Crude oil

Crude oil markets experienced a slight retreat during Monday's trading session.However, there remains a solid foundation of buyers ready to support the crude oil markets.

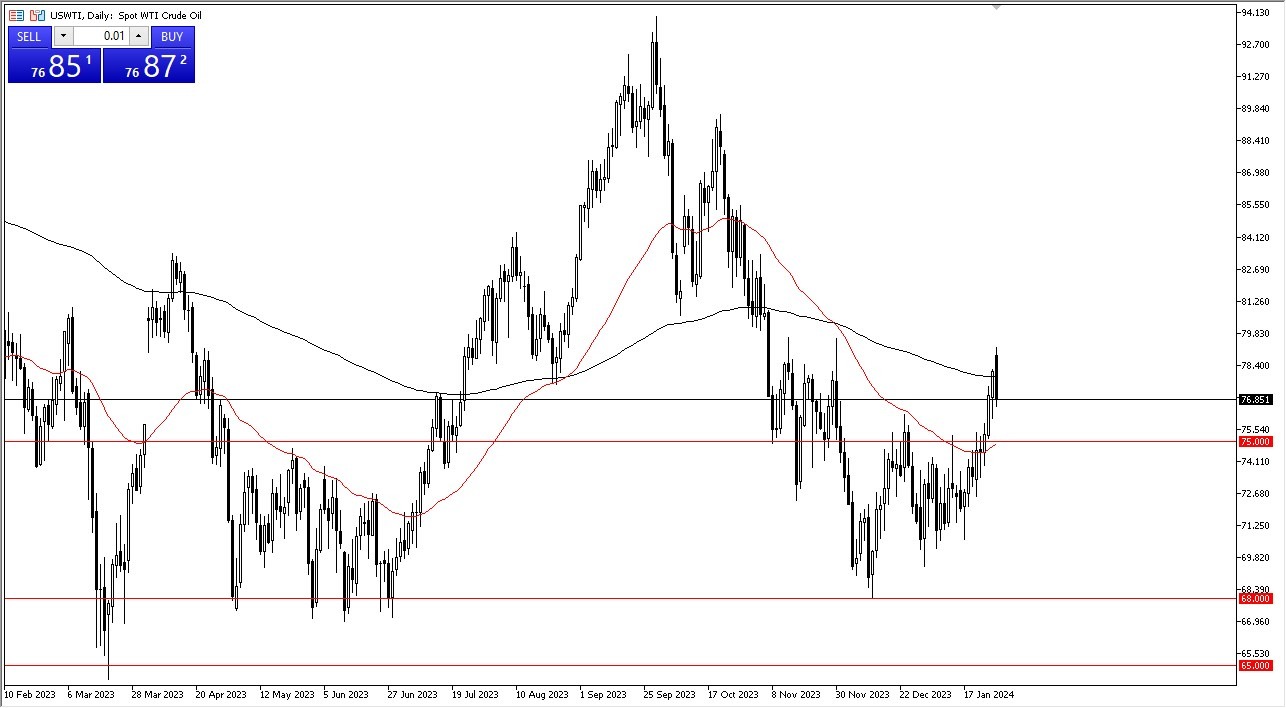

In the case of WTI crude oil, it pulled back slightly from the 50-day Exponential Moving Average on Monday. Currently, there is a possibility of reaching the $75 level, a significant price point for multiple reasons. $75 is not only a round number that garners attention, but it also coincides with the 200-day EMA, an indicator closely monitored by many traders. In this context, buying on price dips appears to be a favorable strategy. The market is in search of the necessary momentum to push higher.

It's essential to recognize that a breakdown below the $65 level would signify a more substantial bearish trend in oil prices. Consequently, the prevailing sentiment leans towards a buy-on-dip approach, not only in the WTI market but also in Brent crude.

Brent Crude – the same story

Speaking of Brent crude, it has encountered resistance at the $80 level. Beneath this resistance, the 200-day EMA offers support, along with the $80.50 level. Similarly, adopting a buy-on-dip perspective seems prudent in this market. A potential target on the upside could be $90. As long as the price remains above $70, a buy-on-dip strategy remains more viable. It's important to acknowledge that the oil markets are not without their challenges and inherent volatility.

Despite this, the pursuit of value appears to be a sensible approach, especially in light of concerns related to incidents in the Red Sea, uncertainties surrounding central banks' monetary policies, and their potential impact on industrial demand. However, oversupply remains a significant factor contributing to market volatility. Nevertheless, it is plausible that the market has found a bottom in recent price movements.

In the end, the crude oil markets experienced a minor pullback on Monday but continued to benefit from a supportive base of buyers. WTI crude oil could aim for the $75 level, while Brent crude encounters resistance at $80. Both markets favor a buy-on-dip approach, considering the potential for volatility and the myriad factors influencing oil prices. Although challenges persist, the pursuit of value remains a sensible strategy, with recent market movements possibly indicating a bottoming out.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.