WTI Crude Oil

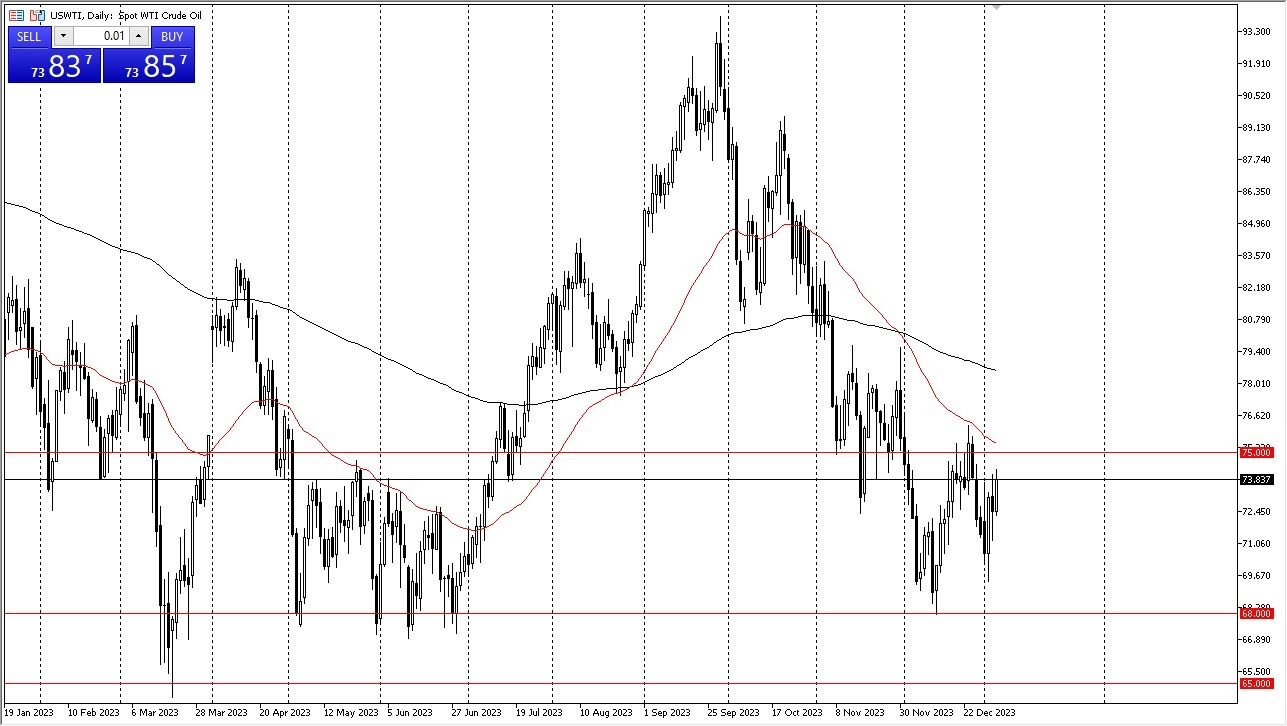

- In the West Texas Intermediate (WTI) crude oil market, there has been a notable rally, bringing prices to the upper boundary of the ongoing consolidation phase.

- The $75 level stands as a formidable barrier to further upside movement. Market participants are likely to perceive this level as a challenging obstacle.

- However, should a breakthrough occur, it could trigger heightened technical trading activities.

Breaking above the 50-day Exponential Moving Average would likely lead to an influx of trading interest in that vicinity, with more participants entering the market. The aim would be to drive prices towards the 200-day EMA, which is currently situated at approximately $79.

Conversely, on the downside, the $68 level remains a substantial barrier, offering significant support. Consequently, adopting a perspective of buying on dips appears to be a prudent approach. That’s been the case for a minute now, and I think that will continue to be going forward.

Brent

Turning to the Brent crude oil market, a similar dynamic is at play. It is advisable to view this scenario as an opportunity to buy during price dips rather than pursuing aggressive buying at current levels. The market is expected to maintain its characteristic noise, with particular attention on the $80.50 level, notably in conjunction with the 50-day EMA.

The presence of the 50-day EMA tends to attract algorithmic traders, adding to the significance of this level. A breach above this point could set the stage for an attempt to reach the 200-day EMA. Overall, the market faces substantial resistance levels just above its current position, which will require concerted effort to overcome. Nevertheless, if such resistance is surmounted, the potential for further upward movement remains.

Top Forex Brokers

In light of ongoing concerns surrounding oversupply, economic recession prospects, and central bank intervention, the market's direction remains uncertain. Additionally, external factors, such as geopolitical events like the Red Sea attacks disrupting oil flow, introduce an additional layer of complexity.

Ultimately, both the WTI and Brent crude oil markets are confronting significant barriers as they navigate their respective price levels. The $75 level for WTI and $80.50 level for Brent are seen as formidable hurdles. Buying on dips remains a prudent strategy, considering the prevailing market noise and uncertainties, including oversupply concerns and geopolitical events impacting oil flow.

Potential signal: I am a buyer of WTI (US OIL) on a daily close above $75.20, with a stop loss at the $73.90 level. I will be aiming for a move to the $77.13 level.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.