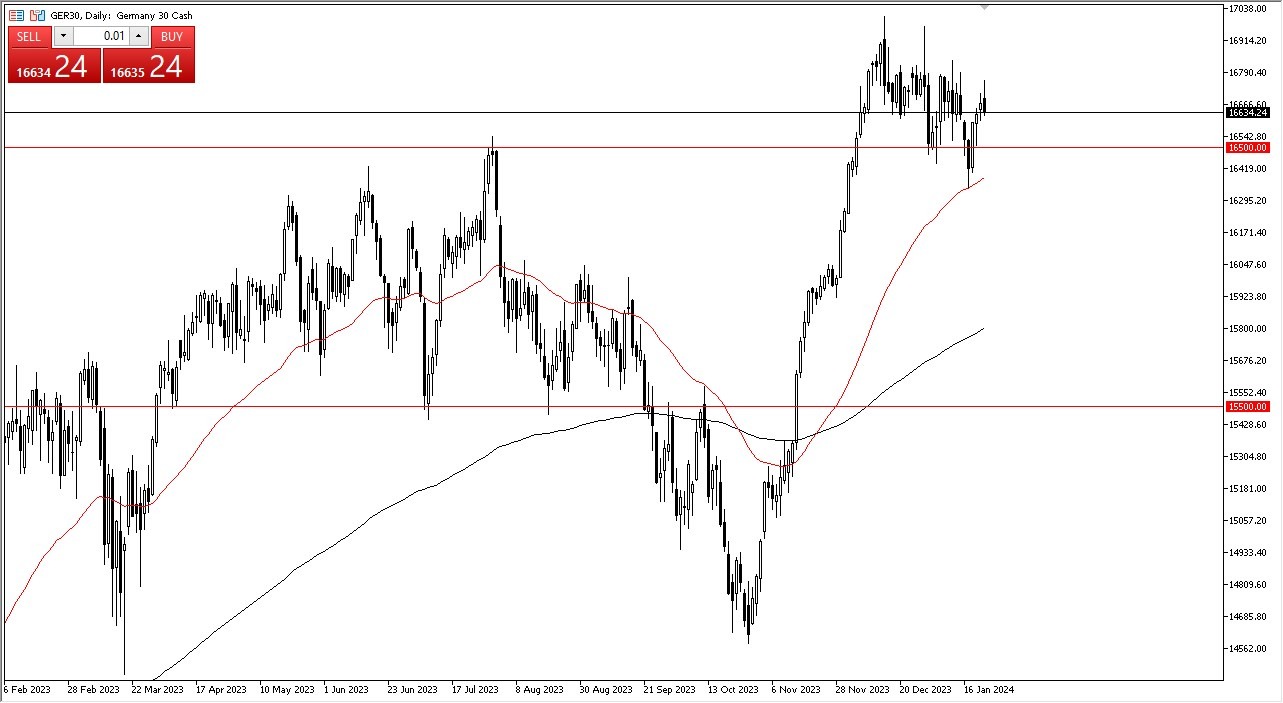

- Taking a look at the DAX, you can see that the German index initially tried to rally during the trading session on Tuesday but has given back gains near the 16,700 level.

- Underneath I see the 16,500 level as an area that could offer a little bit of support, followed by the 50-day EMA.

- The 50-day EMA continues to be an indicator that a lot of people will pay attention to, and therefore you need to recognize that it will be a crucial barrier for anybody who is looking to short this market. At this point, it seems very difficult to make that happen.

When you look at the longer term chart, there is an argument to be made that perhaps we are trying to form some type of bullish flag, and that of course has people thinking that perhaps the DAX has much further to go. Ultimately, I do believe that the 50 day EMA needs to hold as support to keep the bullish flag theory in play. At this juncture, I'm looking for some type of pullback in order to find value, and I am more than willing to take advantage of that value if and when it shows up.

Top Forex Brokers

The Other Scenario

On the other hand, if we were to turn around and take out the 16,800 level to the upside, it's very likely that the DAX would go looking to the 17,000 euros level, which was the recent peak. Anything above there opens up a flood of buying and could in fact be influenced by the European Central Bank. If the ECB is in fact going to start to loosen monetary policy, it will have money flying into stocks again.

This has been the overall trajectory of markets, meaning that when we get lower rates, we get higher stocks. People are always looking for cheap money, it seems, and therefore I think you've got a situation where traders continue to look at this through the prism of whether or not they are getting central bank support. Ultimately, I do think that this is a situation where you are buying dips. I have no interest in shorting this market, at least not until we break down below the 16,000 euros level, which of course is nowhere near where we are right now.

Ready to trade our DAX prediction? Here’s a list of some of the best CFD trading brokers to check out.