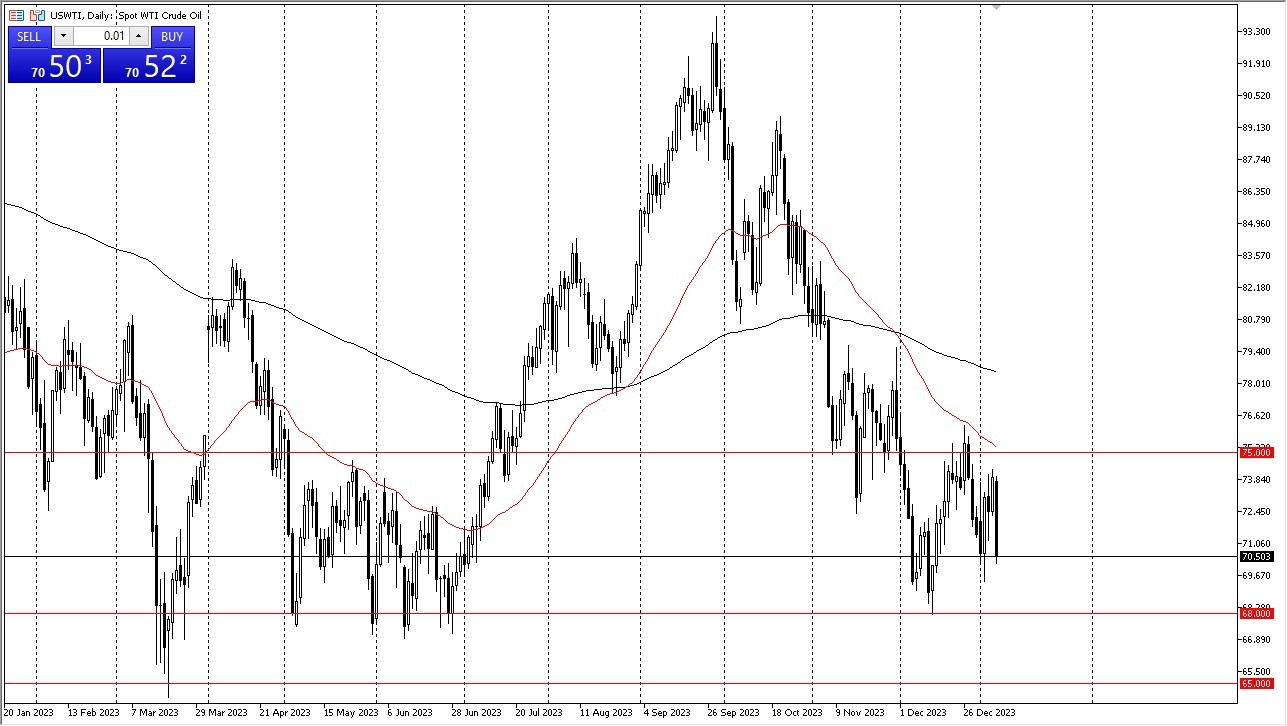

West Texas

Focusing on the West Texas Intermediate (WTI) crude oil market, it's evident that it faced a substantial drop on Monday as traders resumed work after the weekend. This decline underscores the market's continued presence within a range. Key levels to observe are the significant resistance at $75 and the significant support at $68. As the market hovers between these levels, it essentially reaches fair value. Consequently, prudence suggests adopting a wait-and-see approach for now. Considering a purchase might be viable if prices approach the $68 level and show signs of a bounce, but it's advisable to maintain a cautious position size.

Conversely, if a daily close manages to surpass the $75 threshold, it could present an opportunity for a small position. Currently, shorting oil doesn't seem prudent due to the market's relatively low pricing at the moment, and also the fact that the market has bounced multiple times from here.

Brent

The Brent crude market mirrors the WTI situation, with a similar positioning between two crucial levels on the longer-term chart. At present, the $80.50 level serves as resistance, while the $72 level acts as support. Given the market's middle-ground status, it seems prudent to remain on the sidelines temporarily. The odds of a directional move in the short term appear evenly balanced.

Top Forex Brokers

However, as prices approach the $72 support level, considering a modest crude oil position becomes more appealing. Additionally, a willingness to purchase above the $81 level is worth considering, but as always, exercising caution with position size is paramount. The oil market is currently influenced by a confluence of geopolitical, macroeconomic, and noise-related factors, making it a complex landscape to navigate.

Ultimately, the recent decline in crude oil markets introduces a level of uncertainty. Both WTI and Brent find themselves situated between significant support and resistance levels, indicating fair value. Taking a cautious approach by waiting for clearer price action near these levels is a prudent strategy. While there may be opportunities for small positions if prices approach support or break resistance, maintaining vigilance due to the market's sensitivity to various factors is essential.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.